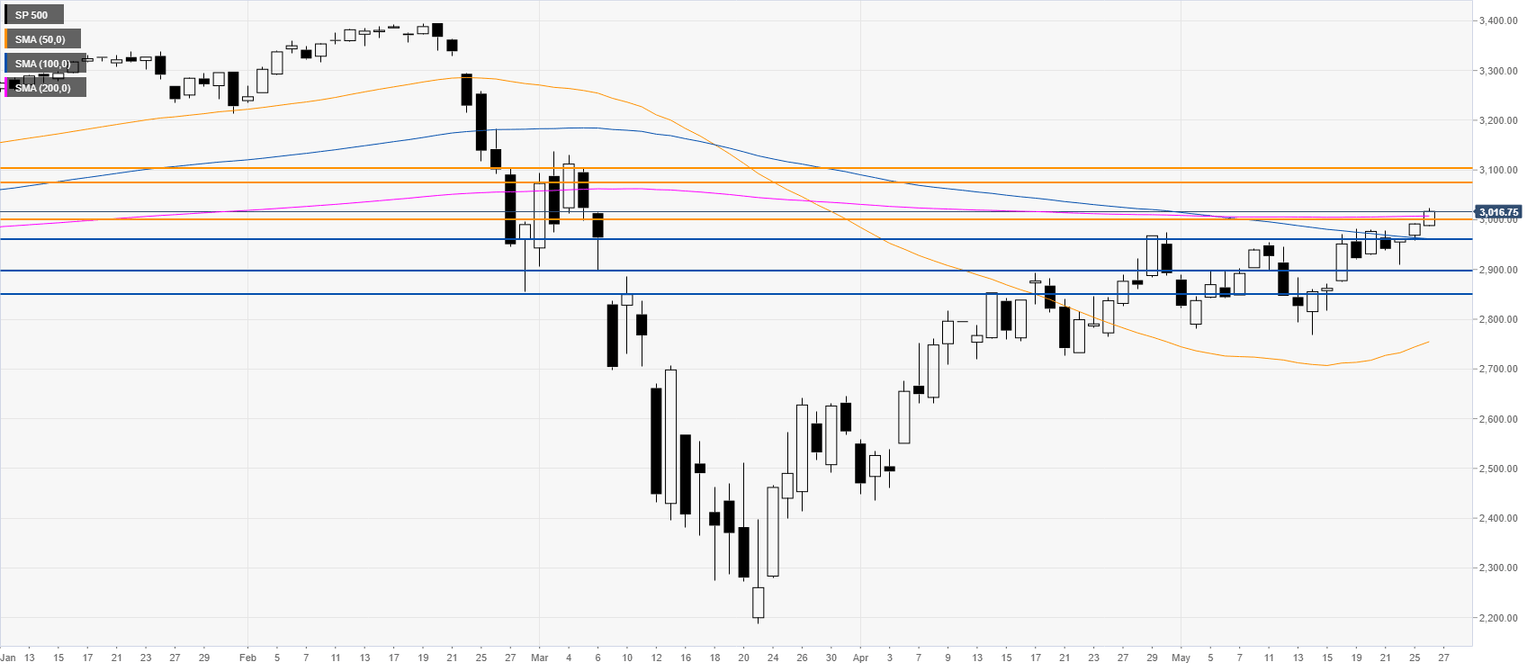

S&P 500 Price Analysis: US stocks break to fresh 2.5-month highs above the 3000 mark

- The bullish recovery sees the market trade in fresh 2.5-month highs.

- The S&P 500 breaks above the 3000 critical resistance.

S&P 500 daily chart

Additional key levels

Author

Flavio Tosti

Independent Analyst