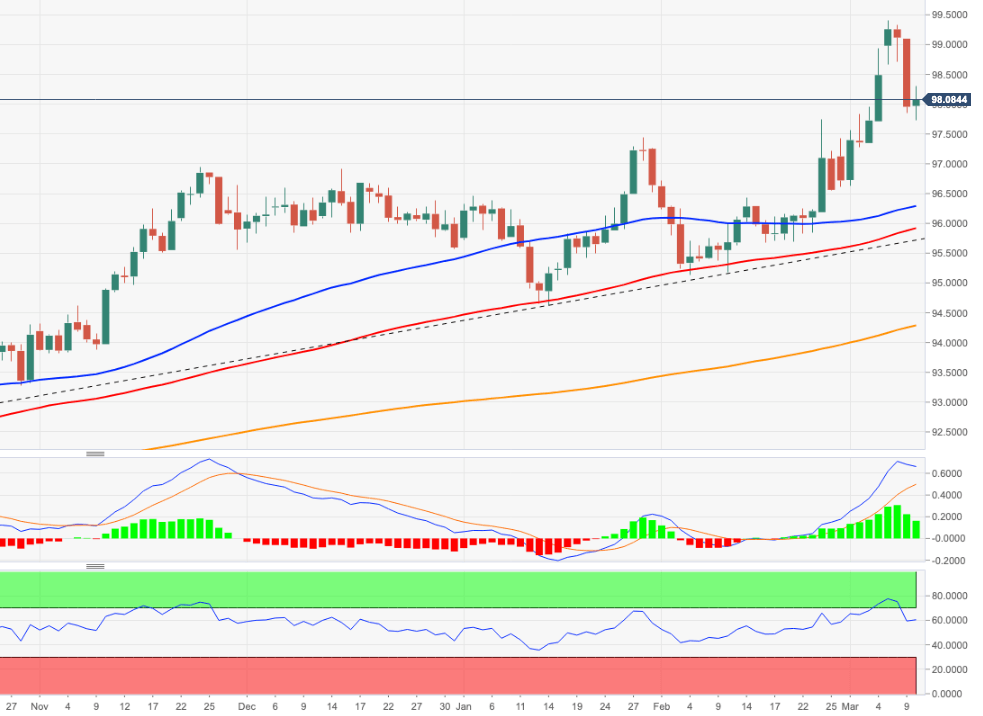

US Dollar Index Price Analysis: Decent support emerged around 97.80

- DXY regains some composure and reclaims the 98.00 mark and above.

- Weakness is still seen as temporary with support near 97.80.

DXY manages to reverse two daily drops in a row and stages a bounce further north of the 98.00 yardstick on Thursday.

Considering the recent price action, the corrective move in the index now carries the potential to extend further, although the area of recent lows in the 97.85/80 band (march 9) is expected to offer decent contention for the time being.

The current bullish stance in the index remains supported by the 5-month line, today near 95.80, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 94.25.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.