Silver Price Analysis: XAG/USD’s recovery stalls below $19.00

- Silver futures recovery losses steam below $19.00.

- Precious metals have pared losses on the back of a softer USD.

- XAG/USD remains close to a key support area at $17.60/18.10.

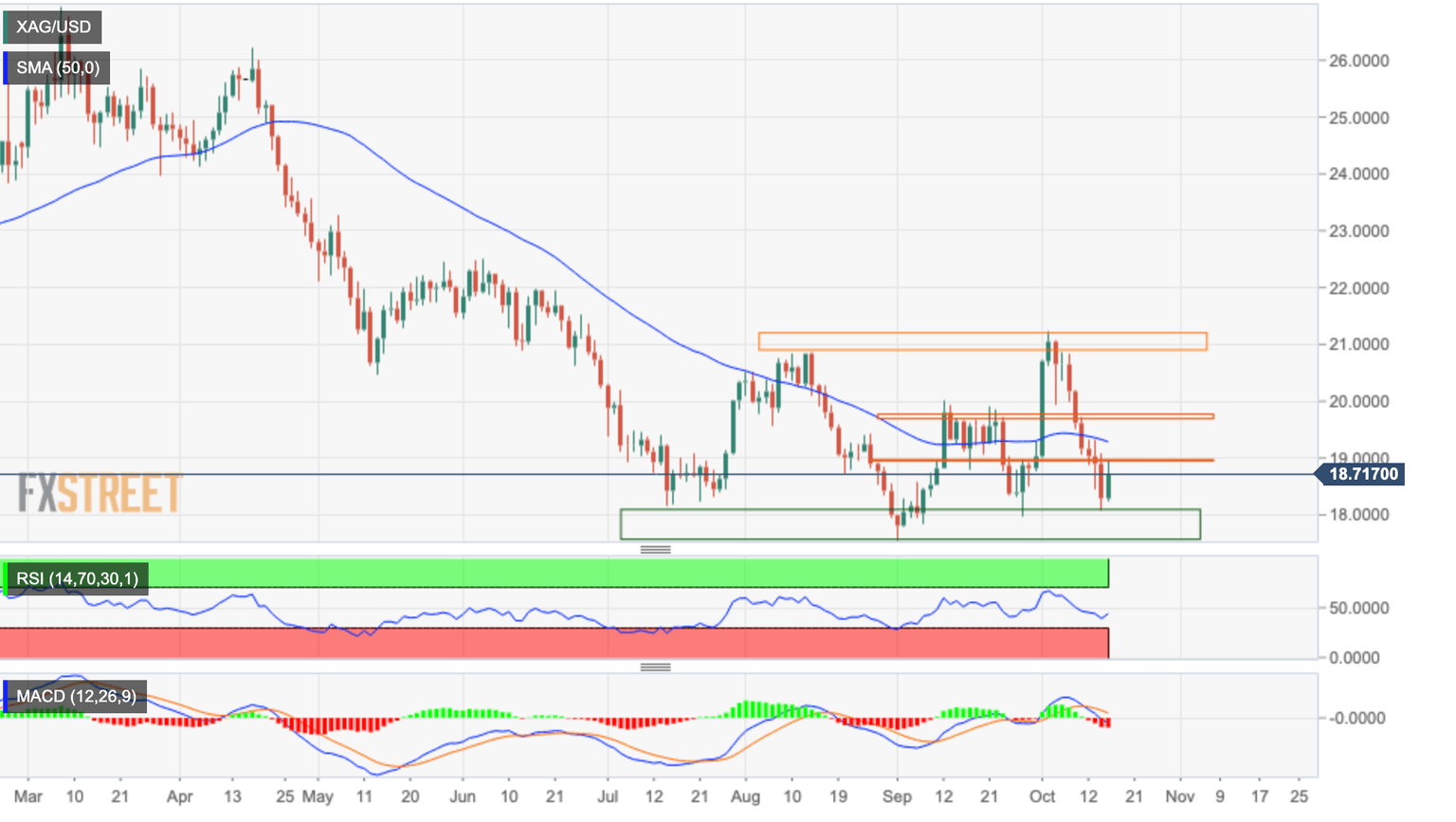

Silver futures’ recovery from Friday’s lows at $18.00 seems to have lost steam on Monday’s US trading session. XAG/USD has failed to find acceptance above $18.90, although downside attempts remain, so far, limited above $18.65.

Precious metals pare losses on the back of a softer USD

In the absence of first-tier macroeconomic releases, the news about the UK Government’s plan to reverse most of the tax cuts announced in September has been welcomed by investors. Stock markets are posting significant advances and the safe-haven US dollar has extended its pullback from recent highs.

The precious metal gained territory on Monday to put an end to a six-day sell-off, although the bullish trend has hesitated in the vicinity of $19.00. The pair would need to breach that revel to gather momentum and aim towards the $19.70/80 resistance area.

A confirmation above the $20.00 psychological level would negate the near-term negative trend and open the path toward August and October’s peaks in the area of $21.00

On the other hand, the pair remains still dangerously close to a key support area between $18.10 and $17.60, which contains July, August, and September’s lows. A downside reversal below here might take the pair to explore June 2020 lows at the $17.00 area and Apr 14, 2020, high at S15.85.

XAG/USD daily chart

Technical levels to watch

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.