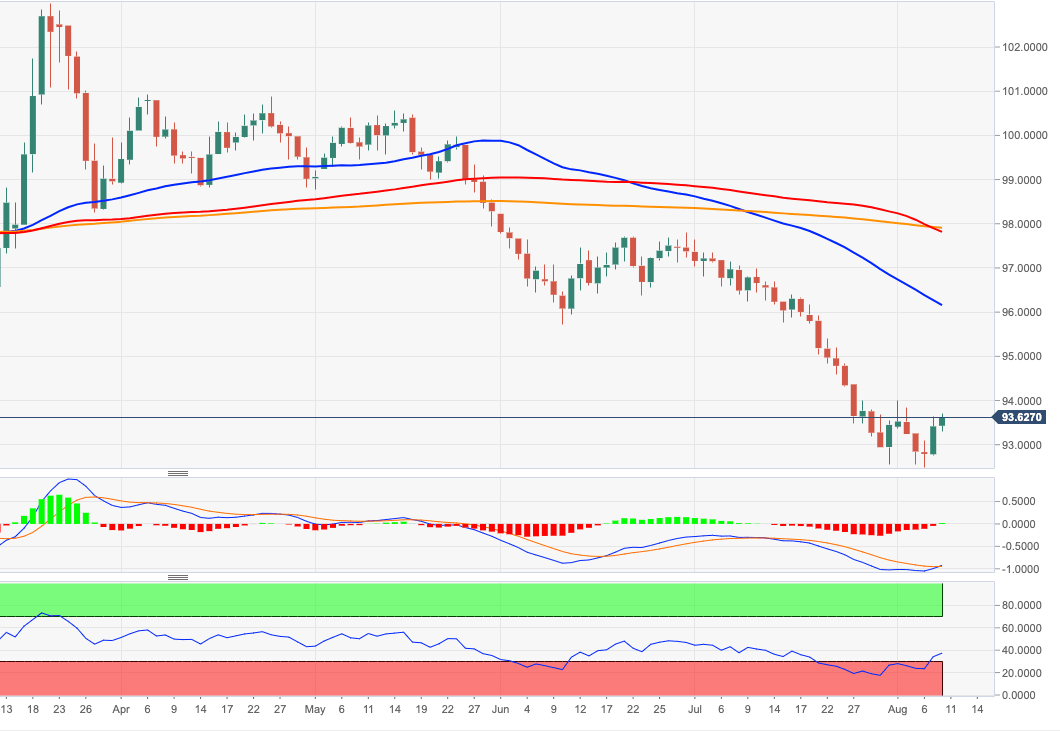

US Dollar Index Price Analysis: Extra gains could test 94.00

- DXY extends the bounce off lows to the 93.70 region on Monday.

- Further recovery is forecasted to meet resistance around 94.00.

DXY is adding to Friday’s recovery and moves further north of the 93.00 mark after bottoming out near 92.50 last Thursday.

If the buying impetus does not subside, then the index is seen re-visiting the so far monthly peaks around 94.00 (August 3), where it is expected to meet strong resistance.

The negative outlook on the dollar is expected to remain unaltered while below the 200-day SMA, today at 97.90. Against this backdrop, a breakdown of 92.52 should open the door to a deeper pullback to the Fibo level (of the 2017-2018 drop) at 91.92 ahead of the May 2018 low at 91.80.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.