Silver Price Analysis: XAG/USD skyrockets over 3% and surpasses $30.00

- Silver climbs over 3%, despite higher US Treasury yields and a stronger US Dollar.

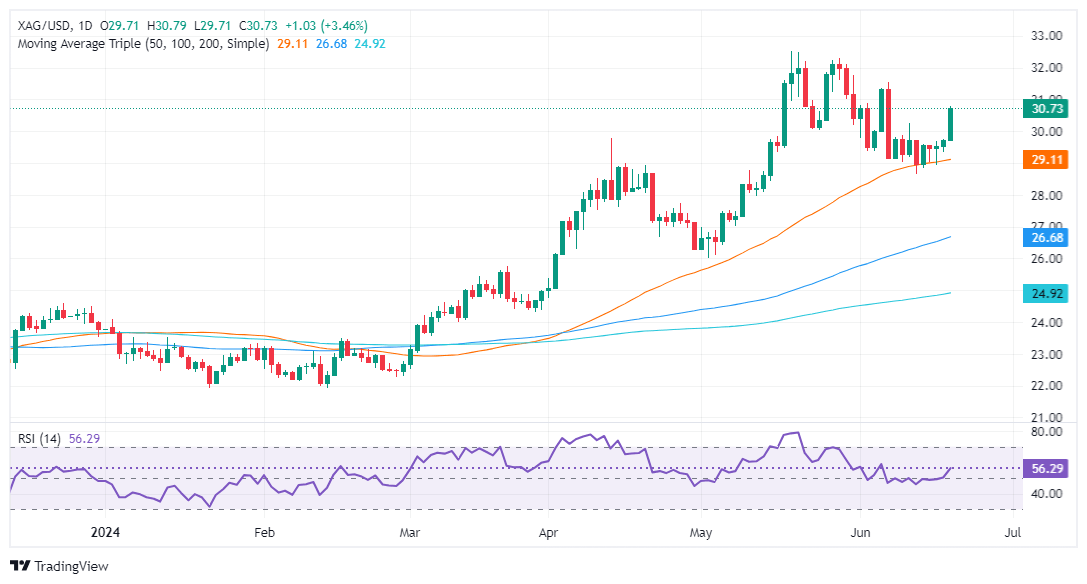

- Technical outlook shows bullish bias with momentum favoring buyers; RSI aims higher above the 50-neutral line.

- Key resistance levels: $31.54 (June 7 high) and $32.00, with YTD high at $32.51 in sight.

- Support levels at $29.09 (50-DMA) and $28.66 (MTD low).

Silver price rallied sharply for the second straight day and climbed past $30.00 on Thursday amid elevated US Treasury bond yields and a stronger US Dollar. The grey metal trades at $30.68 up by more than 3%.

XAG/USD Price Analysis: Technical outlook

Silver remains bullish biased and after consolidating during the last six days within the $28.60-$29.80, it has finally cleared the top of the range and surged past the $30.00 figure.

Momentum shifted in favor of the buyers after the Relative Strength Index (RSI) stood at around the 50-neutral line.

As XAG/USD resumed its uptrend, the next resistance level would be June 7 high at $31.54. Once cleared, the next stop would be $32.00 before challenging the year-to-date (YTD) high of $32.51.

On the other hand, if XAG/USD sellers drag spot prices below the 50-day moving average (DMA) at $29.09, it will expose $29.00. Once cleared, that could expose the MTD low of $28.66, ahead of plunging toward the 100-DMA at $26.60.

XAG/USD Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.