S&P 500 rallies on financial turmoil easing, spurred by authorities and US banks

- The three major indices, the S&P 500, the Nasdaq, and the Dow Jones, finished the day with gains.

- Finance authorities and US banks providing aid to First Republic Bank improved the market sentiment.

- US Initial Jobless Claims rose less than expected, making the labor market tight.

- Money market futures are expecting a 25 bps rate hike by the Fed.

Wall Street finished Thursday’s session with gains after the financial markets turmoil spurred by the collapse of two US regional banks and the Credit Suisse liquidity crisis. However, US banks stepped in and gave $30 billion to First Republic Bank, while Swiss authorities endorsed Credit Suisse.

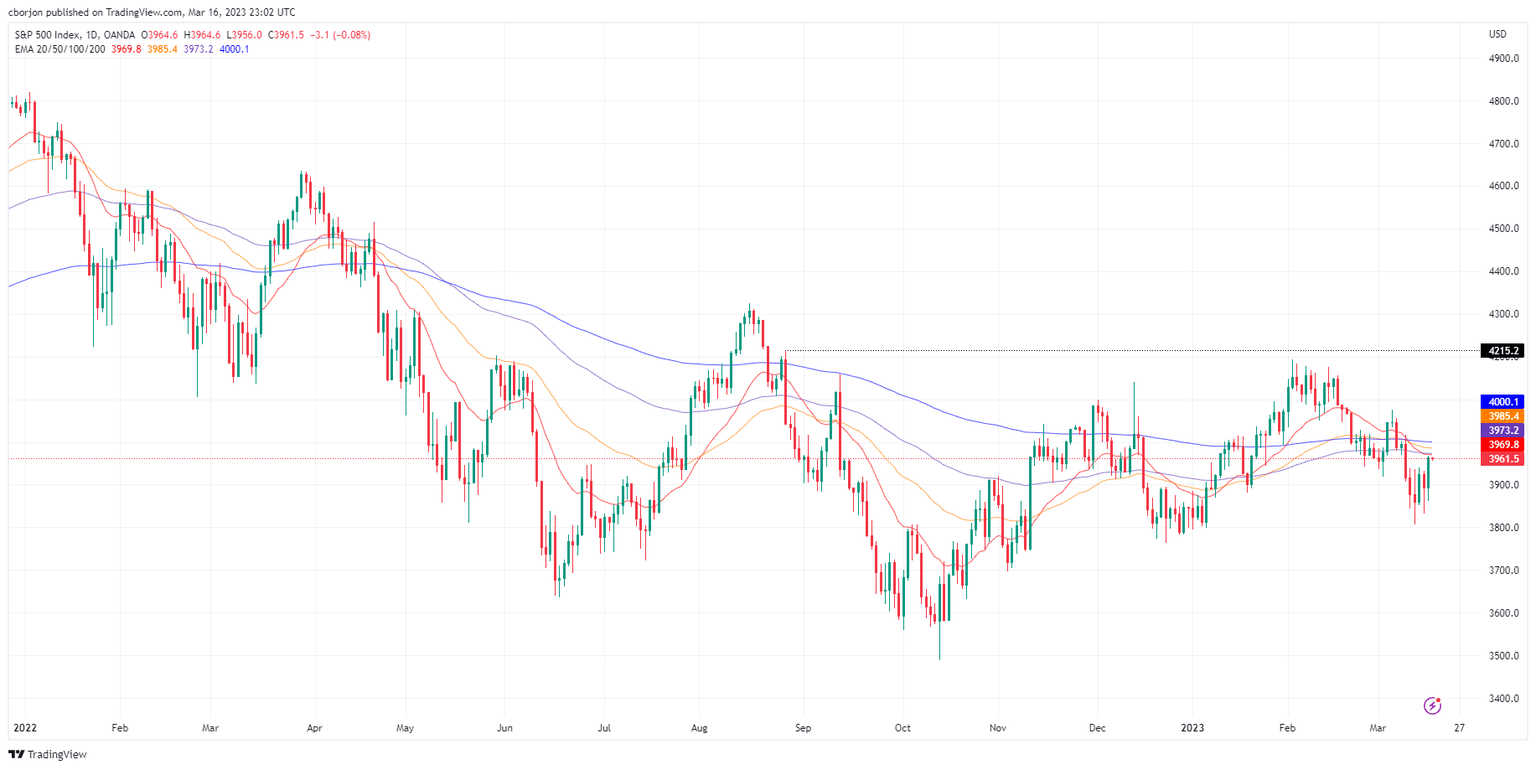

On Thursday, the S&P 500 gained 1.76%, at 3960.28, and the heavy-tech Nasdaq 100 rose 2.48% at 11,717.28. The Dow Jones Industrial Average registered gains of 1.17%.

During the week, turbulence in the global financial markets reminded us of the Global Financial Crisis in the 2000s. That triggered volatility amongst the different asset classes, with safe-haven assets like Gold, Silver, and US Treasuries, amongst others, being the gainers.

Therefore, US Treasury bond yields collapsed, with them, the greenback. The US Dollar Index closed at 104.203, down 0.29%, undermined by the fall of the 10-year bond yield. The US 10-year benchmark note rate is 3.579%, down 0.11%.

Sector-wise, Technology, Communication Services, and Financials were the pack’s leaders, up 2.82%, 2.77%, and 1.95%, respectively. The laggards were Consumer Staples and Real Estate, each down 0.06% and 0.07%.

The Bureau of Labor Statistics (BLS) revealed that unemployment claims for the week ending on March 12 increased by 192K, beneath estimates of 205K, lower than the previous week’s 212K. At the same time, housing data like Building Permits and Housing Starts came above estimates, and the Philadelphia Fed revealed that manufacturing activity contracted at a slower rate in March.

In the meantime, expectations for a 25 bps rate hike by the Federal Reserve (Fed) shifted up. The CME FedWatch Tool odds for a 25 bps hike lie at 79.7% to the 4.75% - 5.00% range.

What to watch?

The US calendar will feature Industrial Production for February in monthly and annual readings. The MoM figures are estimated at 0.2%, above January’s 0%. In addition, the University of Michigan (UoM) Consumer Sentiment poll will update American sentiment regarding the economy and revise inflation expectations.

S&P 500 Daily chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.