Is being bullish still justified?

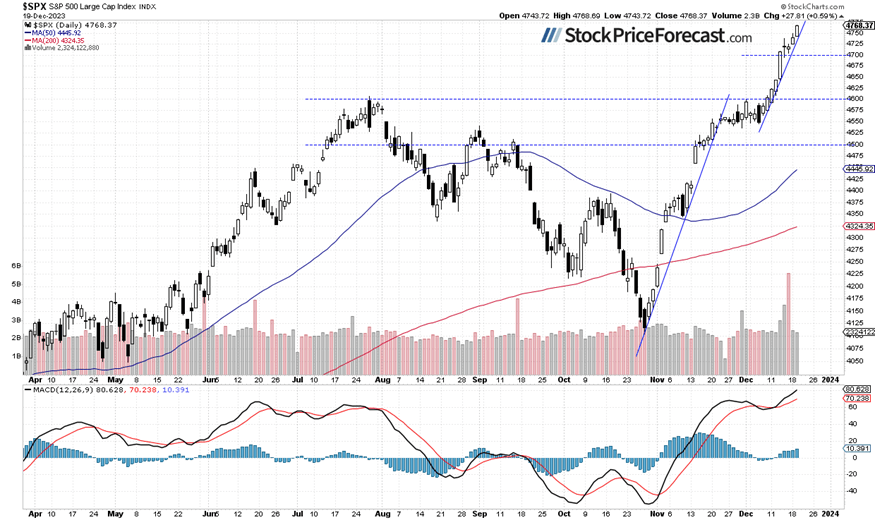

The S&P 500 index gained 0.59% on Tuesday, further extending the uptrend following last week’s release of the FOMC Statement release on Wednesday, which marked a pivot in the Fed’s monetary policy. The market went even closer to its Jan. 4 of 2022 all-time high level at 4,818.62 yesterday. Recently the S&P 500 broke above the late July local high of around 4,607 after resuming a rally from the local low of 4,103.78 on October 27.

Stocks will likely open 0.2% lower today, so the S&P 500 index may trade sideways, but there’s still potential for it to reach the mentioned record high level, which was only 1.05% above yesterday’s closing price. The S&P 500 index continues to trade along its steep upward trend line as we can see on the daily chart:

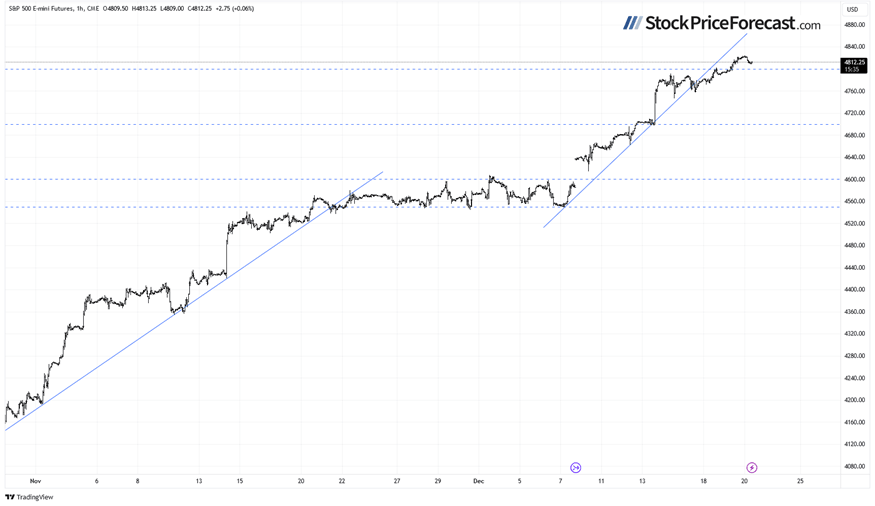

Futures contract remains above 4,800

Let’s take a look at the hourly chart of the S&P 500 futures contract. It’s trading above 4,800 level ahead of the index open, but the market is basically going sideways following yesterday’s daily advance. The nearest important support level is now at 4,780-4,800, among others.

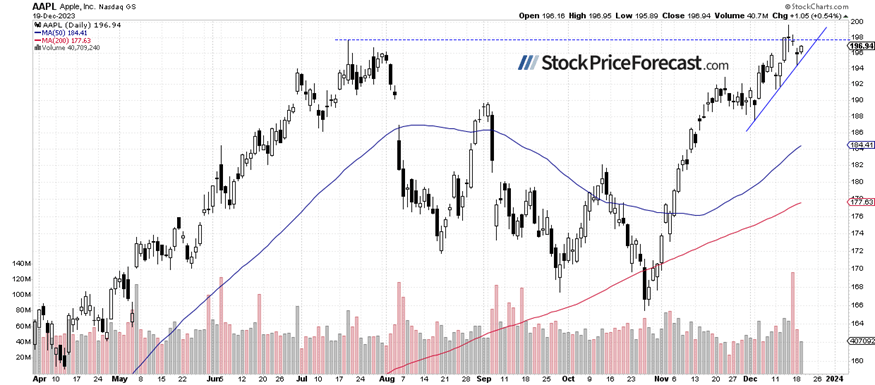

Apple is still at resistance level

Let’s move on to an individual stock. Apple is one of the most important market movers. On Monday I wrote that it “looks like a topping pattern or just some flat correction following the rally”, and indeed, the market retraced some of its recent rally before bouncing from the upward trend line. The $200 price level remains an important resistance level here.

Conclusion

Stocks are expected to retrace some of their yesterday’s advance, yet the market remains very close to its medium-term high. Will the S&P 500 reach a new record high soon? There is a chance of extending the uptrend, given the yesterday’s daily close was just 1.05% below the all-time high level.

There have been no confirmed negative signals so far, but the market may experience a downward correction at some point. The long position remains profitable and yesterday it added even more gains. Overall the index has gained 776 points or 19.4% since opening that trade at 3,992.4 on Feb. 27. In the near future, I will be looking to close that trade and shift focus to a more short-term oriented trading strategy. For now, it remains justified as stocks may further extend their uptrend.

Here’s the breakdown:

-

The S&P 500 further extended its advance as it got closer to the record high level from early 2022.

-

There may be a downward correction at some point.

-

In my opinion, the short-term outlook is still bullish.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.