Silver Price Forecast: XAG/USD plunges below $24.00 amid a mixed mood, firm US dollar

- The Silver Price will extend its losses if a daily close below the 200-DMA is achieved.

- The market sentiment shifted positive, but China’s coronavirus outbreak could turn it sour.

- The greenback remains in the driver’s seat, as shown by the US Dollar Index, reaching a new YTD high at 101.85

- Silver Price Forecast (XAG/USD): A daily close below the 200-DMA could extend the Silver slide towards $22.00.

Silver Price is dropping sharply on the back of an early risk-off dominated session, courtesy of China’s coronavirus outbreak spreading towards Beijing and market participants’ woes regarding a faster pace of tightening by the Federal Reserve. At $23.61, XAG/USD reflects the aforementioned, as safe-haven flows went to the greenback, not precious metals, as Gold is also down 1.73 in the day.

China’s coronavirus spreads from Shanghai to Beijing as further lockdowns loom

The market mood improved late near Wall Street’s close, as US equities recorded gains. China’s growing concerns weighed on commodity prices, as shown by oil, precious, and base metals, ending the day with losses. A renewed coronavirus outbreak in Shanghai triggered lockdowns in the city, extending to certain districts in Beijing. If the lockdowns continue, that would weigh on the global economic outlook. Additionally, the US central bank tightening expectations have fully priced in a 100% chance of a 0.50% rate hike in the May meeting, while for June, the odds are at 80%, as shown by the CME FedWatch Tool.

In the meantime, the greenback remains underpinned by increasing bets that the Federal Reserve would hike rates at a faster pace, with the US Dollar Index gaining some 0.61%, sitting at 101.738. Meanwhile, the US 10-year Treasury yield lost eight basis points on Monday, down to 2.818%.

This week’s highlight of the US economic docket is the first-quarter GDP, which would be unlikely to change the view of Fed policymakers of a 50-bps rate hike in May. Regarding the report, analysts at ING wrote in a note that “t[T]he coming data shouldn’t impact this outlook meaningfully. 1Q GDP data is expected to show the economy expanded at a 1-1.5% annualised rate, which would mark quite a deceleration from 4Q 2021’s 6.9% rate, reflecting the Omicron wave of the pandemic that impacted people movement quite considerably. However, recent data has pointed to a renewed uptick in activity and we expect to see stronger GDP growth for the second quarter.”

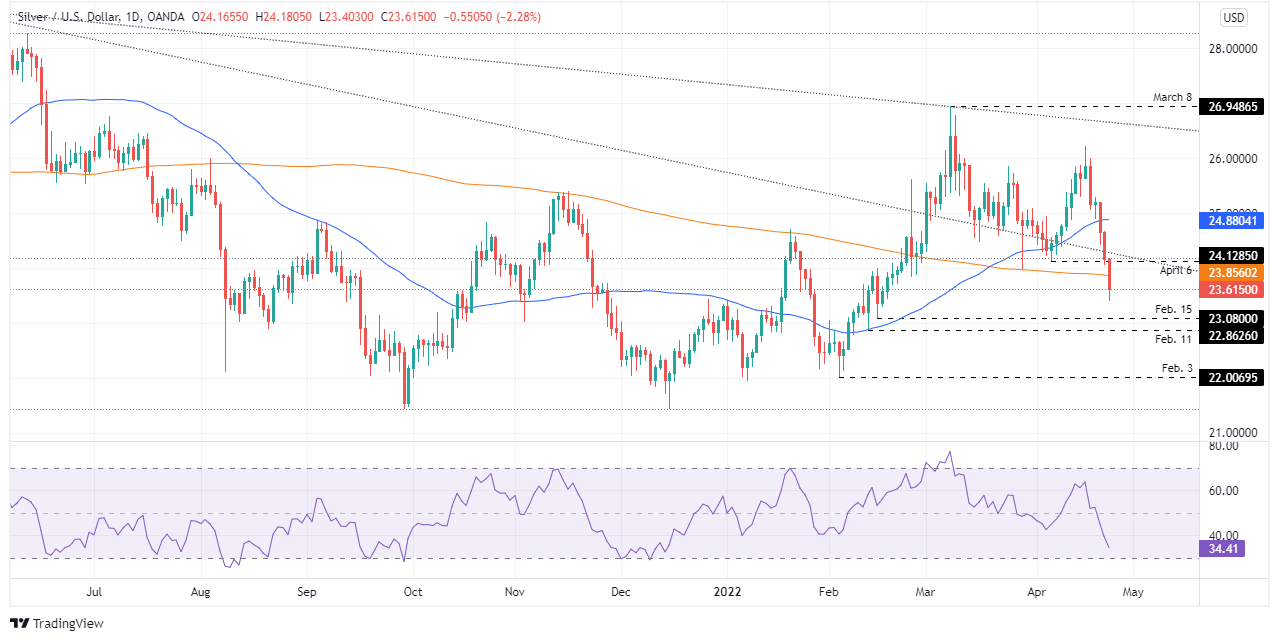

Silver Price Forecast (XAG/USD): Technical outlook

On Monday, the XAG/USD daily chart shows that the price action broke below the 200-day moving average (DMA) at $23.85. However, a daily close below the latter is required to further cement that the bias shifted from upwards to neutral. Furthermore, it’s worth noting that the Relative Strength Index (RSI) is aiming downwards, at 34.41, but it has some room to spare if Silver extends its losses.

In the case of further downside, the XAG/USD’s first support would be the February 15 daily low at $23.08. Once cleared, the following demand zone would be the February 11 daily low at $22.86, which, once out of the way, has a long run towards Silver bull’s last line of defense at $22.00.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.