Silver Price Analysis: XAG/USD treads water above $19.50

- Silver prices' recovery stalls at $19.50 area.

- A weaker USD underpins the precious metals recovery.

- XAG/USD needs to breach an important resistance hurdle at $19.65/75.

Silver prices are trading higher for the second consecutive day on Wednesday, with the white metal extending its recovery from the $18.80 low on Tuesday to two-week highs at $1975, where it seems to have found a significant resistance hurdle.

USD weakness underpinning precious metals’ recovery

The XAG/USD appreciated earlier on Wednesday, fueled by a broad-based US dollar weakness, as the investors start to price in a slowdown on the Federal Reserve’s monetary tightening path.

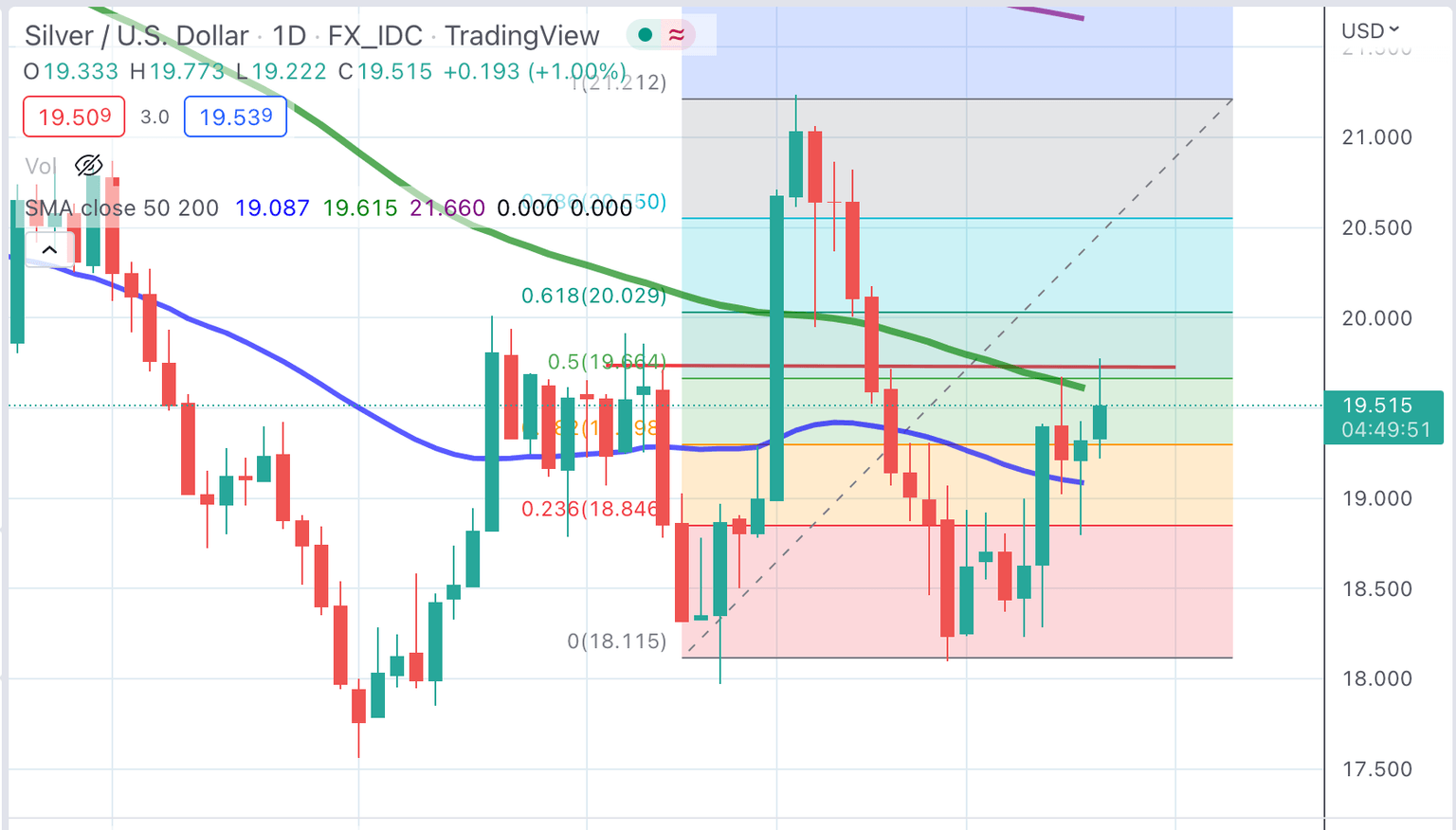

The positive price action, however, has stalled right below the $19.65/75 area, where the 100-day SMA meets the 50% Fibonacci retracement level of the October 4-14 decline and the September 23 high.

A successful break above that area would put the pair aiming for the $20.00 psychological level (and the 61,8% Fib level of the aforementioned decline) before aiming at $20.85 October 6 and 7 highs.

On the downside, the 50-day SMA, at $19.00 is defending the pair from further decline, so far, with the next potential support area at $18.80 (Oct 25 low) ahead of the October 14 low at $18.10.

XAG/USD daily chart

Technical levels to watch

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.