Silver Price Analysis: XAG/USD struggles to build on modest gains below 200-hour SMA

- Silver struggles to capitalize on a modest uptick and fails near the $23.80 support breakpoint.

- The mixed technical setup warrants some caution before placing aggressive directional bets.

- A sustained move beyond the $24.50 area is needed to negate any near-term negative outlook.

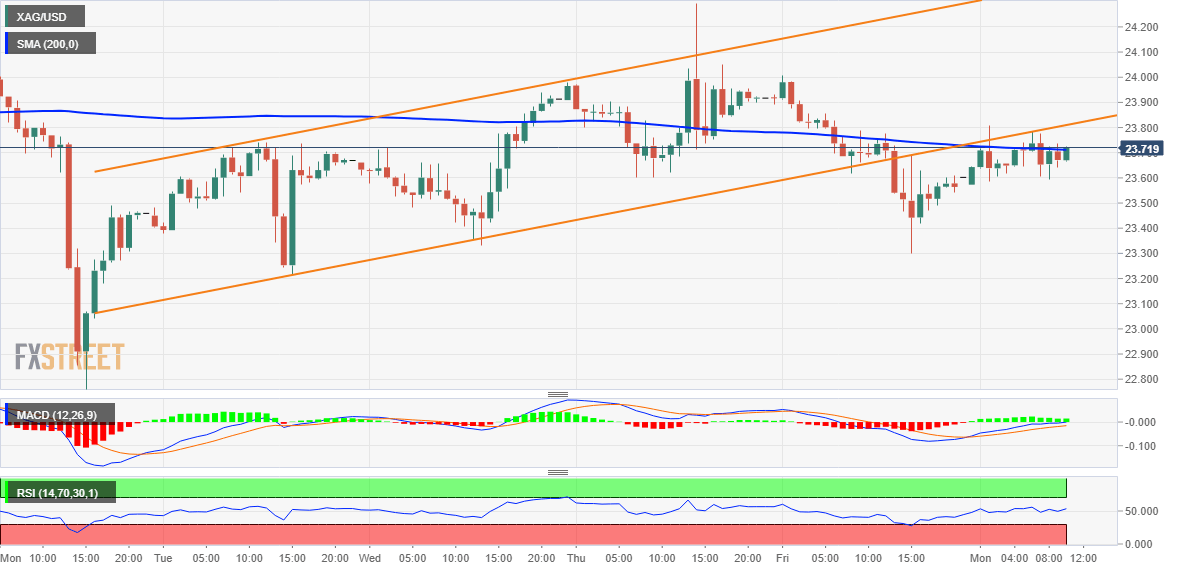

Silver builds on Friday's modest bounce from the $23.30 area and gains some positive traction on the first day of a new week. The white metal, however, struggles to capitalize on the strength and remains capped near the $23.70-$23.80 confluence support breakpoint, comprising the 200-hour SMA and the lower end of a short-term ascending channel.

From a technical perspective, last week's break below the aforementioned confluence support suggests that the near-term bias might have already shifted in favour of bearish traders. That said, oscillators on daily/hourly charts - though they have been losing momentum - are yet to confirm the negative outlook. This, in turn, warrants some caution before positioning for any further depreciating move.

In the meantime, Friday's swing low, around the $23.30 region, now seems to act as immediate support. A convincing break below will make the XAG/USD vulnerable to weaken below the $23.00 mark and test the next relevant support near the $22.75 area. The downward trajectory could eventually drag the white metal towards the $22.20-$22.15 intermediate support en route to the $22.00 round figure.

On the flip side, momentum beyond the $23.70-$23.80 support-turned-resistance, might confront hurdle near the $24.00 mark. This is followed by last week's peak, around the $24.30 region, and the $24.50-$24.55 supply zone, or a multi-month peak touched on January 3. A sustained above should allow the XAG/USD to aim back to reclaim the $25.00 psychological mark for the first time since April 2022.

Silver 1-hour chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.