Stock market check in: Defense stocks steal the limelight

- UK’s index lifted by defense names

- Oil majors hit by falling oil price

- Europe also buoyed by defense names

- US could see rotation out of tech and into defense

2026 is turning out to be full of surprises, mostly due to President Trump. He is once again dominating markets, and this time his rapid expansion of foreign policy is triggering a surge into defense stocks. The market is eagerly watching developments with Greenland and also the ongoing situation in Venezuela, and as tensions rise this sector is outperforming.

If you want to gauge the market’s view on the geopolitical situation, take a look at the early YTD performance of the FTSE 100 and the Dax. The FTSE100’S top performers are dominated by defense firms. BAE Systems, Babcock International and Rolls Royce are higher by 18%, 17% and 10% respectively. This isn’t bad for the 8th January.

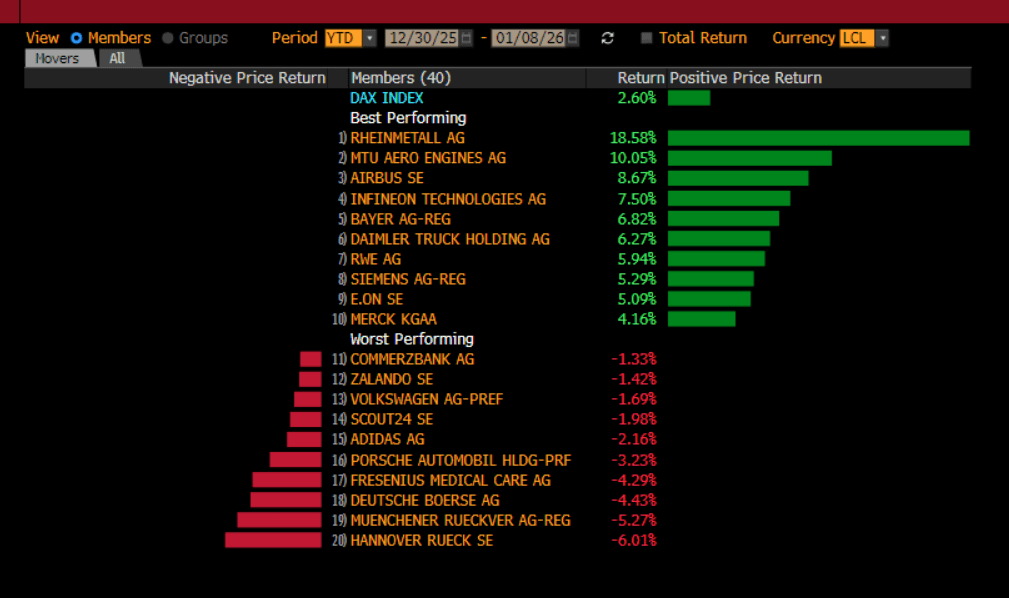

In Germany, the situation is similar, with a rush into defense names including Rheinmetall, MTU Engineering, Airbus and Infineon. Rheinmetall is also up 18% YTD with smaller gains for the other names.

So far, European stocks are outperforming their US counterparts, especially the Dax. The FTSE 100 is higher by just over 1% in 2026, however, underperformance of some retailers and the oil majors, as the oil price remains subdued which is weighing on their profits, is limiting the upside for the UK index.

US stocks had been led higher by a strong rally in semiconductor stocks as the AI theme extended into the start of the new year. The new year rally was led by a broader array of AI names than we have been used to, including Sandisk. However, the rally has stalled, and we could see a rotation into US defense names after President Trump announced his plans to raise defense spending to $1.5 trillion by 2027. Halliburton is up 12% YTD, while Lockheed Martin is up nearly 8%. While this is not quite top 10 territory, we expect investors to remain attracted to US defense stocks in the medium term.

In time, we expect President Trump to dial down some of his rhetoric, especially around Greenland, and his defense spending ‘plan’ is likely to be an aspirational target rather than set in stone, even so, the first week of trading in January is likely to set the tone for some time and defense is expected to be one of the key themes for the year.

Chart 1: YTD top and bottom performers in the FTSE 100

-1767897767420-1767897767420.png&w=1536&q=95)

Source: XTB and Bloomberg

Chart 2: YTD top and bottom performers in the Dax

Source: XTB and Bloomberg

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.