The weekend macro highlights do little for the open

The forex market has started out the week and a new month pretty much where they left off on Friday.

The US dollar is steady with the DXY index in a tight 91.2450/2970 range.

Yellen: US will see 'big returns' by passing Biden spending proposals

In a weekend news recap, Treasury Secretary Janet Yellen insisted that the US will see 'big returns' by passing Biden spending proposals.

She says the administration's proposals “are extremely important and necessary to invest in our economy so that we can be competitive."

“The plans are extremely important and necessary to invest in our economy so that we can be competitive and have families and children succeed, invest in infrastructure, in R&D, and things that shore up middle-class prosperity, education, childcare, and health care,” Yellen said in an interview on "Meet the Press."

“There will be a big return. I expect productivity to rise. There will be great returns from investing in research and development and enabling families to participate with paid leave and childcare support in the workforce.”

The markets have been pricing out a hike from the Federal Reserve for now and are banking on higher inflation due to stimulus. This is a negative factor for the US dollar.

Fed’s dovish tilt to unleash tide of bets on resurgent euro

Meanwhile, in a Bloomberg article, it spoke of the Federal Reserve's Jerome Powell who said in the week that ''creeping US inflation won’t last and doesn’t justify higher interest rates.''

''Creeping US inflation won’t last and doesn’t justify higher interest rates, he said. That’s narrowed the gap between what investors can expect to earn in the US over Europe, dashing the chances of a resurgent dollar and vindicating FX strategists who said the euro’s April rally has further to run.

“It is clear that Fed monetary withdrawal is off the agenda anytime soon, capping the upside on US yields and helping euro-dollar bulls,” said Bloomberg Intelligence’s chief G-10 FX strategist Audrey Childe-Freeman,'' the article wrote.

Further, the article explained that ''the euro zone’s vaccination program is accelerating and investment strategists have been revising their expectations for European growth upward.''

Additionally, the article notes that ''Europe’s catch up is showing up in the rates market and the gap between 10-year U.S. yields and their German counterparts is close to its narrowest since early March at 185 basis points.''

''In this environment, predictions of a euro advance against the dollar through to the year-end are becoming plentiful, even after the common currency gained more than 2% in April,'' the article added further.

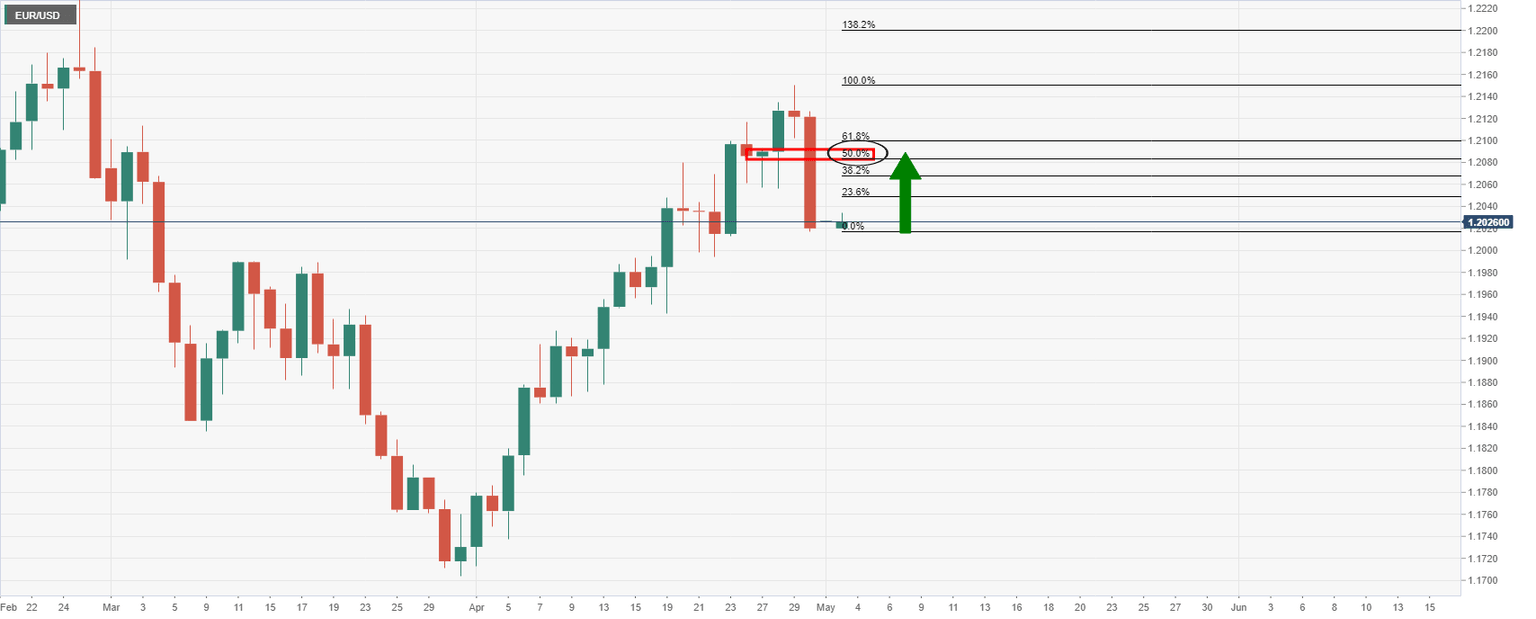

For the open on Monday in early Asia, EUR/USD is flat trading between a high of 1.2033 and a low, 1.2024. The M-formation is a compelling chart pattern on the daily time frame to note. Bulls might be inclined to test the prior lows and support at this juncture:

North Korea says Biden policy shows hostile US intent, vows response

Meanwhile, on the geopolitical front, ''North Korea lashed out at the United States and its allies in South Korea on Sunday in a series of statements saying recent comments from Washington are proof of a hostile policy that requires a corresponding response from Pyongyang,'' Reuters reported.

''The statements, carried on state news agency KCNA, come after the White House on Friday said US officials had completed a months-long review of North Korean policy, and underscore the challenges US President Joe Biden faces as he seeks to distinguish his approach from the failures of his predecessors.''

This leaves the matter as a subject for markets for weeks ahead, although there is little risk of an immediate escalation given Bide's diplomatic tendency in character.

US denies any deal with Iran to ease sanctions, swap prisoners

According to Bloomberg, US officials said a deal to revive a nuclear accord with Iran and ease sanctions isn’t imminent and separately denied an Iranian report on an impending prisoner swap.

'''The short answer is there is no deal now, National Security Adviser Jake Sullivan said on ABC’s'This Wee' on Sunday. US diplomats 'will keep working at that over the coming weeks to try to arrive at a mutual return' to the nuclear deal within guidance laid out by President Joe Biden, he said.'''

For oil, the wild card of the market is Iran as more supply could come on to the market is a deal is reached.

The WTI market is heavy but given the support structure on the daily chart, there could be an upside extension on the cards:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637555934430962770.png&w=1536&q=95)