Silver Price Forecast: XAG/USD plummets towards the $21.00 on broad US dollar strength

- The white metal remains on the defensive and dives more than 2% on Thursday.

- Fed officials backed further rate hikes, though Fed chair Powell acknowledged that the US might get into a recession.

- Silver Price Forecast (XAG/USD): Stays downward biased, and a break below $21.00 might pave the way for fresh YTD lows.

Silver (XAG/USD) plunges in the mid-North American session, falling from daily highs around $21.50 just above the $21.00 figure, weighed by a buoyant greenback amidst a mixed market mood, portrayed by US equities advancing, while European bourses closed in the red. At the time of writing, XAG/USD is trading at $21.03.

Recession fears and robust greenback drag metals prices down

The US and global recession fears struck the white metal price and Gold also. On Wednesday, US Federal Reserve chief Jerome Powell admitted that achieving a “soft landing” would be challenging while accepting that the US economy might tip into a recession. Nevertheless, he reiterated Fed’s compromise to tame inflation, and Powell stated that he is not taking any size of rate increases off the table.

Today at the US House of Representatives, Powell reiterated his and the commitment of the Fed to tame inflation, and his narrative stuck around Wednesday’s speech. Meanwhile, one of his colleagues at the Fed, Governor Michelle Bowman, said that she supported a 75 bps in July and commented that inflation is unacceptably high, showing no signs of moderating.

Therefore, the greenback advanced as Fed officials laid the ground for another rate hike. The US Dollar Index, a measure of the buck’s value vs. a basket of currencies, climbs 0.15% to 104.339, contrarily to the US 10-year Treasury yield, which is sliding seven basis points, yielding 3.085%.

Elsewhere US 10-year TIPS (Treasury Inflation-Protected Securities), a proxy for US Real yields, slumps nine bps and is back below 0.60%. Usually, lower Real yields would mean that appetite for precious metals augments, but a strong US dollar puts a lid on precious metals prices.

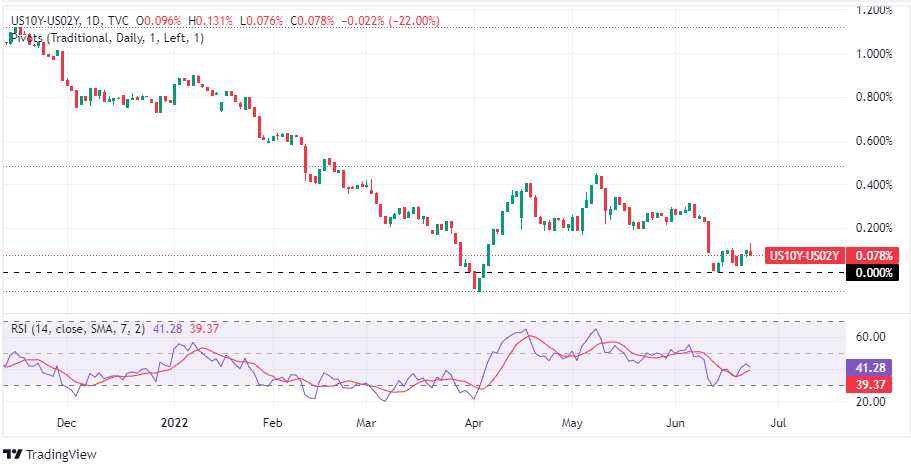

Meanwhile, the US 10s-2s yield spread remains positive at 0.078%, though it remains to push towards 0%. A reading below 0% would imply that traders forecast a recession in the US.

Data-wise, the US economic docket reported Initial Jobless Claims, which rose by 229K higher than the 227K estimated, illustrating that the labor market is tight. Later US S&P Global PMIs, on its Manufacturing, Services, and Composite numbers for June, exposed that the US economy is slowing down, which unnerved investors.

Silver Price Forecast (XAG/USD): Technical outlook

Silver remains downward biased from a technical perspective, though facing strong support around the $21.00 figure. Oscillators, in this case, the Relative Strenght Index (RSI) is signaling that selling pressure is piling; but failure to achieve a daily close below $21.00 would keep XAG/USD buyers hopeful of a rebound towards the 20-EMA at $21.74.

So as the XAG/USD path of least resistance is downwards, the first support would be $21.00. Break below would send prices towards June 13 low at 20.96, followed by the YTD low at $20.45.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.