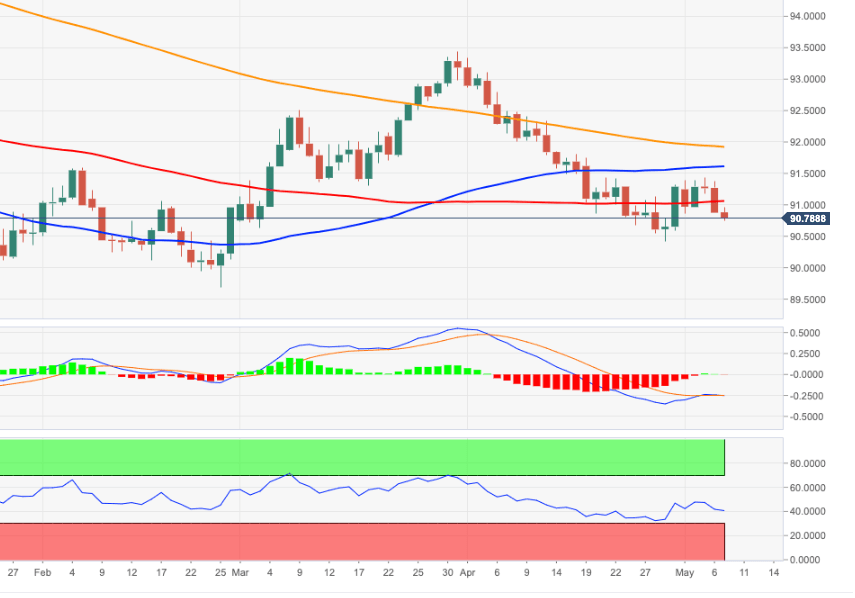

US Dollar Index Price Analysis: Initial contention lines up at 90.42

- The index remains on the defensive below 91.00.

- Next support comes in at the April low near 90.40.

The leg lower in the dollar remains well in place on Friday, with DXY extending the corrective downside to the sub-91.00 area ahead of key US data.

The very near-term price action in the index highly hinges on the Payrolls results due later on Friday. Against that, a deeper pullback carries the potential to re-visit the April’s low at 90.40, while an upbeat outcome of the labour report could push DXY to the next up barrier in the 91.40/50 band.

In the meantime, and looking at the broader scenario, while below the 200-day SMA, today at 91.92, the outlook for the buck is expected to remain negative.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.