US Dollar gains due to a negative market enviroment

- The DXY climbs above 107.00 amid geopolitical tensions.

- Russia sees no reason for a Trump-Putin meeting as demands remain unresolved.

- Empire State Manufacturing Index surprises with a return to positive territory.

The US Dollar Index (DXY), which tracks the US Dollar's (USD) performance against six major currencies, rises on Tuesday as traders react to discouraging headlines from the United States (US)-Russia talks in Riyadh. Despite efforts to negotiate a ceasefire or peace deal for Ukraine, Russia has dismissed the need for a Trump-Putin meeting this month, citing ongoing demands. At the time of writing, the DXY hovers above 107.00, fueled by geopolitical uncertainties.

Daily digest market movers: US Dollar rises as Russia dismisses Trump-Putin meeting

- Geopolitical risks support the US Dollar as US-Russia talks in Riyadh show no progress.

- Russia states that a Trump-Putin meeting is unnecessary due to unresolved demands and the previous sparks of hope of a hypothetical ceasefire seem to be fading away.

- On the Ukrainian side, President Volodymyr Zelensky commented that “fair” negotiations to end the war with Russia must involve Ukraine and Europe, also contributing to a negative market environment.

- On the data front, the New York Empire State Manufacturing Index for February jumped to positive territory after months of contraction but had little impact on the USD.

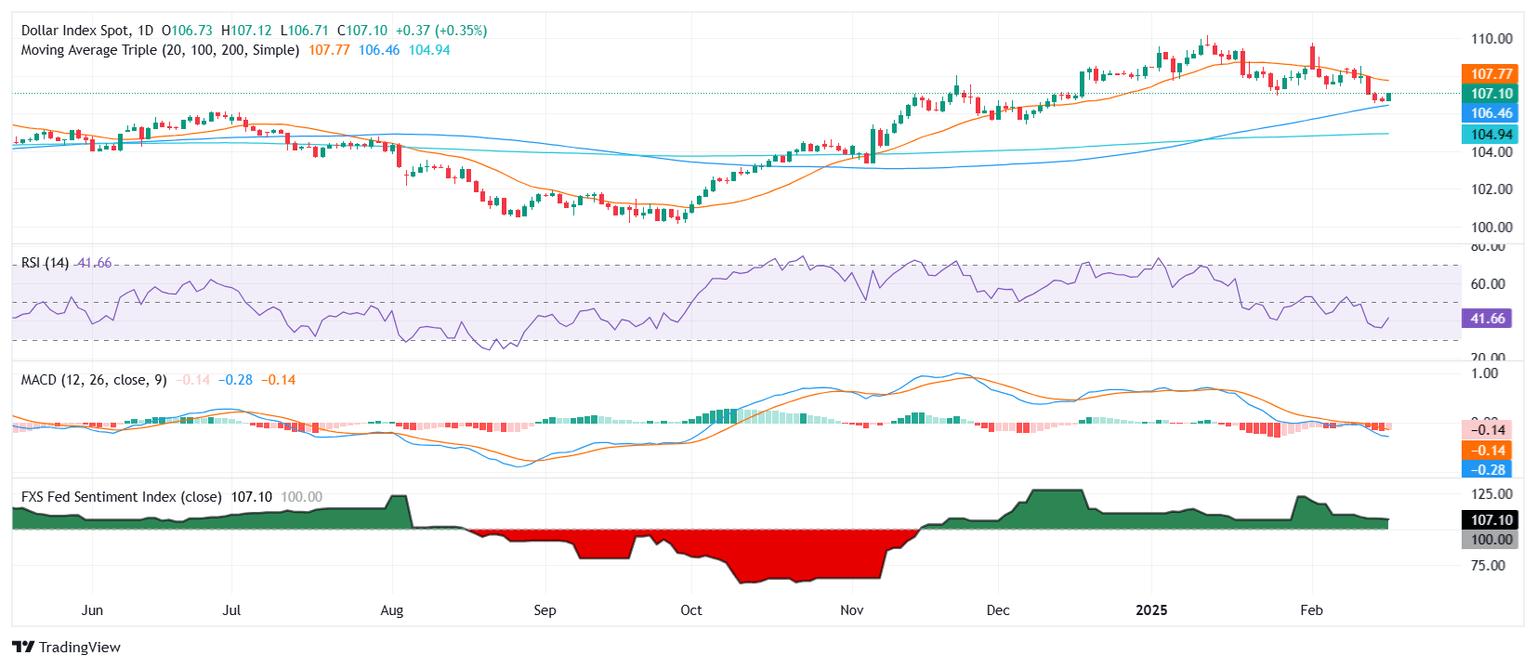

- Federal Reserve officials continue to assess the impact of holding interest rates steady and maintain a cautious stance. In fact, the Fed’s sentiment index on the daily chart continues to be stuck in hawkish terrain.

DXY technical outlook: Key resistance at 107.50, but downside risks persist

The US Dollar Index struggles to sustain gains after reclaiming the 107.00 level. Despite this mild rebound, the 20-day Simple Moving Average (SMA) remains a key resistance after being lost last week. The Relative Strength Index (RSI) is entrenched in negative territory, while the Moving Average Convergence Divergence (MACD) signals steady bearish momentum. Immediate support is seen at the 100-day SMA at 106.30, and a break below this level could confirm a short-term bearish outlook. Bulls need stronger momentum to challenge 107.50.

Central banks FAQs

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.