UK unemployment rate beats with 3.9% in June, claims disappoint with +94.4 in July, GBP/USD shakes

The UK has reported mixed labor figures. The unemployment rate remained depressed at 3.9% in June, a result of the government's furlough schemes. Wages dropped by 1.2% when including bonuses and -0.2% when excluding them.

The Claimant Count Change for July disappointed by leaping by 94,400, far worse than 10,000 projected. That is a concerning sign moving forward.

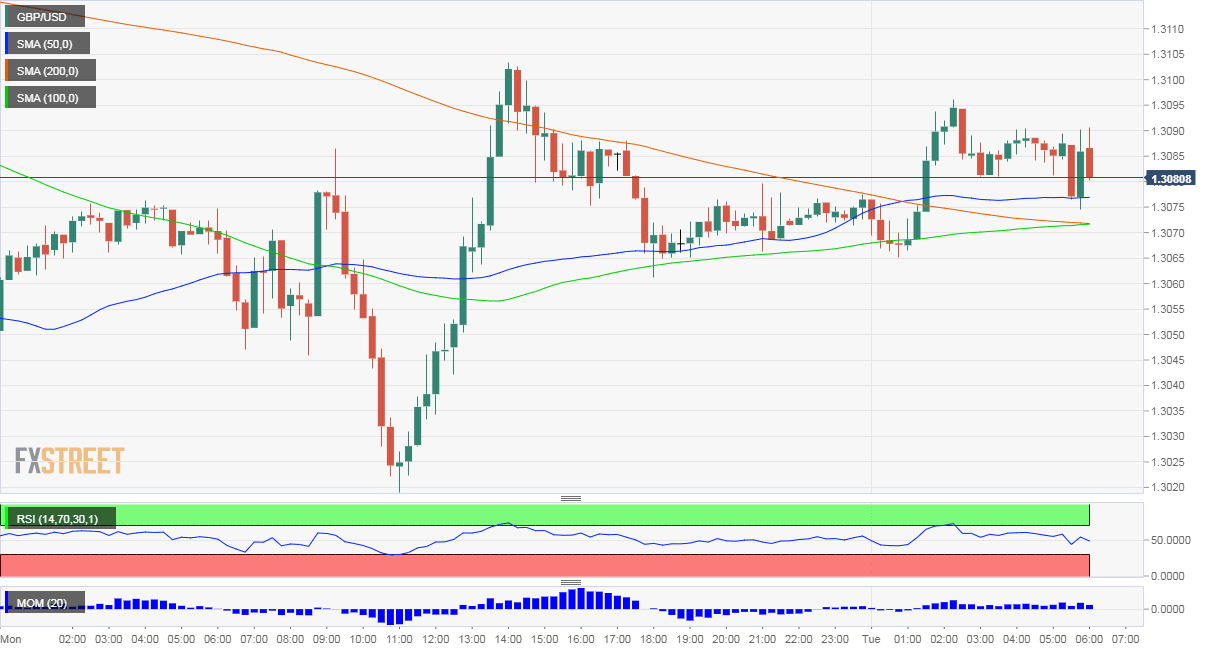

GBP/USD dipped just ahead of the publication yet quickly stabilized, trading just below 1.31. See a live GBP/USD chart.

The UK was expected to report an increase in the unemployment rate to 4.2% in June from 3.9% in May. Economists estimated that wages would fall 1.1% year on year when including bonuses in June, a sharper fall than 0.3% in May. Excluding extra pay, a drop of 0.1% was on the cards, compared with an increase of 0.7% beforehand.

The Claimant Count Change – also known as jobless claims – carried expectations for an increase of 10,000 in July after a drop of 28,100 in June. GBP/USD was trading steadily below 1.31 ahead of the publication, edging up amid some dollar weakness.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.