Silver Price Analysis: XAG/USD recovers further from YTD low, lacks bullish conviction

- Siler gains traction for the second straight day and recovers further from the YTD low.

- The setup favours bearish traders and supports prospects for further near-term losses.

- A sustained strength beyond the $22.00 confluence could negate the negative outlook.

Silver builds on the previous day's recovery move from the $20.40 area, or a nearly four-month low and scales higher for the second successive day on Wednesday. The white metal, however, trims a part of its intraday gains and trades around the $21.00 mark, still up nearly 0.50% for the day heading into the North American session.

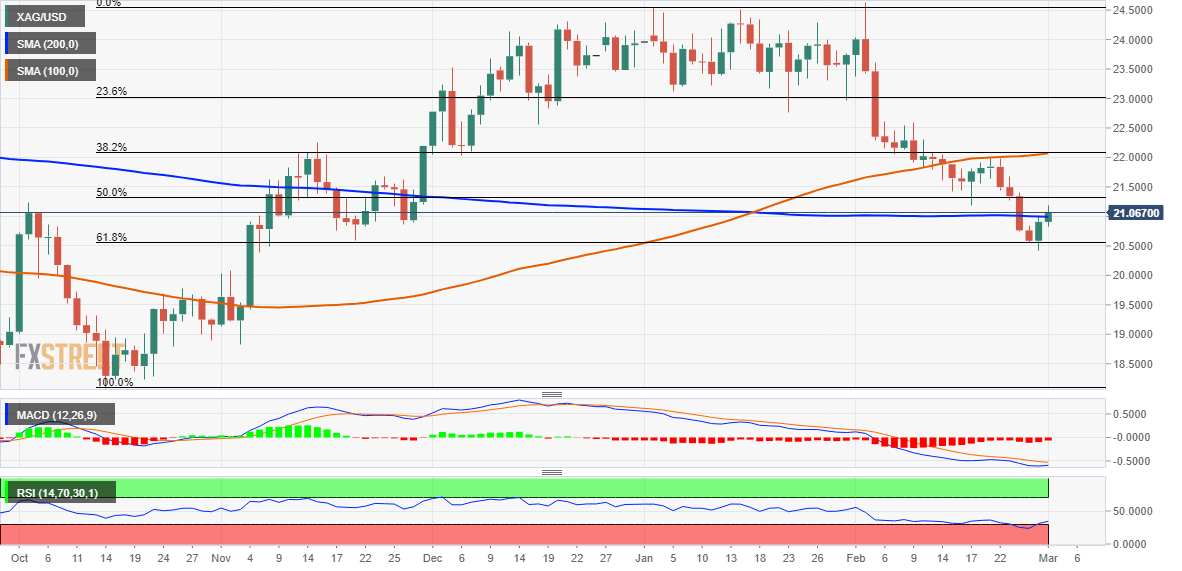

Looking at the broader picture, the XAG/USD on Tuesday showed some resilience below the 61.8% Fibonacci retracement level of the recent rally from the October 2022 low. The said support, around the $20.60 area, should now act as a pivotal point. Given that technical indicators on the daily chart have recovered from the oversold zone and are still holding deep in the negative territory, the bias still seems tilted in favour of bearish traders.

Hence, the ongoing recovery move is more likely to confront stiff resistance near 50% Fibo. level, around the $21.35 region, ahead of the mid-$21.00s. Any subsequent strength could be seen as a selling opportunity and runs the risk of fizzling out near the $22.00 confluence support breakpoint. The said handle comprises 100-day Simple Moving Average (SMA) and 38.2% Fibo. level, which if cleared could negate the near-term bearish bias.

A sustained strength beyond could trigger a short-covering rally and lift the XAG/USD towards the $22.55-$22.60 supply zone. Bulls might eventually aim to reclaim the $23.00 round-figure mark, which coincides with the 23.6% Fibo. level.

On the flip side, 61.8% Fibo. level, around the $20.60 area, now seems to protect the immediate downside. Some follow-through selling below the overnight swing low, around the $20.40 region, should make the XAG/USD vulnerable to weaken further. The downward trajectory should pave the way for a fall below the $20.00 psychological mark, towards testing the next relevant support near the $19.75-$19.70 region.

Silver daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.