S&P 500 Index extends slide into second straight day

- Wall Street's main indexes trade in the negative territory.

- Energy shares suffer heavy losses after the opening bell.

- CBOE Volatility Index (VIX) is up more than 7%.

After posting modest losses on Monday, major equity indexes in the US opened in the negative territory on Tuesday. Reflecting the negative shift in market mood, the CBOE Volatility Index (VIX), Wall Street's fear gauge, is up more than 7% on a daily basis.

At the moment, the S&P 500 is down 0.55% at 4,140, the Dow Jones Industrial Average is losing 0.72% at 33,832 and the Nasdaq Composite is falling 0.55% at 13,831.

Among the 11 major S&P 500 sectors, the Energy Index is down 3% pressured by a 1.7% decline in the US crude oil prices. On the other hand, the defensive sectors, the Utilities Index and the Real Estate Index, both rise around 1%, confirming the risk-averse market environment.

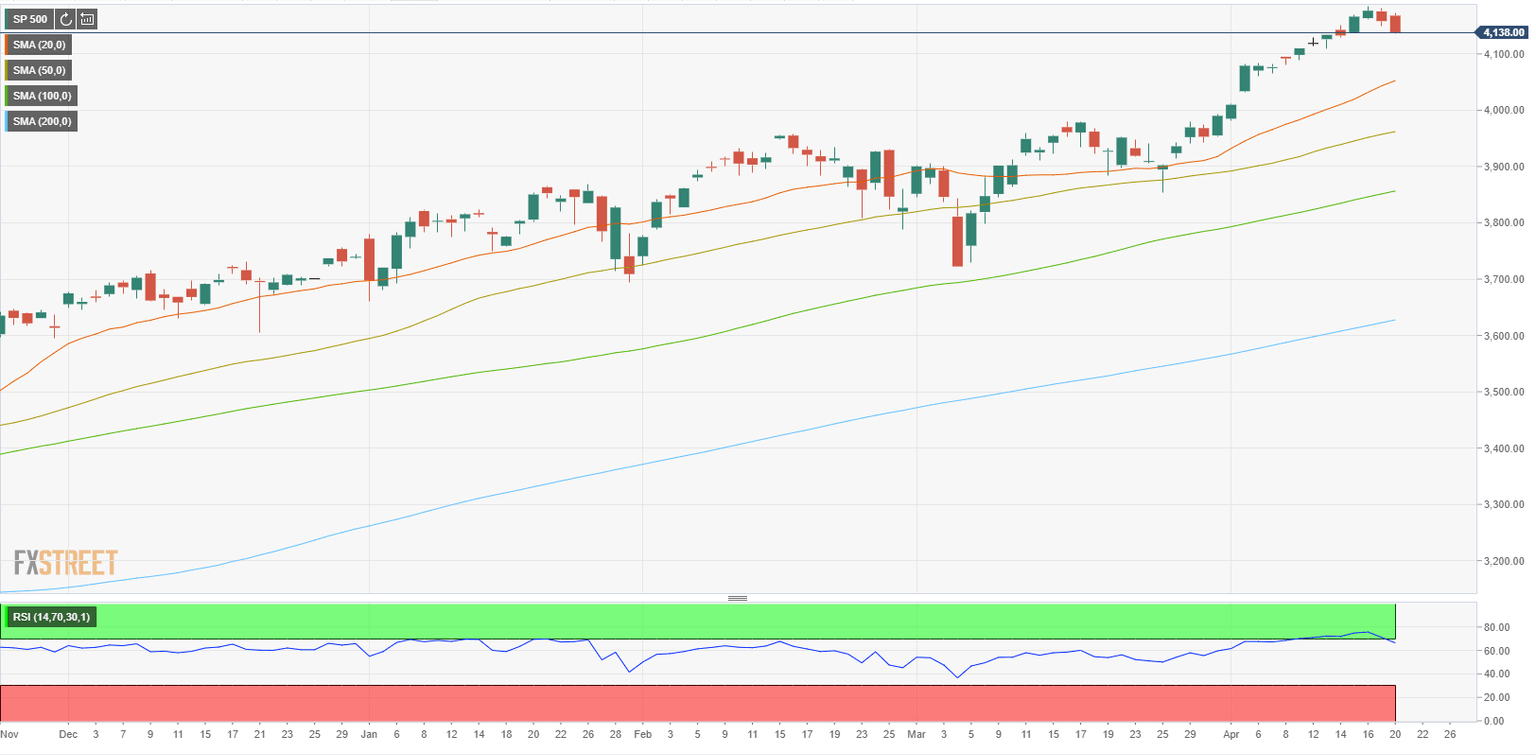

S&P 500 chart (daily)

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.