Silver Price Analysis: XAG/USD seems vulnerable, convincing break below $24.00 awaited

- Silver comes under fresh selling pressure and reverses a part of Friday’s modest recovery gains.

- The technical setup favours bearish traders and supports prospects for further near-term losses.

- A sustained strength above the $25.00-$25.25 region is needed to negate the negative outlook.

Silver meets with a fresh supply on the first day of a new week and erodes a part of Friday's modest recovery gains from the vicinity of the $24.00 mark, or over a two-week low. The white metal maintains its offered tone through the early European session and currently trades around the $24.25 region, down nearly 0.50% for the day.

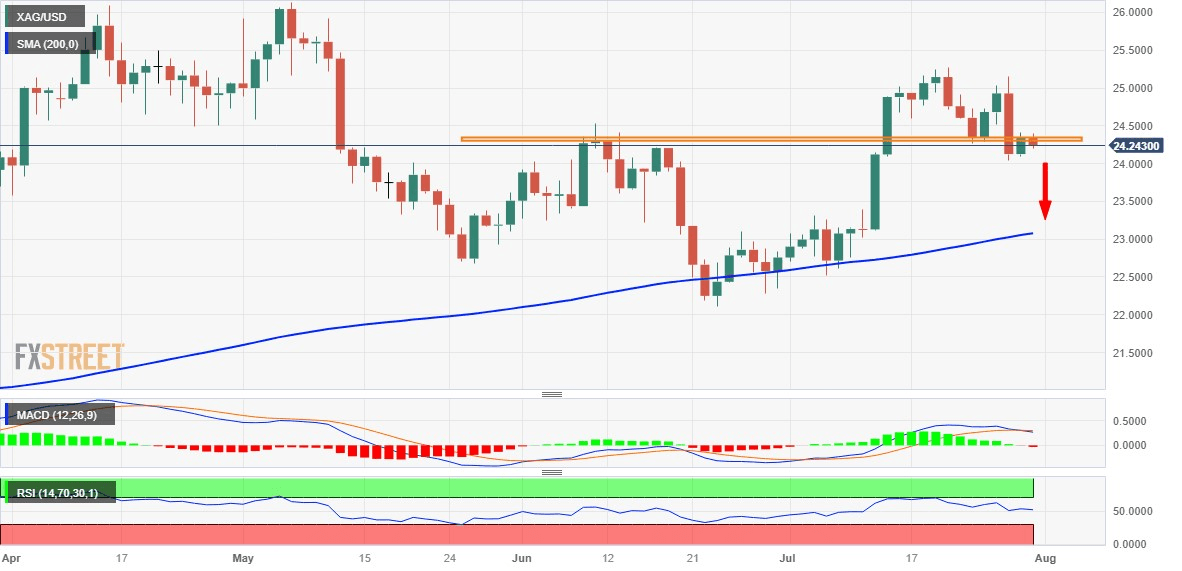

From a technical perspective, last week's failure ahead of the $25.00 psychological mark and the subsequent slump below the $24.30-$24.25 resistance-turned-support was seen as a fresh trigger for bearish traders. This, along with the emergence of fresh selling on Monday and negative oscillators on hourly charts suggest that the path of least resistance for the XAG/USD is to the downside.

That said, technical indicators on the daily chart - though have been losing traction - are yet to confirm the negative outlook. This makes it prudent to wait for a sustained break below the $24.00 mark before positioning for deeper losses. The XAG/USD might then turn vulnerable and accelerate the downfall towards testing the next relevant support near the $23.20-$23.15 area en route to the $23.00 mark.

The latter coincides with the very important 200-day Simple Moving Average (SMA), which if broken decisively should pave the way for a fall towards challenging the multi-month low, around the $22.15-$22.10 area touched in June.

On the flip side, the $24.30-$24.35 region might continue to act as an immediate hurdle ahead of the $24.60-$24.65 area. Some follow-through buying could lift the XAG/USD back to the $25.00 mark. This is followed by the monthly peak, around the $25.25 zone, which if cleared will negate the negative outlook. Silver might then surpass the $25.50-$25.55 hurdle and aim to reclaim the $26.00 mark.

Silver daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.