Silver Price Forecast: XAG/USD tests key support at $37.50 ahead of Fed decision

- Silver extends decline, hovers near $37.50 after hitting a 14-year high of $39.53 on July 23.

- The US Dollar rallies on strong macro data; Q2 GDP grew 3.0%, beating expectations.

- The Fed is expected to hold rates at 4.25%-4.50%; political pressure builds after Trump calls for rate cuts.

Silver (XAG/USD) drifts lower on Wednesday, hovering around $37.50 after two days of muted, range-bound trading, pressured by renewed strength in the US Dollar (USD). The Greenback extended its rally after a string of stronger-than-expected US economic data, putting pressure on precious metals. At the same time, a broader risk-on tone across global markets is further dampening demand for safe-haven assets such as Silver. Traders now turn their attention to the Federal Reserve’s (Fed) monetary policy decision due later on Wednesday, which could inject fresh volatility into the market.

Fresh US economic data released Wednesday reinforced the narrative of a resilient economy. The preliminary reading for second-quarter GDP showed the US economy expanding at a 3.0% annualized rate, far outpacing the 0.5% contraction recorded in Q1. Meanwhile, the preliminary Core PCE price index rose 2.5% in Q2, remaining above the central bank’s 2% target. However, the GDP Price Index eased to 2.0%, below the expected 2.4%, while headline PCE inflation slowed significantly to 2.1% from 3.7%. On the labor front, the ADP Employment Change report revealed a stronger-than-expected gain of 104,000 private sector jobs in July, a notable recovery from June’s revised 33,000. The data points to sustained momentum in growth and hiring, but softening inflation signals may give the Fed room to maintain a cautious tone in its policy guidance.

The Fed is widely expected to leave interest rates unchanged at the 4.25%-4.50% range in today’s policy decision. However, the central bank continues to face growing political pressure. US President Donald Trump weighed in on Wednesday’s stronger-than-expected GDP figures, posting on Truth Social: “2Q GDP just out: 3%, way better than expected! ‘Too late’ — must now lower the rate. No inflation! Let people buy, and refinance, their homes.” While the Fed maintains its stance of independence and data-dependence, such comments may heighten the spotlight on Fed Chair Powell’s post-meeting remarks.

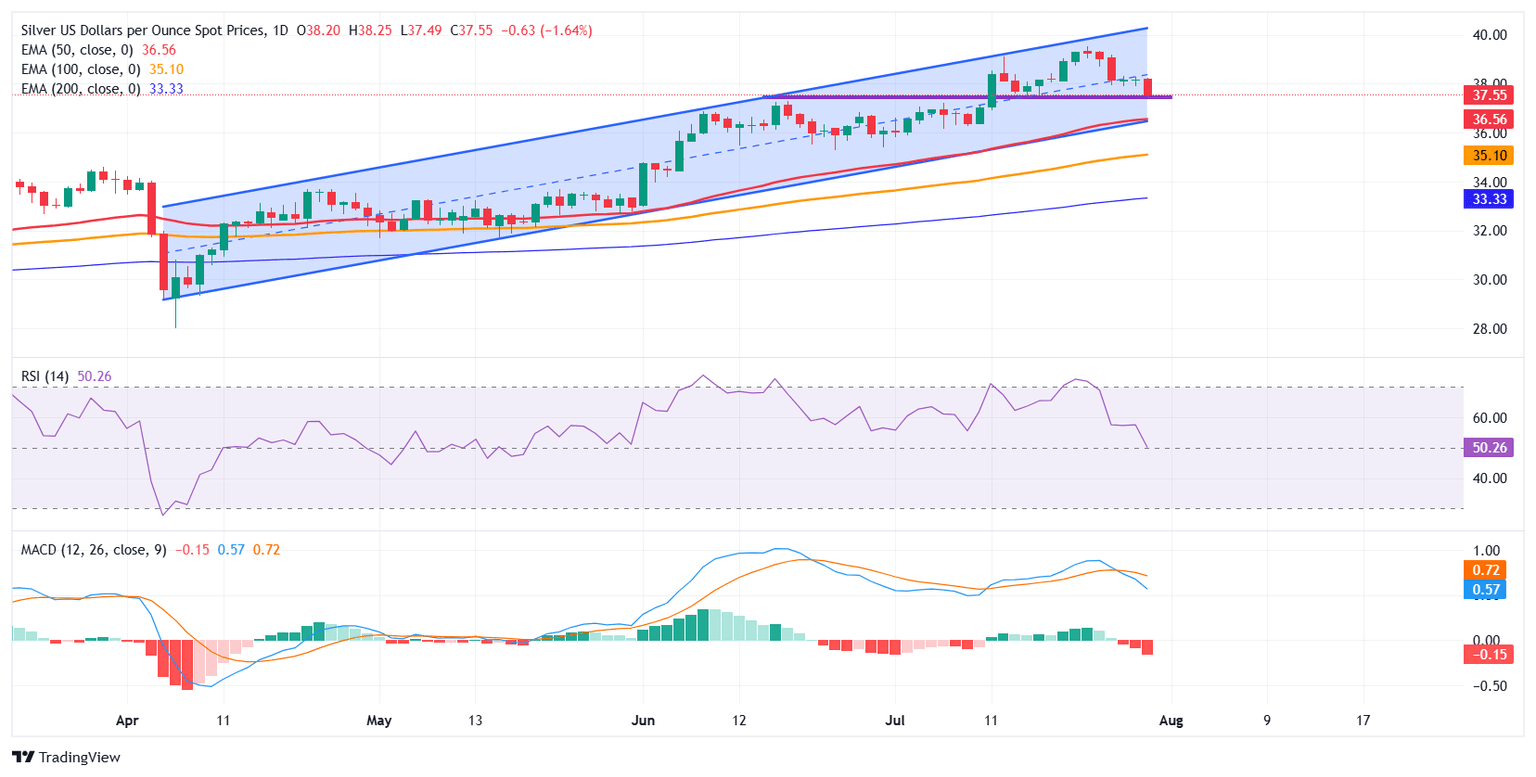

From a technical standpoint, silver (XAG/USD) has come under pressure after hitting a 14-year high of $39.53 on July 23. The price has since fallen nearly 4.75%, slipping below the midpoint of the ascending channel that has defined the uptrend since April.

As of now, silver is testing a key support level at $37.50 — a zone that previously acted as resistance. A daily close below this area could pave the way for a move toward the lower boundary of the ascending channel, which closely coincides with the 50-day Exponential Moving Average (EMA), increasing the risk of a deeper pullback if buyers fail to defend this level. A clean break below that region would likely expose the 100-day EMA at $35.10, followed by the 200-day EMA near $33.31, raising the risk of a deeper corrective move.

Momentum indicators are flashing warning signs. The Relative Strength Index (RSI) has slipped to 50, suggesting fading bullish momentum. At the same time, the Moving Average Convergence Divergence (MACD) indicator has turned bearish, with the MACD line crossing below the signal line and the histogram moving into negative territory, indicating growing downside pressure.

On the upside, initial resistance lies in the $38.25-$38.50 zone. A break above this area is needed to restore short-term bullish control. A move through $39.53 would confirm a breakout and likely pave the way for a test of the psychological $40.00 level. Until then, the near-term bias leans bearish.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.