Silver Price Analysis: XAG/USD outshines Gold, near YTD highs despite high US yields

- Silver's bullish streak leads above $25.00, defying broader market trends with over 1.40% gains.

- A new year-to-date high at $25.44 highlights XAG/USD’s resilience, with $26.00 now in sight as next resistance.

- Should Silver retreat below $25.00, a move towards $24.50 and potentially $24.01 could unfold, testing buyer strength.

Silver's price shines on Friday and registers solid gains of more than 1.40%, shrugging off Gold’s two consecutive days of losses. It rises 1.52%, trading at $25.18 a troy ounce at the time of writing. XAG/USD advanced even though the Greenback remains strong, underpinned by high US Treasury bond yields.

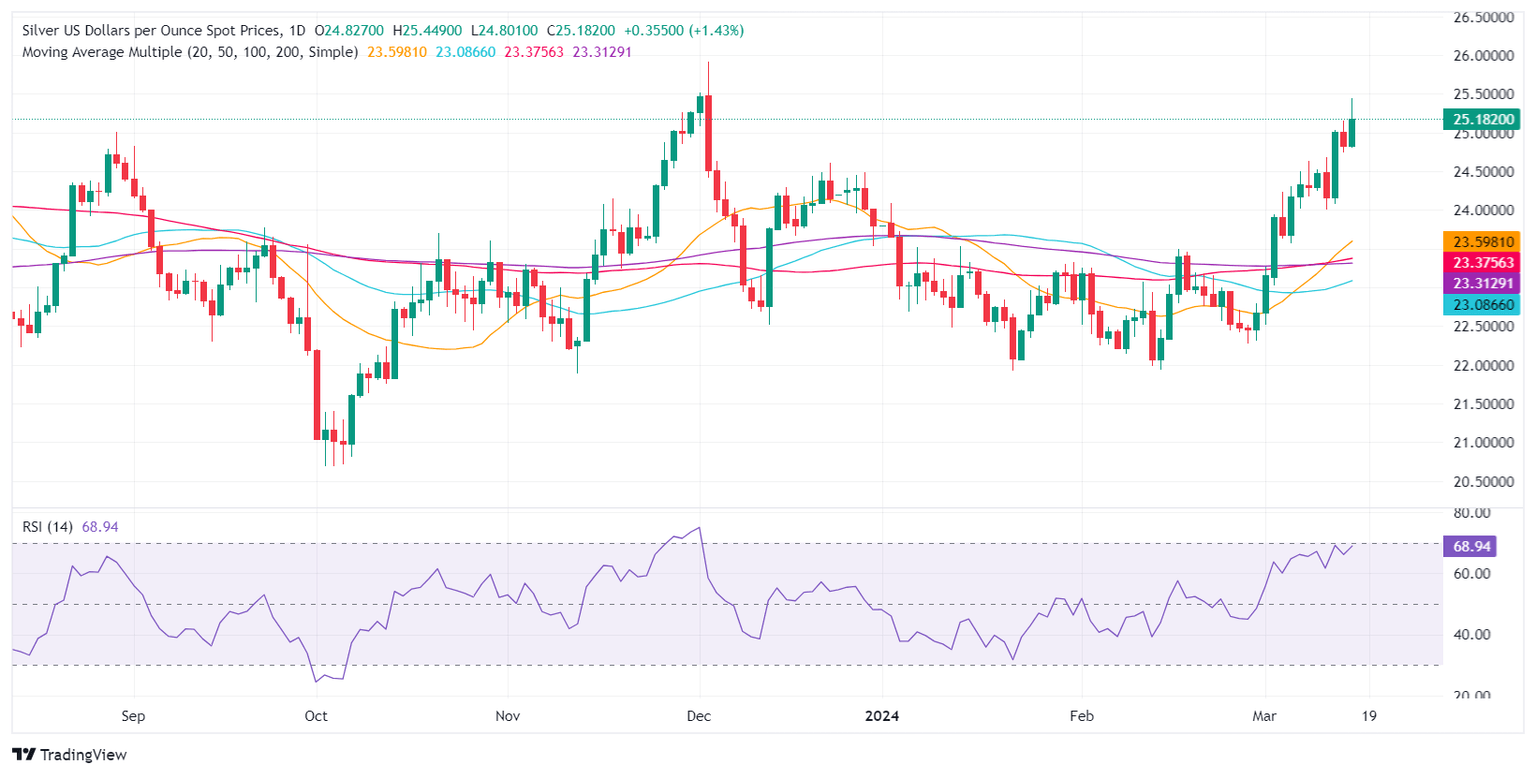

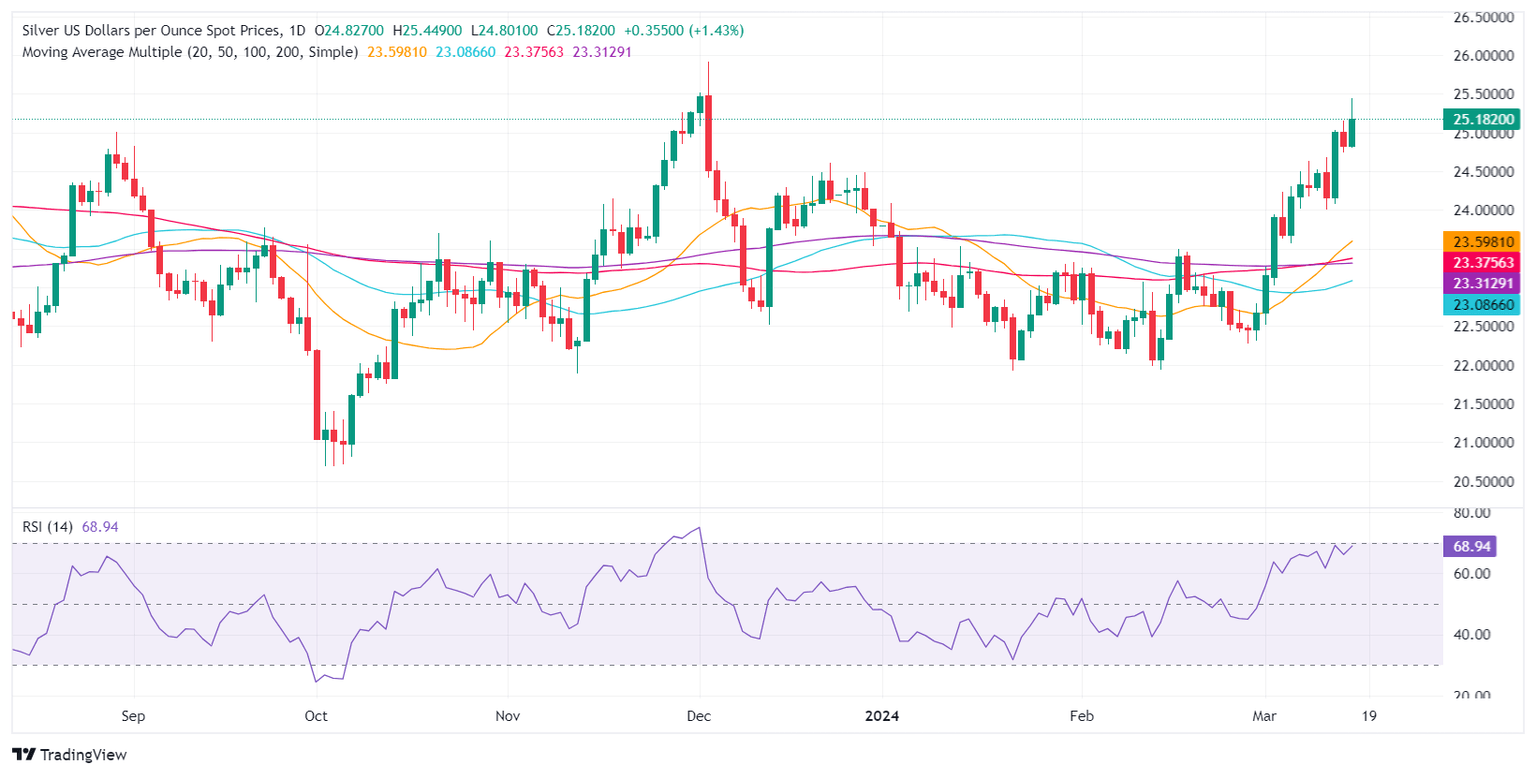

XAG/USD Price Analysis: Technical outlook

During the session, Silver printed a new year-to-date (YTD) high of $25.44, but the advance toward $26.00 was capped by an upslope support trendline that turned resistance. That sent XAG/USD retreating toward the current price levels. Nevertheless, the Relative Strength Index (RSI) indicator is still bullish, indicating that bullish momentum remains in charge, and the $26.00 resistance level could be up for grabs.

On the other hand, if XAG/USD falls below $25.00, sellers could launch an assault towards the $24.50 area, followed by the March 12 daily low of $24.01.

XAG/USD Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.