The White House targets Amazon, as tariff risks weigh on stocks

The US administration has changed its tone towards tariffs yet again on Tuesday. The White House Press secretary and the Treasury Secretary accused Amazon of a ‘hostile political act’, after Amazon planned to expose the cost of tariffs to its consumers. This comes days before Amazon reports earnings on Thursday, and its stock price fell ahead of the US open and is down more than 2% so far.

Political risk rises yet again

The US administration has mostly saved its ire for other countries that it believes gives the US a raw deal in global trade. Now it appears that the US administration is targeting US companies who question the logic of its moves. This is significant. Financial markets have been roiled by political interference in the global economy in recent weeks. Investors do not digest political risks well, so if the Trump administration is now publicly accusing US companies of hostile acts if they disagree with the President’s US economic policy then this could stop the recent recovery rally in risky assets.

This announcement has weighed on US stocks ahead of the open, with the consumer discretionary sector taking the biggest knock. The Vix index is ticking higher on the back of these comments, US stock markets are pointing to a lower open, and the dollar has also backed away from recent highs. President Trump is scheduled to speak later on Tuesday, if he doubles down on criticism of Amazon, it will be worth watching the market reaction.

US Trade deficit widens to record

The Amazon news comes after the release of the US trade deficit for March. It widened to $162bn last month, up from $147.8bn in February, and was much larger than expectations. The 12-month total is now $1.4 trillion, a record high. Although this data does not include the impact of Trump’s reciprocal tariffs, it could trigger President Trump, since the US’s goods deficit with China is roughly the same as China’s goods surplus with the US. This should narrow in the coming months, but at what cost to the US economy? Some analysts are now focusing on supply shocks in the US after a drop in container ships from China to the US in recent weeks.

The latest update from the White House suggests that traders and investors needs to be wary once more about tariff risks, especially as China does not seem to be playing ball when it comes to negotiating an end to the US/ China trade embargo.

FTSE 100 outperforms

European equity markets are mostly mixed as we move through the day on Tuesday. The FTSE 100 has done a 180-degree turn, from lagging the Eurostoxx index, it is now outperforming, as materials and financial stocks get a boost and counteract weakness in the healthcare and energy sectors. The FTSE 100’s defensive qualities are also attractive when negative tariff headlines arise. Earnings reports are having a big impact on the UK index today. Associate British Foods, BP and Astra Zeneca are all weighing on the FTSE 100. Astra Zeneca may have posted earnings that beat expectations; however, almost half of its revenue comes from the US, and this is under threat from US pharma tariffs.

Mixed signals from markets

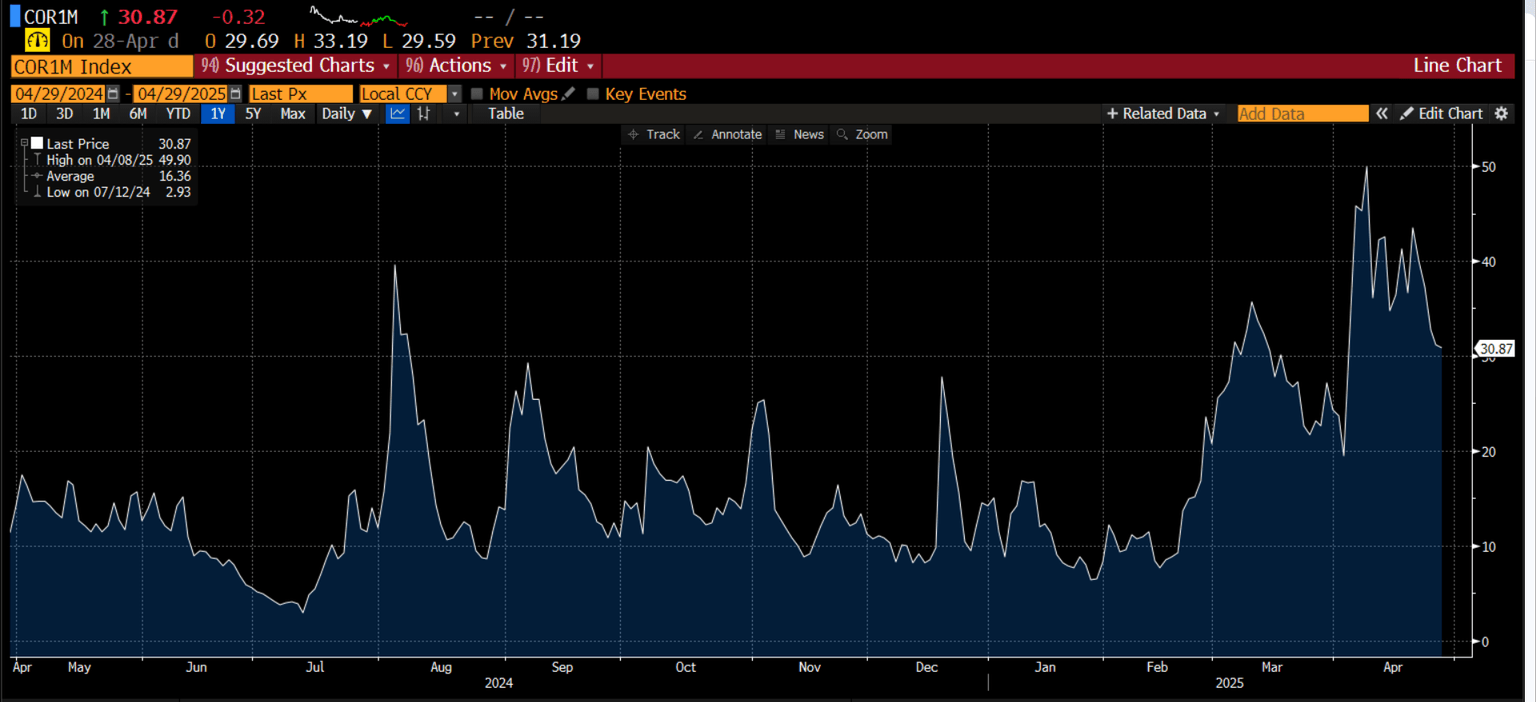

Financial markets and risk sentiment may have staged a decent recovery in recent weeks, but as today shows, risks remain. Volatility markers are also telling us different things. The Vix index, Wall Street’s fear gauge is returning to levels last seen at the start of April, however, the ICE Bond market volatility index may fallen sharply from its peak, however, it remains well above the levels from late March. Likewise, the CBOE 1-month implied correlation index for the 50 largest S&P 500 companies, has retreated from its peak in early April, but it still remains close to the highs from August 2024. This means that the biggest US stocks are tending to move together, so one bad headline about risk could see the largest stocks falling in unison and weigh on the overall index.

CBOE 1-month implied volatility for the biggest 50 stocks on the S&P 500

Source: XTB and Bloomberg

Although the absence of incendiary tariff comments from the White House in recent weeks has boosted the market mood, the question now is, does this good news need to continue for markets to maintain their recovery? We could find that out on Tuesday. Both the US and China seem to have two different agendas when it comes to trying to negotiate a deal to end the effective trade embargo between the two nations. President Trump has suggested that he has already had a good conversation with President Xi of China, yet the commentary in China seems to be getting more aggressive in its criticism of the US.

China is approaching its neighbors in Asia and beyond and painting the US as a bully that cannot be trusted with the economic and financial management of the global economy. Instead, it is painting itself as the protector of the ‘old’ rules-based order. China is approaching the US as an equal in trade negotiations this time around. This shift in the relationship could make it harder for both sides to negotiate an end the trade war, which may come back to haunt financial markets.

For now, investors are wondering what the fall out will be for the US economy and for US firms. US GDP for Q1 is released on Wednesday, and Apple and Amazon will report results later this week.

In the FX space, the dollar was broadly higher on Tuesday, especially vs. the Aussie and kiwi dollars, and the Swiss franc. The euro and the CAD are holding up vs. their G10 peers, but even they fell as the dollar tried to stage a comeback. The dollar has lagged in the recent market recovery, especially vs. stocks, which could be a sign that the FX market is more exposed to trade flows and US trading relations compared to the globally focused US companies. As we move to the US session, the dollar is rapidly weakening and backing away from the day’s highs, as tariff headlines once again turn negative.

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.