RIVN Stock News: Rivian jumps higher as electric pickup truck race heats up

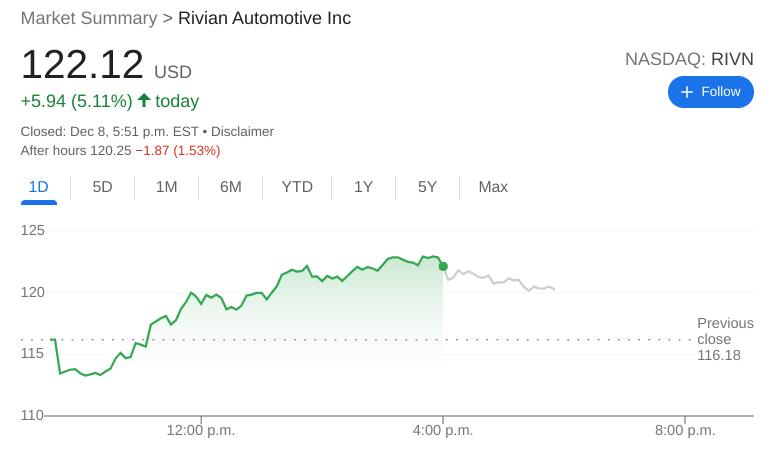

- NASDAQ:RIVN gained 5.11% during Wednesday’s trading session.

- Rivian hits the roads first but Tesla and Ford are not far behind.

- Tesla reports its China sales figures and gets a fresh new price target.

NASDAQ:RIVN resumed its uphill climb on Wednesday after taking a brief pause during Tuesday’s session. Shares of RIVN gained 5.11% and closed the trading day at $122.12. The broader markets rallied for a third straight day on Wednesday, with the NASDAQ gaining 0.64%, while the Dow Jones and S&P 500 edged higher once again. The EV sector had plenty of buzz on Wednesday after President Biden inked an executive order that will see all 600,000 vehicles in the federal fleet be upgraded to electric vehicles. Another major announcement came after hours when Lucid Group (NASDAQ:LCID) reported a proposed convertible senior note offering in the amount of $1.75 billion that sent shares of Lucid tumbling after the close.

Stay up to speed with hot stocks' news!

Rivian has yet to deliver many vehicles, but its electric trucks look like they will be the first ones on the road in 2022. Tesla (NASDAQ:TSLA) CEO Elon Musk did hint at the long awaited Cybertruck finally getting closer to production, while Ford (NYSE:F) announced it had over 200,000 standing orders for the upcoming Ford F-150 Lightning electric truck. This is all to say that 2022 could be the year of the electric pickup truck, which could have a significant impact on President Biden’s new executive order.

Rivian stock forecast

In other EV news, Tesla reported strong sales in China once again, although a bulk of the models produced at the Shanghai GigaFactory were exported to Europe. When the Berlin GigaFactory opens later this year, it should be able to take some of the pressure off of Shanghai. For its efforts, Tesla received its highest price target yet from New Street Research which provided the stock with a street-high target of $1,580.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet