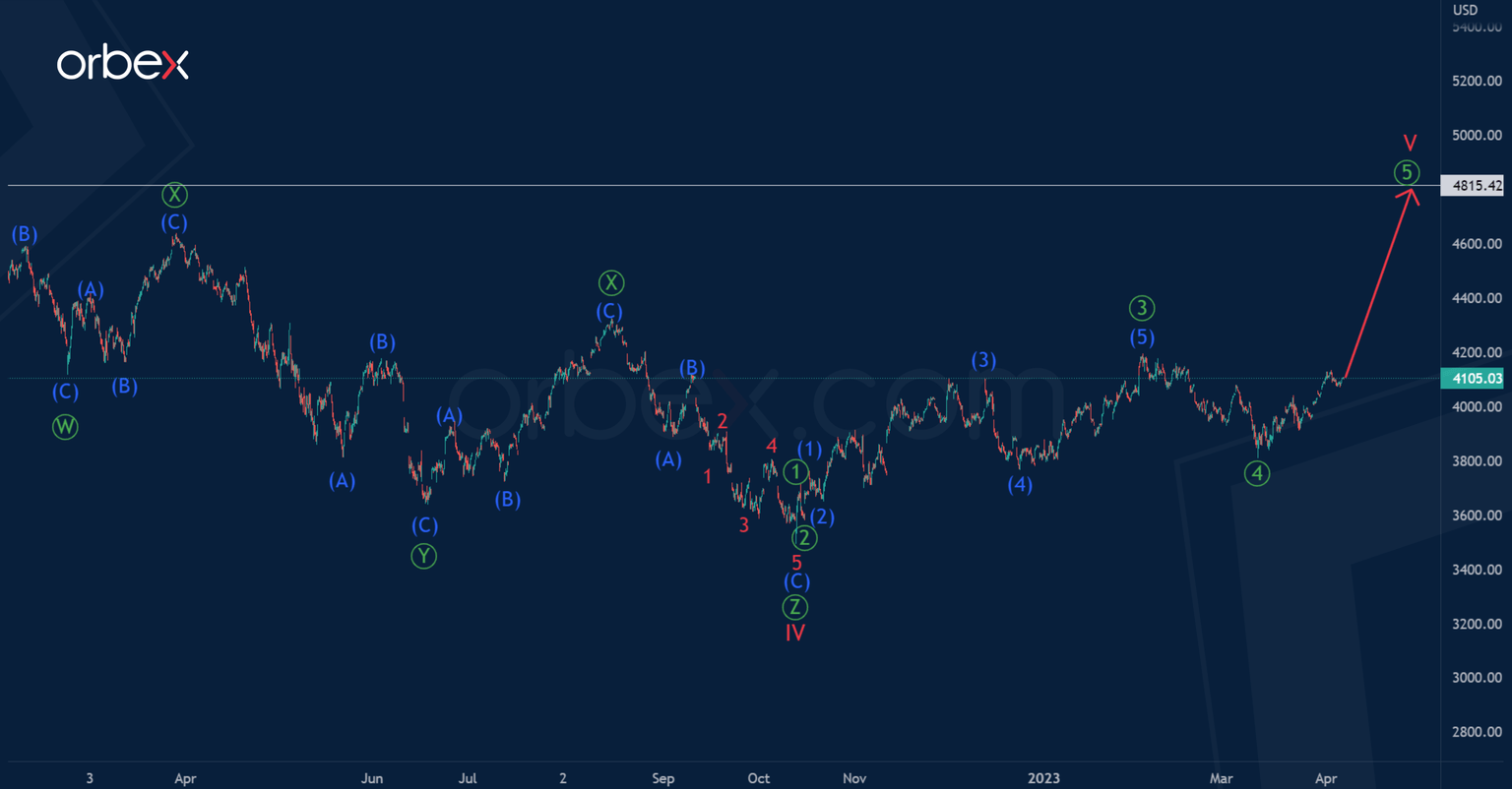

SPX500: We continue to wait for bullish growth to the maximum of 4815.42

We talked about the SPX500 index a few weeks ago. Today we see that the market continues to develop a major impulse consisting of sub-waves I-II-III-IV-V, or rather its final part.

It is assumed that the cycle correction IV was completed in the form of a primary triple zigzag, after which the price went up.

Impulse V is under development. In the near future, the market may move up to the maximum of 4815.42, which was marked by the cycle impulse wave III (it is not visible on this chart).

Also, let's look at the second scenario. Perhaps the construction of correction IV can continue. There is an assumption that its actionary wave tends to equality with the wave.

In the near future, the price is expected to fall to the price mark of 3335.47, at which the sub- waves and will be equal to each other.

The market can move down, forming a minor impulse 1-2-3-4-5 to the specified level.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.