Silver Price Analysis: XAG/USD dives to 14-month lows below $21.65

- Silver prices plunge to a year-to-date low at $21.50.

- XAG/USD dives on US dollar strength and a risk-on mood.

- Confirmation below $21.65 could send XAG/USD to test $20.00.

Silver prices have accelerated their downtrend on Wednesday, breaching recent lows at the $22.00 area and extending beyond September 2020 lows at $21.65 to reach $21.50 so far, the cheapest price since July last year.

US dollar strength and an improved risk appetite are crushing metal prices

The solid dollar rally, with the US Dollar Index surging to YTD prices beyond 94.00 on the back of higher US bond yields amid prospects of upcoming bonds buying tapering by the Federal Reserve, is hurting dollar-denominated metals.

Beyond that, the improved market sentiment, with the main stock markets in Europe and the US posting a solid rebound after Tuesday’s sell-off and the upbeat US pending home sales data have increased selling pressure for silver and other precious metals.

XAG/USD: attempting to confirm the breach of $21.65 low

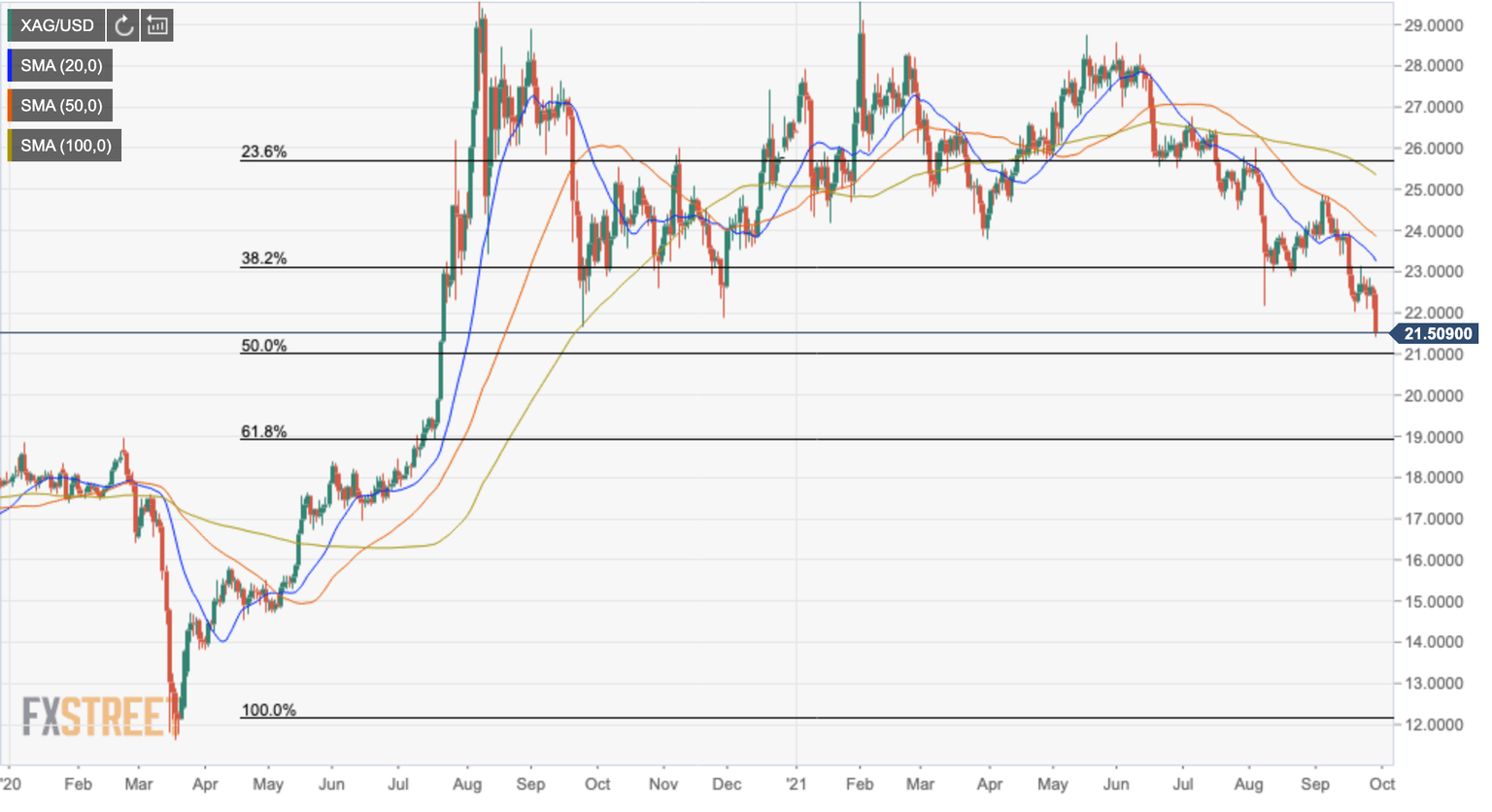

The daily chart shows the spot silver prices struggling against September 2020 lows at $21.65. If the pair manages to extend lower, the next support level might be at $21.00, the 50% retracement of the March-August 2020 rally, and then probably $20.00 psychological level.

On the upside, the pair should return above September 22 and 24 lows at $22.00/10 to attempt another attack to September 21 high at $23.00, where the 32.2% Fib retracement level might also offer some resistance ahead of September 16 high at $23.95.

XAG/USD daily chart

Technical levels to watch

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.