US Dollar Index Price Analysis: Extra downside remains in the pipeline

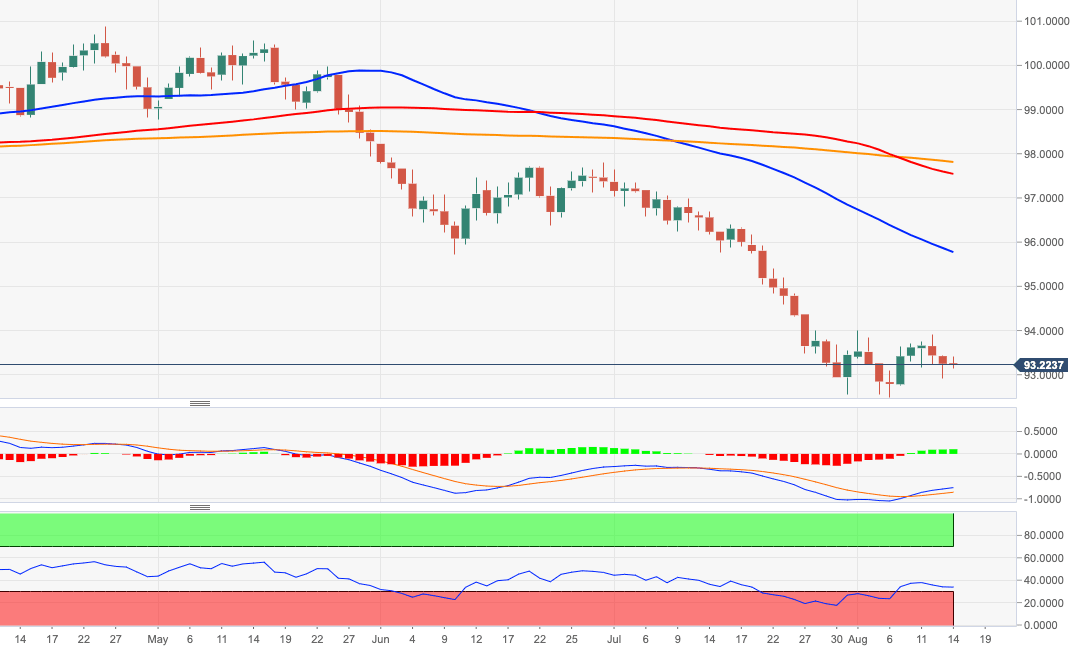

- DXY briefly tested the sub-93.00 area on Thursday.

- Further south emerges the YTD lows in the mid-92.00s.

DXY managed to rebound from the area below the 93.00 yardstick on Thursday, or fresh weekly lows. The bullish attempt, however, lost traction in the 93.40/45 band.

Solid resistance is located in the 94.00 region so far and the inability of the index to surpass this area – ideally in the short-term – should open the door to the resumption of the bearish trend.

The offered stance in the dollar is expected to remain unchanged while below the 200-day SMA, today at 97.80.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.