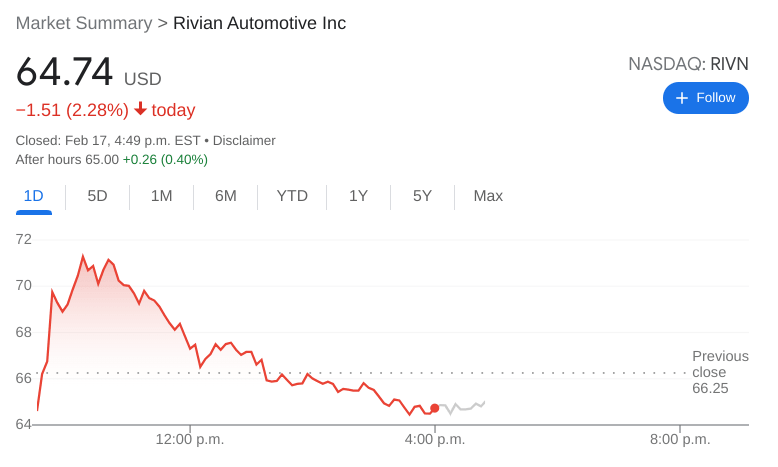

RIVN Stock News: Rivian closes lower after hot start to the day

- NASDAQ:RIVN fell by 2.28% during Thursday’s trading session.

- More hedge funds report starting positions in Rivian’s stock.

- Ford’s Mustang Mach-E dethrones Tesla’s Model 3 at Consumer Reports.

NASDAQ:RIVN had a bullish start to the day, but market weakness and EV sector declines sent the stock tumbling into the closing bell. Shares of Rivian fell by 2.28% and closed the trading day at $64.74. It was a bearish session for the broader markets as renewed tensions between Russia and Ukraine weighed on investors. Notable stocks fell after earnings reports including Palantir (NYSE:PLTR) and NVIDIA (NASDAQ:NVDA), the latter despite beating analyst estimates for the quarter. All three major indices fell back into the red on Thursday, with the Dow Jones dropping 622 basis points, the NASDAQ falling by 2.88%, and the S&P 500 plummeting by 2.12% during the session.

Stay up to speed with hot stocks' news!

Even more hedge funds have disclosed initiating a position in Rivian last quarter after the stock tumbled in the weeks following its IPO. After George Soros and David Einhorn showed their support for Rivian, Third Point also added a position of over 4 million shares valued at more than $408 million. It’s no surprise that investors wanted to follow the big money into Rivian’s stock, especially considering how much the stock has fallen since December.

RIVIAN stock forecast

Rivian stakeholder and early investor, Ford (NYSE:F), scored another victory in the EV sector. Consumer Reports named the Ford Mustang Mach-E as the new ‘Top Pick’ for the EV market, replacing Tesla’s (NASDAQ:TSLA) Model 3. Surprisingly, Tesla fell seven spots to be ranked 23rd out of the 32 major automakers that Consumer Reports covers, in the company's poorest showing on the list in the seven years that Tesla has been a part of the ‘Top Picks’ category.

Like this article? Help us with some feedback by answering this survey:

Author

Stocks Reporter

FXStreet