Riot Stock News: Riot Blockchain Inc price extends losses despite red hot crypto markets

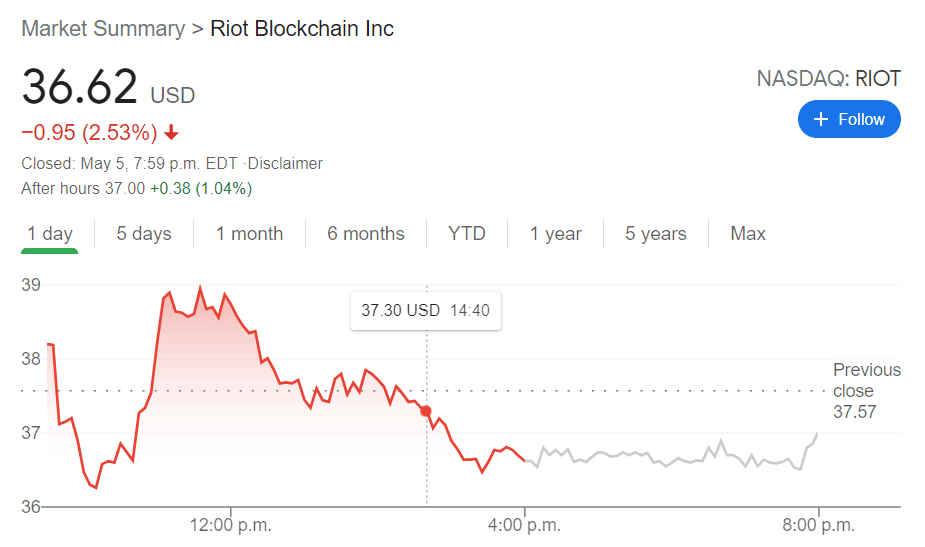

- NASDAQ:RIOT fell by 2.53% as NASDAQ stocks took another breather as the choppiness continued.

- Bitcoin is on the rise again but miner stocks ended Wednesday in the red.

- A prominent voice in the Bitcoin industry makes a strong proclamation for the future price.

NASDAQ:RIOT had an April to forget, but thus far, May has not been any friendlier to the Bitcoin mining company based out of Castle Rock, Colorado. Wednesday saw another red day for Riot, as the stock fell 2.53% to close the trading day at $36.62. Shares have now lost over 30% during the past month as Riot inches lower towards its 200-day moving average price of $28.71. Generally this can act as a support level for stocks in technical analysis, but it is curious to see Riot struggle even when action in the crypto markets have picked back up.

Stay up to speed with hot stocks' news!

The price of Bitcoin rebounded over the past few days and at the time of this writing, is trading at approximately $57,000 USD per coin. Despite this, Riot and other Bitcoin mining companies like Marathon Digital Holdings (NASDAQ:MARA) were trading lower on the day, perhaps signaling that the share price is moving away from its direct correlation to the price of Bitcoin. Investors are faced with the dilemma of investing in the Bitcoin miners or just buying Bitcoin itself now that it is so readily available. While these companies may artificially rise and fall with the price of cryptos, the underlying strength of Riot and Marathon is still yet to be determined.

RIOT stock forecast

CoinDesk editor Ollie Leech made headlines by reiterating his stance on Bitcoin’s future price of $1 million per coin. Leech points to the next Bitcoin halving, which is set to take place at some point in 2024, where he predicts a strong price surge due to a lack of supply. How this will affect mining companies like Riot remains to be seen, and investors will be looking to management for some forward looking guidance at its quarterly earnings call next week.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet