Pound Sterling Price News and Forecast: GBP/USD under bearish pressure ahead of Fed

GBP/USD Forecast: Pound Sterling under bearish pressure ahead of Fed

After posting gains to start the week, GBP/USD edges lower and trades in negative territory below 1.3350 in the European session on Wednesday as investors gear up for the Federal Reserve's (Fed) monetary policy announcements.

The US Dollar (USD) stays resilient against its peers midweek on improving risk mood. Washington confirmed that United States (US) Treasury Secretary Scott Bessent and chief trade negotiator Jamieson Greer will meet China's economic tsar He Lifeng in Geneva this Saturday, to kick off official talks with China. Read more...

GBP/USD expected to be between 1.3300 and 1.3400 – UOB Group

Pound Sterling (GBP) is likely to trade in a range vs US Dollar (USD), expected to be between 1.3300 and 1.3400. In the longer run, the current price movements are part of a 1.3240/1.3450 range-trading phase, UOB Group's FX analysts Quek Ser Leang and Peter Chia note.

24-HOUR VIEW: "Our view for GBP to trade with a downward bias yesterday was incorrect, as after dipping to a low of 1.3260, GBP soared, reaching a high of 1.3402. The subsequent pullback from the high amid overbought conditions suggests GBP is likely to trade in a range today, expected to be between 1.3300 and 1.3400." Read more...

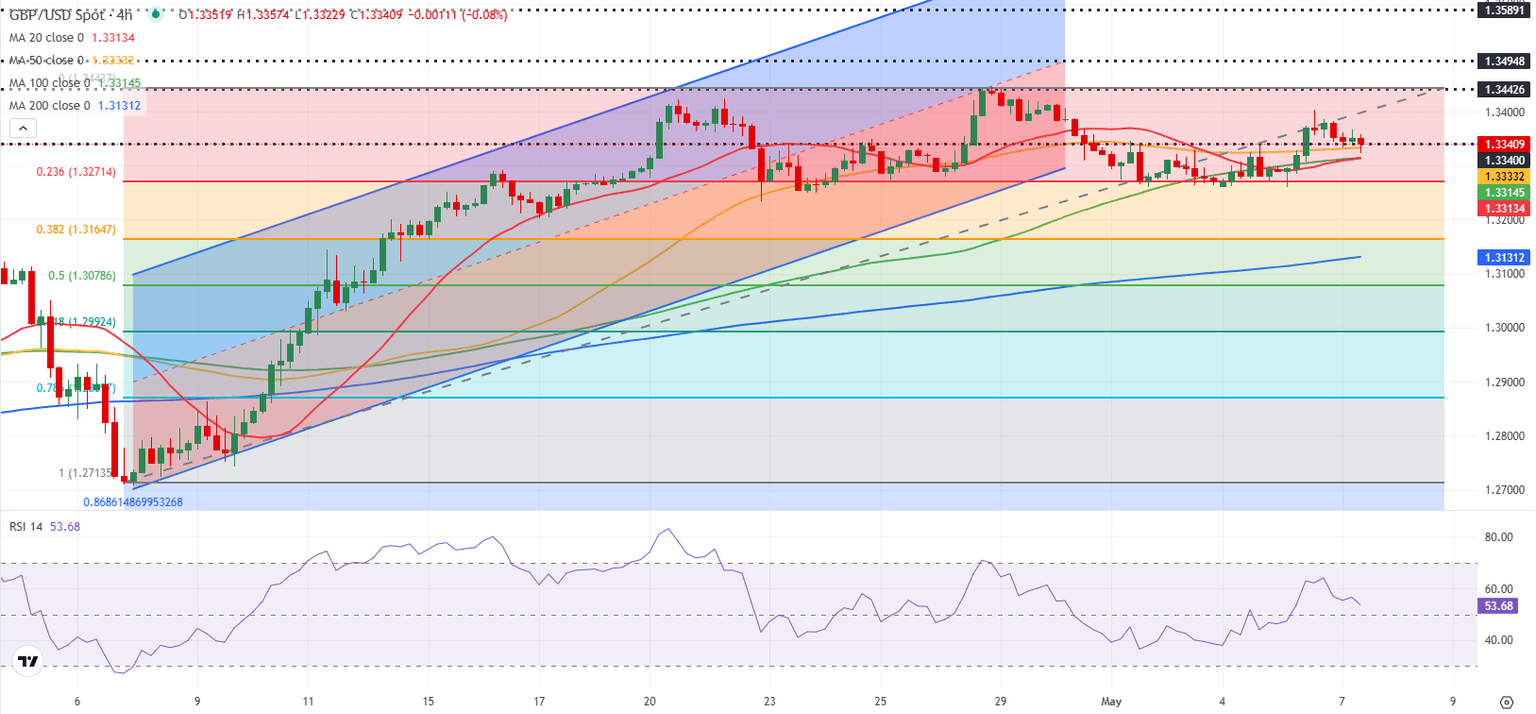

GBP/USD – Strategic sell idea [Video]

Fake breakout of the consolidation and rejection of the Pitchfork Median Trend line. Read more...

Author

FXStreet Team

FXStreet