Twitter (TWTR) Stock News and Forecast: TWTR stock rallies as board to meet at 10am EST to consider offer

- TWTR stock rallies sharply to over $50 as Elon Musk offers $54.20 cash.

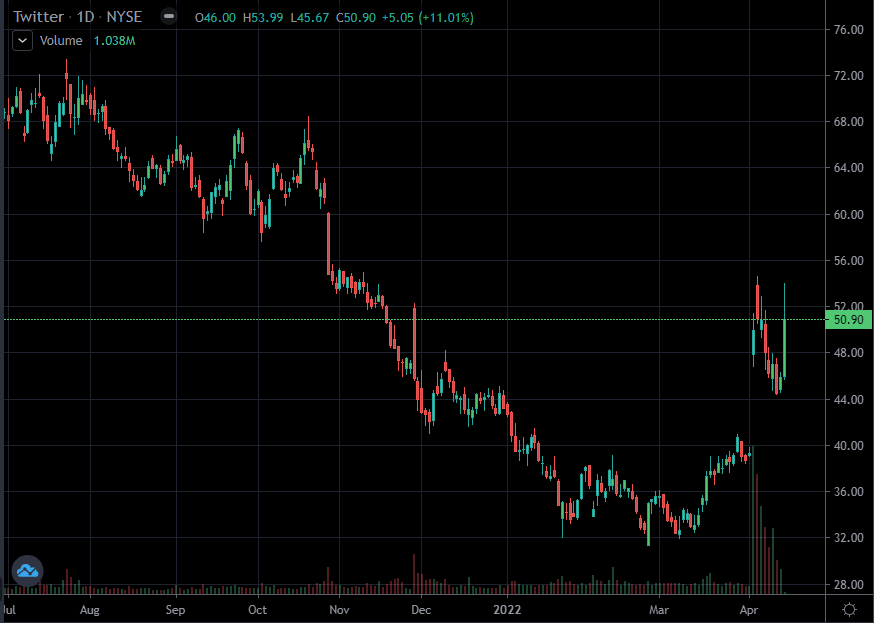

- TWTR stock had closed Wednesday at $45.85.

- TWTR stock is down over 30% in the past 12 months.

Update: The Twitter board is set to meet at 10am EST to consider Elon Musk's offer to buy the company for $54.20 in all cash. TWTR shares have given up some ground from where they were trading in the premarket and currently sit at $46.65.

Twitter (TWTR) stock is back at the top of the chart in Thursday's premarket as it spikes on the back of Elon Musk offering to buy the company.

Twitter (TWTR) stock news

Elon Musk has offered to buy Twitter (TWTR) for $54.20 all cash. Elon Musk recently made headlines when taking a large stake in the company and now this appears to be his possible end game. Reuters reports that Elon Musk delivered a letter to Twitter on April 13 detailing his proposal. "My Offer Is My Best And Final Offer"; Says If Offer Is Not Accepted, "I Would Need To Reconsider My Position As A Shareholder"..."I Don't Have Confidence In Management Nor Do I Believe I Can Drive The Necessary Change In The Public Market"-Reuters. "I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy," Musk told Twitter Chairperson Bret Taylor on Wednesday, as disclosed in an amended SEC filing on Thursday morning. "However, since making my investment I now realize the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company."-Benzinga.

Wow, well Elon Musk certainly knows how to keep things interesting. Twitter (TWTR) stock rallied sharply up to $53.99 before retracing slightly to trade at $50.93 at the time of writing for a gain of 11%.

Twitter (TWTR) stock forecast

The curent spike is topping out just where Twitter (TWTR) spiked on the previous disclosure of Elon Musk's stake. This then looks like a classic bearish double top. Newsflow is likely to be the main driver here rather than technicals but this is interesting if Elon Musk steps away as his "I Would Need To Reconsider My Position As A Shareholder" hints at. The best and final offer does seem to put a top on the price for now unless some other bidder emerges for Twitter (TWTR).

TWTR stock chart, daily-Tradingview

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.