US Dollar Index pressured with markets bracing for trade talks over the weekend

- The US Dollar Index extends gains to 100.86 on Friday before reversing course.

- Trump floats 80% tariff on Chinese goods, urging China to open up economy to US goods.

- The US Dollar Index looks set to test a vital earlier resistance at 100.22 now for support.

The US Dollar Index (DXY), which tracks the performance of the US Dollar (USD) against six major currencies, is fully reversing course this Friday ahead of the United States (US) trade talks with China in Switzerland over the weekend. The DXY index trades near 100.30 at the time of writing after hitting a near-a-month high of 100.86 earlier in the day. The euphoria over the United Kingdom (UK) trade deal with the US is being written off as not a trade deal at all. The US gets to keep its 10% tariffs on UK goods while getting better and easier access to the UK consumer markets.

It was not at all a comprehensive and all-around trade deal that US President Donald Trump promised in the run-up to the announcement. Such a poor deal is being brokered with one of the smaller countries in terms of exposure to the US, and it sets the scene for trade talks this weekend with China not to go that smoothly. Although President Trump, according to sources, said tariffs could drop as low as 50% if China cooperates this weekend, it rather looks as if the US is not the strongest party sitting at the negotiating table, Bloomberg reports.

Daily digest market movers: Headline risks ahead

- As already mentioned, China and the US will meet in Switzerland for trade talks over the weekend. However, no trade deal would be discussed, but only defusing the situation. Besides that, the Chinese Ministry of Commerce has reiterated several times this week that trade talks can only take place if the US unilaterally drops its tariffs.

- Just ahead of the US trading session, Trump commented on Truth Social Network that an 80% tariff on Chinese goods 'seems right' while urging China to open its markets to the US, ahead of this weekend's trade talks.

- A slew of Fed speakers are lined up to speak this Friday:

- At 12:30 GMT, Federal Reserve Governor Adriana Kugler and New York Fed President John Williams deliver a speech about employment at the Reykjavik Economic Conference 2025 in Iceland.

- At 14:00 GMT, Federal Reserve Bank of Chicago President and CEO Austan Goolsbee shares opening remarks at the Fed Listens event, Perspectives from the Midwest, at the Federal Reserve Bank of Chicago.

- At 15:30 GMT, Federal Reserve Governor Christopher Waller participates in a panel discussion about monetary policy research at the Hoover Monetary Policy Conference in Stanford.

- At 22:45 GMT, Federal Reserve Governor Lisa Cook, Federal Reserve Bank of Cleveland President Beth Hammack, and St. Louis Fed President Alberto Musalem participate in a panel discussion about productivity dynamics at the Hoover Monetary Policy Conference in Stanford.

- Equities are in the green on Friday, though not massively. European indices are up 0.5% on average. US Futures are flat to marginally higher, less than 0.5%.

- The CME FedWatch tool shows the chance of an interest rate cut by the Federal Reserve in June’s meeting at 17.1%. Further ahead, the July 30 decision sees odds for rates being lower than current levels at 63.2%.

- The US 10-year yields trade around 4.37%, edging higher again after the mid-week dip.

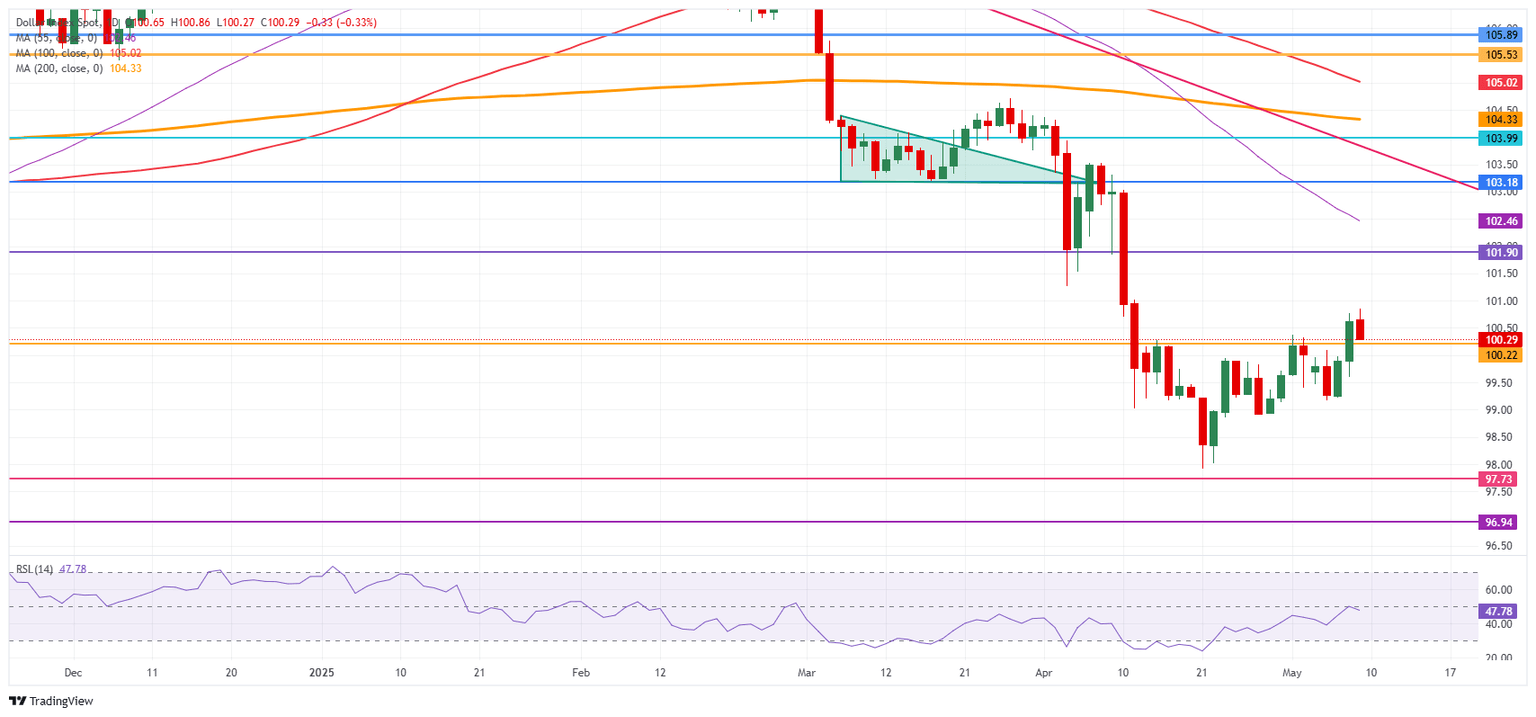

US Dollar Index Technical Analysis: Testing support

The US Dollar Index (DXY) has broken through substantial resistance at 100.22 and is starting to look bullish. However, there are a few questions, as the first trade deal after the ‘Liberation Day’ still sees US tariffs in place. This means elevated prices for US consumers who want to buy specific UK goods, which could still fuel a stagflationary scenario.

On the upside, the DXY’s first resistance comes in at 101.90, which acted as a pivotal level throughout December 2023 and as a base for the inverted head-and-shoulders (H&S) formation during the summer of 2024. In case Dollar bulls push the DXY even higher, the 55-day Simple Moving Average (SMA) at 102.47 comes into play.

On the other hand, the previous resistance at 100.22 should now act as support. The 97.73 support could quickly be tested on any substantial bearish headline. Further below, a relatively thin technical support comes in at 96.94 before looking at the lower levels of this new price range. These would be at 95.25 and 94.56, meaning fresh lows not seen since 2022.

US Dollar Index: Daily Chart

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.