Pound Sterling declines against US Dollar ahead of Fed-BoE policy decision

- The Pound Sterling struggles around 1.3000 against the US Dollar ahead of the Fed’s monetary policy decision, dot plot, and economic projections.

- Investors expect the Fed and BoE to keep interest rates steady this week.

- Market sentiment remains cautious as US President Trump is poised to impose reciprocal tariffs on April 2.

The Pound Sterling (GBP) corrects to near 1.2960 after failing to extend the rally above the key level of 1.3000 against the US Dollar (USD) in North American trading hours on Wednesday. The GBP/USD pair trades cautiously ahead of the Federal Reserve’s (Fed) monetary policy decision at 18:00 GMT.

According to the CME FedWatch tool, the Fed is certain to keep interest rates unchanged in the range of 4.25%-4.50% for the second time in a row. Therefore, the major catalyst for the US Dollar will be the Fed’s dot plot, which shows where policymakers see the Federal funds rate heading in the medium and longer term, and the Federal Open Market Committee’s (FOMC) Summary of Economic Projections (SEP).

It would be interesting to know whether Fed officials will see easing inflationary pressures and declining consumer confidence in the current scenario or accelerating consumer inflation expectations due to United States (US) President Donald Trump’s economic policies while forecasting the monetary policy outlook. In February, the annual core Consumer Price Index (CPI) – which excludes volatile food and energy prices – rose by 3.1%, the lowest level seen since April 2021.

According to analysts at Fitch, tariff shocks are estimated to “accelerate inflationary pressures by one point percent” in the near term. This scenario will discourage Fed officials from cutting interest rates before the last quarter of the year. Meanwhile, the CME FedWatch tool shows that the Fed will cut interest rates in the June meeting.

Daily digest market movers: Pound Sterling struggles ahead of BoE policy

- The Pound Sterling trades with caution against its peers ahead of the United Kingdom (UK) labor market data for the three months ending January and the Bank of England’s (BoE) monetary policy decision, scheduled for Thursday. Investors will pay close attention to the Average Earnings data, a key measure of wage growth that has contributed significantly to the high inflation in the services sector.

- UK’s leading global provider of people data, analytics, and insight firm Brightmine showed on Tuesday that the pay growth has slowed as business owners are cautious before the implementation of an increase in payroll taxes from April. UK Chancellor of the Exchequer Rachel Reeves announced an increase in employers’ contribution to National Insurance (NI) from 13.8% to 15% in the Autumn Budget.

- Brightmine also said that a significant number of firms have planned a hiring freeze or team restructuring in response to the government’s decision to increase employers’ social security contributions, with some considering pay freezes and delays to increases, Reuters report. Meanwhile, economists expect Average Earnings (Excluding and Including) bonuses to have grown almost steadily by 5.9%.

- The BoE is expected to keep interest rates steady at 4.5%, with a 7-2 vote split. BoE Monetary Policy Committee (MPC) members Catherine Mann and Swati Dhingra are expected to support an interest rate cut, while the other seven policymakers will vote to keep rates unchanged. Investors will pay close attention to BoE Governor Andrew Bailey’s commentary on the UK economic outlook amidst US President Trump’s tariff policies.

- On Tuesday, US Treasury Secretary Scott Bessent confirmed in an interview with Fox Business that reciprocal tariffs would become effective on April 2. Bessent added that he is optimistic some of the tariffs may not have to go on because a deal can be “pre-negotiated” or that once countries receive their “reciprocal tariff number”, they will come to us and want to “negotiate it down”.

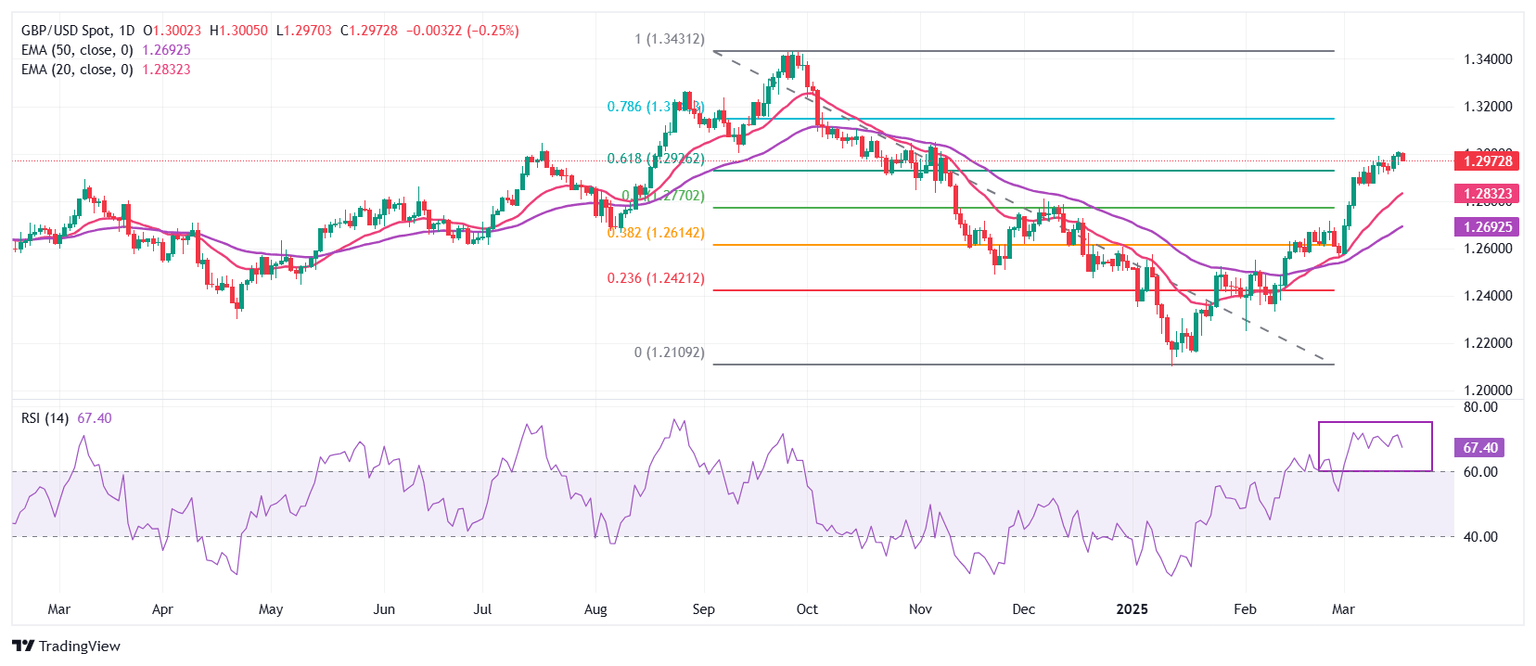

Technical Analysis: Pound Sterling remains above 20- and 50-day EMAs

The Pound Sterling looks for a fresh trigger to extend its two-month rally above the key level of 1.3000 against the US Dollar on Wednesday. GBP/USD bulls take a breather as the 14-day Relative Strength Index (RSI) reached overbought levels above 70.00. However, this doesn’t reflect that the bullish trend is over. The upside trend could resume once the momentum oscillator cools down to near 60.00.

Advancing 20-day and 50-day Exponential Moving Averages (EMAs) near 1.2830 and 1.2690, respectively, suggest that the overall trend is bullish.

Looking down, the 50% Fibo retracement at 1.2770 and the 38.2% Fibo retracement at 1.2614 will act as key support zones for the pair. On the upside, the October 15 high of 1.3100 will act as a key resistance zone.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

BRANDED CONTENT

Finding the right broker for your trading strategy is essential, especially when specific features make all the difference. Explore our selection of top brokers, each offering unique advantages to match your needs.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.