Silver Price Forecast: XAG/USD extends decline as safe-haven flows ease

- Silver (XAG/USD) drops for a third straight day, tracking profit-taking as geopolitical risk premium eases.

- US President Donald Trump signals two-week window before deciding on possible US intervention in Iran–Israel crisis.

- The price hovers near $36.00, supported by the 100-period moving average on the 4-hour chart, intraday low is at $35.51.

Silver (XAG/USD) remains under pressure for a third day in a row on Friday, retreating further after US President Donald Trump announced he would hold off for two weeks before deciding whether the US should step into the escalating Iran–Israel standoff. This pause has eased some of the geopolitical risk premium that recently fueled safe-haven flows into precious metals, prompting traders to book profits and reassess positions as investors digest the shifting geopolitical landscape.

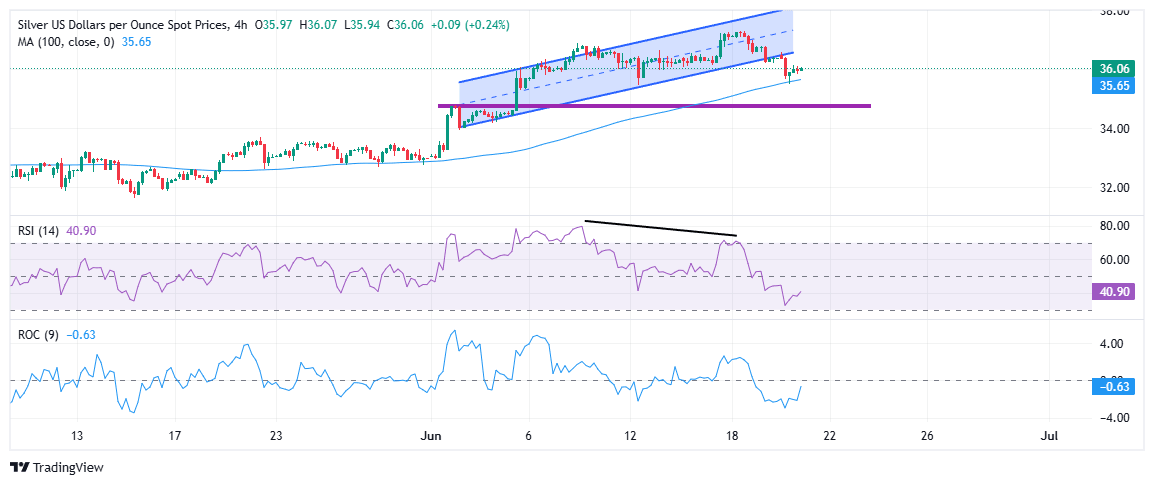

At the time of writing, Silver is trading around $36.00 during the American trading hours, recovering modestly after easing from an intraday low of $35.51. The metal found some support near its 100-period Moving Average (MA) on the 4-hour chart, which is acting as a key cushion for prices amid the current pullback.

From a technical perspective, Silver has begun to show signs of weakness in its recent uptrend, suggesting a potential deeper pullback as momentum wanes. After enjoying a steady climb within a neat rising channel since early June, the metal has now slipped below the channel’s lower boundary, signaling that buyers are losing grip, at least in the short run.

Currently, Silver is hovering just above its 100-period moving average around $35.65, which has reliably cushioned price dips in recent weeks. This dynamic support will be the first line of defense for bulls.

The Relative Strength Index (RSI) continues to drift lower after flashing a clear bearish divergence, reinforcing signs that bullish momentum is fading. At the same time, the Rate of Change (ROC) has slipped into negative territory, further confirming that Silver’s recent upward drive has lost steam and that the door is now open for a broader corrective phase.

Looking ahead, a sustained move back above the broken channel and a decisive break above $36.50 would be needed to revive bullish momentum and expose the next resistance around $37.00–$37.30. On the flip side, if Silver fails to defend the 100-period MA and slides below $35.50, the metal could come under increased pressure, with the next meaningful support seen at $35.00 and then $34.50. For now, the near-term bias remains cautiously tilted to the downside unless buyers regain control above $36.50 with conviction.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.