Silver Price Analysis: XAG/USD sees slight gains amid soft US Dollar

- Silver gains 0.15% to $22.60, buoyed by a softer USD despite higher Treasury yields.

- Indications of bottoming out between $22.15-$22.50, hinting at a potential move towards $23.00.

- Death cross' suggests bearish outlook; fall below support might aim for January low at $21.93, then $20.69.

Silver price prints minimal gains of 0.15% on Friday even though US Treasury bond yields climbed. Nevertheless, the Greenback remains down, a tailwind for Silver prices, which trade at $22.60 after jumping from a low of $22.37.

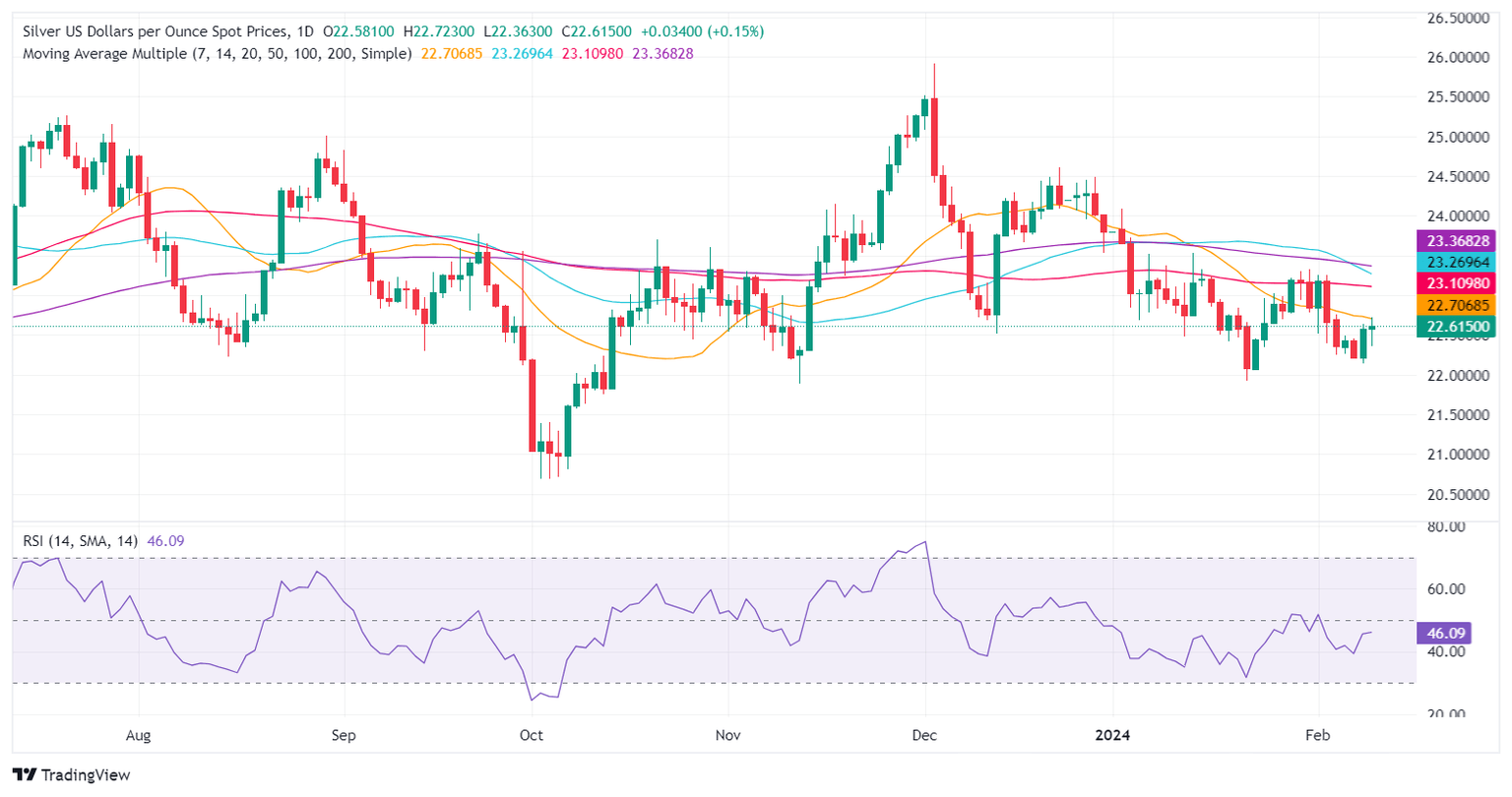

XAG/USD is downward biased but has bottomed out at around $22.15-$22.50, which has opened the door for an upward correction. If buyers could lift prices toward $23.00 per troy ounce, that could open the door to test the 100-day Moving Average (DMA) at $23.09, followed by the 50-DMA at $23.26.

On the other hand, a ‘death cross’ formed three days ago on the path of least resistance, a bearish signal that could clear the path for further downside. The next support surfaces at the January 22 low of $21.93, followed by the October 23 pivot low at $20.69.

XAG/USD Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.