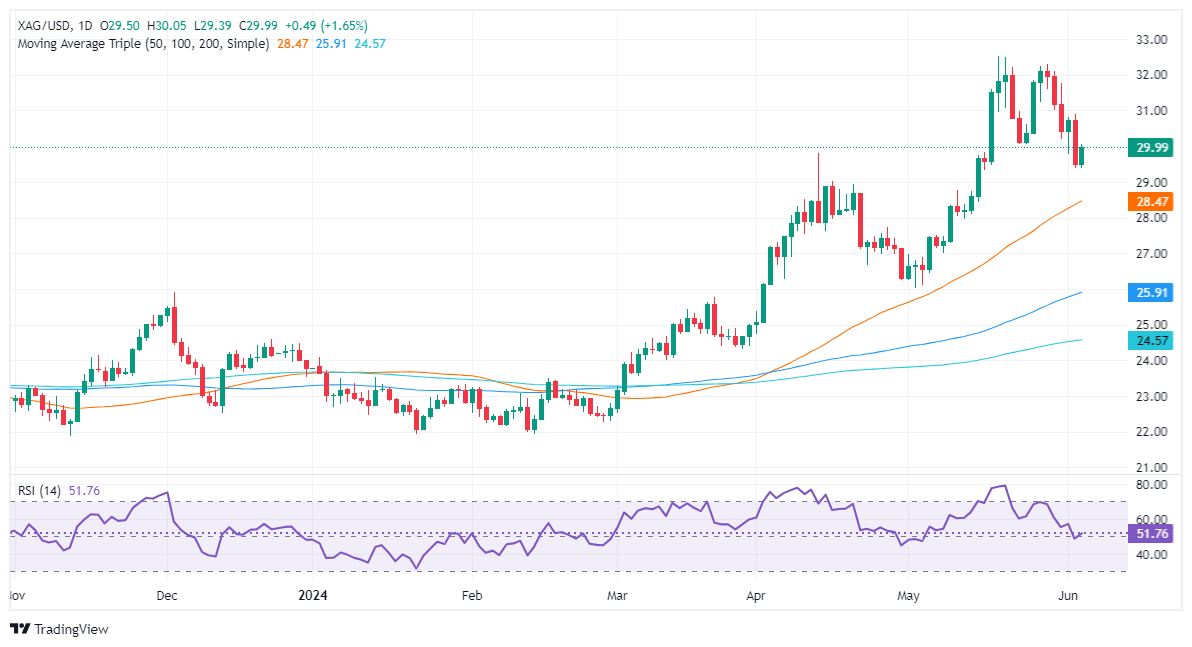

Silver Price Analysis: XAG/USD rises and tests ‘double top’ neckline around $30.00

- Silver climbs to $29.98, gaining 1.69%, supported by weaker-than-expected US jobs data.

- Technical outlook shows a double top pattern, indicating potential for further losses.

- Key levels to watch: Resistance at $30.05; support at $29.79, $29.00, $28.74, $28.34, and the double top objective at $27.80.

Silver recovered some ground on Wednesday as US Treasury bond yields plunged due to weaker-than-expected US jobs data. At the time of writing, the XAG/USD trades at $29.98 and gains 1.69%.

XAG/USD Price Analysis: Technical outlook

A double top chart pattern emerged in Silver’s daily chart, opening the door for further losses. Although the grey metal climbed toward the May 24 low, turning resistance at $30.05, buyers are struggling to reclaim $30.00, paving the way for further downside.

If the XAG/USD falls below the latest cycle high seen on April 12 at $29.79, that would open the door to challenging $29.00. A breach of the latter will expose previous key resistance levels that turned support, like the May 18, 2021, high of $28.74, followed by the June 10, 2021, high of $28.34. Up next would be the ‘double top’ objective at $27.80.

XAG/USD Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.