Silver Price Analysis: XAG/USD retreats from weekly highs around $30.00

- Silver rises 1.45% as Fed leaves policy unchanged, adjusts inflation outlook, and anticipates one rate cut.

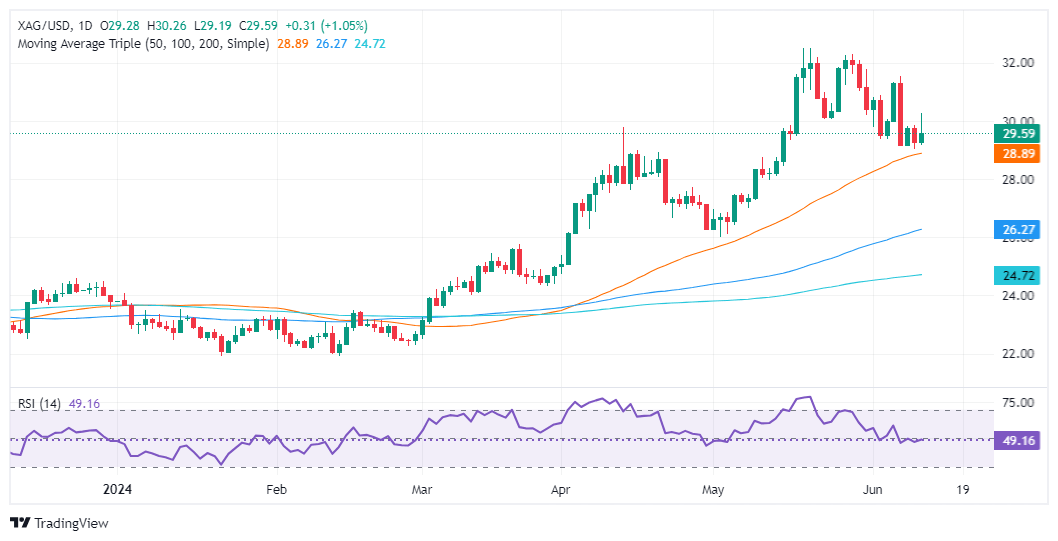

- XAG/USD shows a double-top pattern indicating potential declines; initial support at $29.00.

- Resistance at $30.05; surpassing this could target recent highs, though buyers continue to face challenges.

Silver prices registered solid gains of 1.45% on Wednesday, as the US Federal Reserve kept monetary policy unchanged while upwardly reviewing its inflation expectations and adjusted its estimates for the federal funds rate. As the US central bank projects one rate cut, the XAG/USD trades at $29.59, down 0.29% as Thursday’s Asian session begins.

XAG/USD Price Analysis: Technical Outlook

Silver's double-top chart pattern remains in effect, suggesting that the metal's spot prices might decline further. XAG/USD fell below the May 24 low of $30.05, confirming the double-top pattern.

The initial support for XAG/USD is at $29.00, followed by the June 7 low of $29.12. Breaking below this level could lead to a drop under $29.00, then to the May 18, 2021, high turned support of $28.74, and subsequently to the June 10, 2021, high of $28.34. The final target is the double top objective at $27.80.

Conversely, if XAG/USD moves upwards and closes above $29.00, it could challenge the May 24 low, which has turned into resistance at $30.05. Buyers are struggling to reclaim $30.00, indicating potential for further downside.

XAG/USD Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.