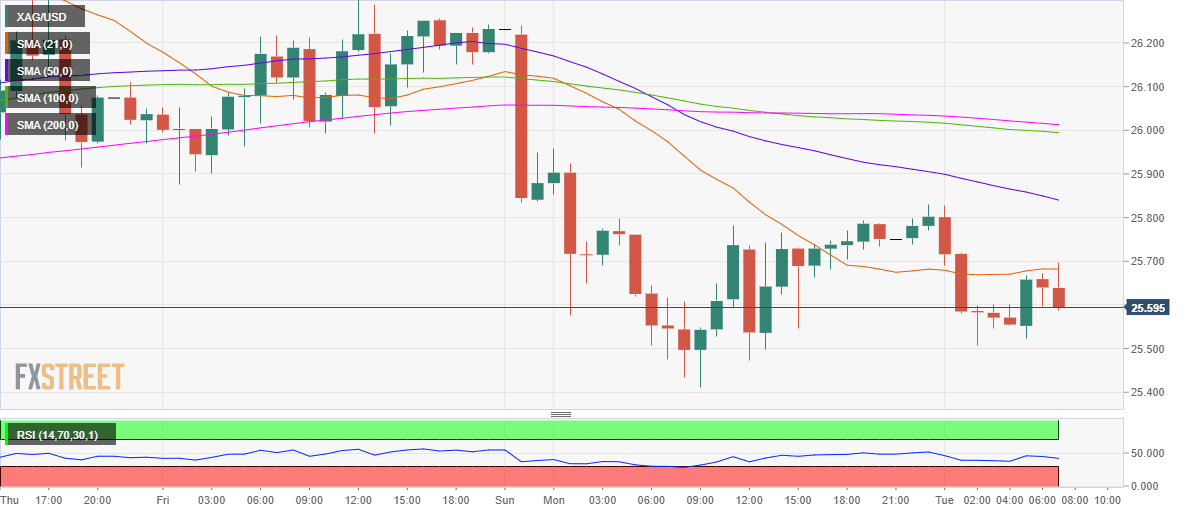

Silver Price Analysis: XAG/USD’s rebound stalls at 21-HMA, $25 support at risk

- Silver attempts a bounce after holding onto the $25.50 level.

- Acceptance above 21-HMA is critical to unleashing further gains.

- RSI stays bearish, pointing to a shallow recovery in XAG/USD.

Silver (XAG/USD) is attempting a minor bounce in European trading, having found solid support near the midpoint of the $25 level.

However, the XAG bulls appear to lack follow-through, as it faces stiff resistance at the horizontal 21-hourly moving average (HMA), now at $25.68

Silver Price Chart: Hourly

Acceptance above the latter is needed for the bulls to revive the recovery momentum towards the $25.85 level, where the price faced rejection in the US last session. At that level, the bearish 50-HMA also coincides.

The white metal could look to recapture the powerful resistance at $26, the confluence of the 200 and 100-HMAs, if the abovementioned hurdle is cleared on a sustained basis.

The Relative Strength Index (RSI) points south below the midline, suggesting that any pullback attempts are likely to remain shallow.

To the downside, a sustained move below the $25.50 support area would threaten the $25 threshold.

The March 5 low of $24.83 could be tested if the selling pressure intensifies.

Silver Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.