S&P 500 Index opens lower following Monday's rebound, energy stocks plunge

- Wall Street's main indexes trade little changed on Tuesday.

- Energy shares fall sharply pressured by plunging crude oil prices.

- Investors await FOMC Chairman Powell and Treasury Secretary Yellen's testimony.

Major equity indexes started the day relatively close to Monday's closing levels as investors seem to be refraining from taking large positions ahead of FOMC Chairman Jerome Powell's and Treasury Secretary Janet Yellen's testimony before Congress.

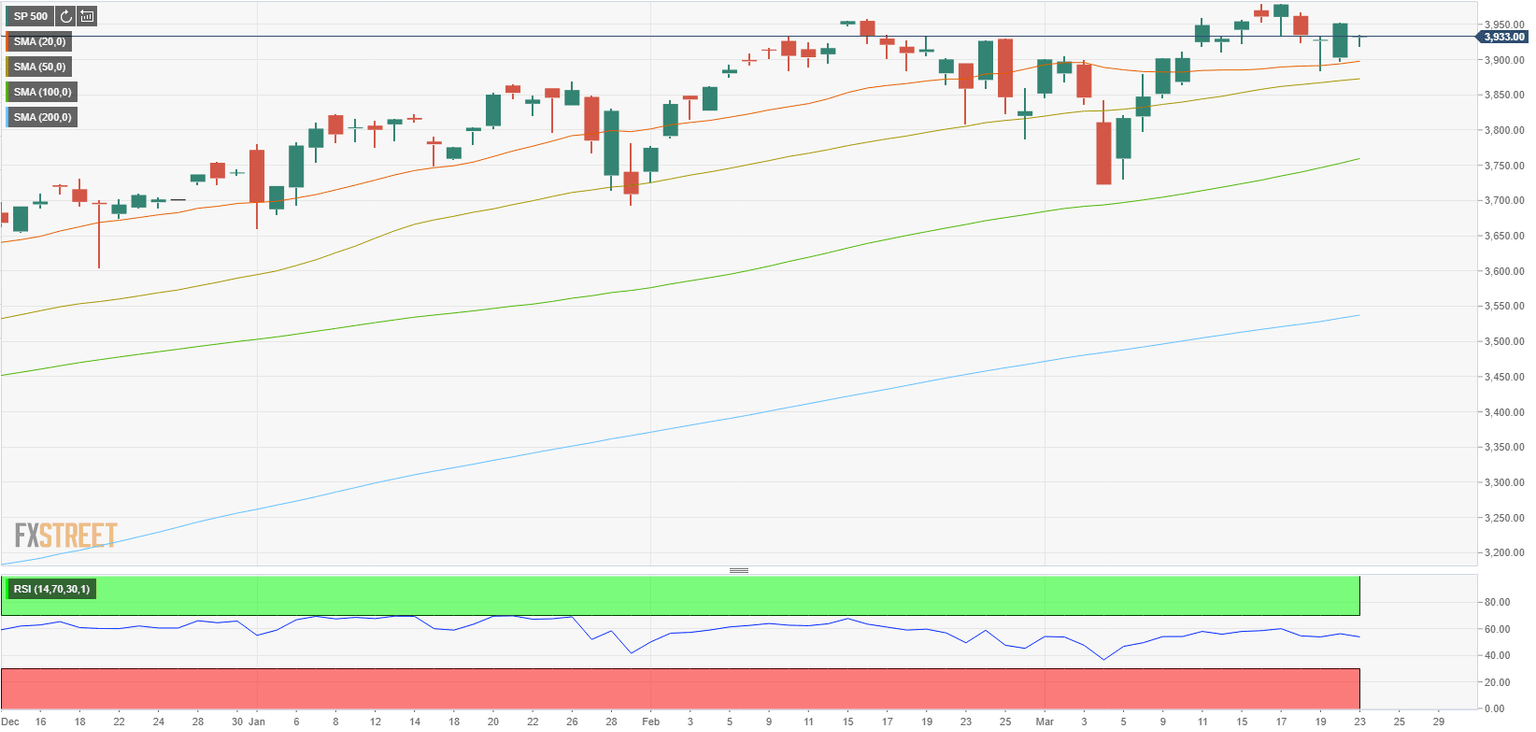

As of writing, the S&P 500 Index was down 0.2% on the day at 3,932, the Dow Jones Industrial Average was losing 0.25% at 32,656 and the Nasdaq Composite was rising 0.3% at 13,127.

Among the 11 major S&P 500 sectors, the Energy Index is down 2% after the opening bell pressured by a 3.5% decline in crude oil prices. Meanwhile, the Financials Index is losing 0.4% as the 10-year US Treasury bond yield is losing more than 2% for the second straight day on Tuesday. On the other hand, the Technology Index is posting modest daily gains.

Later in the session, New Home Sales and Richmond Fed Manufacturing Index data will be featured in the US economic docket.

S&P 500 chart (daily)

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.