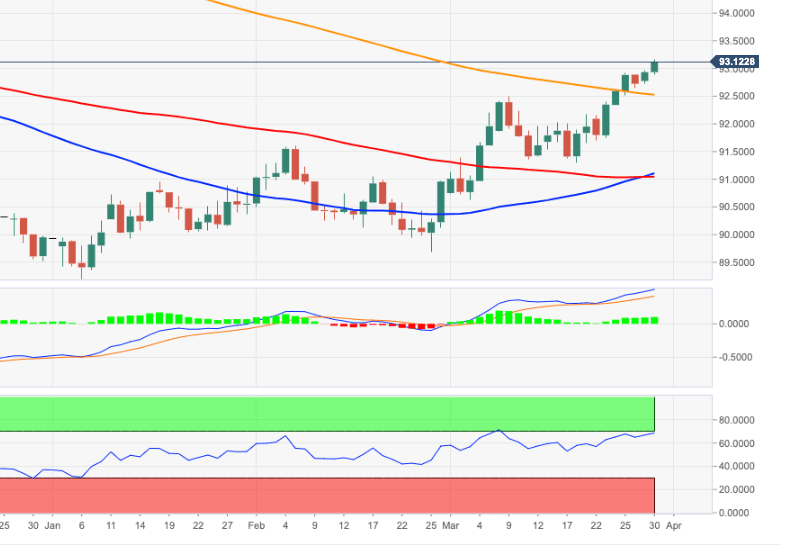

US Dollar Index Price Analysis: Extra gains could see 94.30 re-tested

- DXY prints 2021 highs beyond the 93.00 mark on Tuesday.

- Further north comes in the November 2020 high near 94.30.

The dollar extends the rally further and manages well to finally break above the key barrier at 93.00 the figure when tracked by the US Dollar Index (DXY).

Against this, the continuation of the uptrend looks likely in the short-term horizon. That said, there are no relevant up barriers until the November 2020 highs in the 94.25/30 band.

The downside pressure around the index looks alleviated after the recent breakout of the 200-day SMA (92.52). If DXY manages to keep business above the latter on a sustainable basis, then the outlook should shift to constructive, at least in the near-term.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.