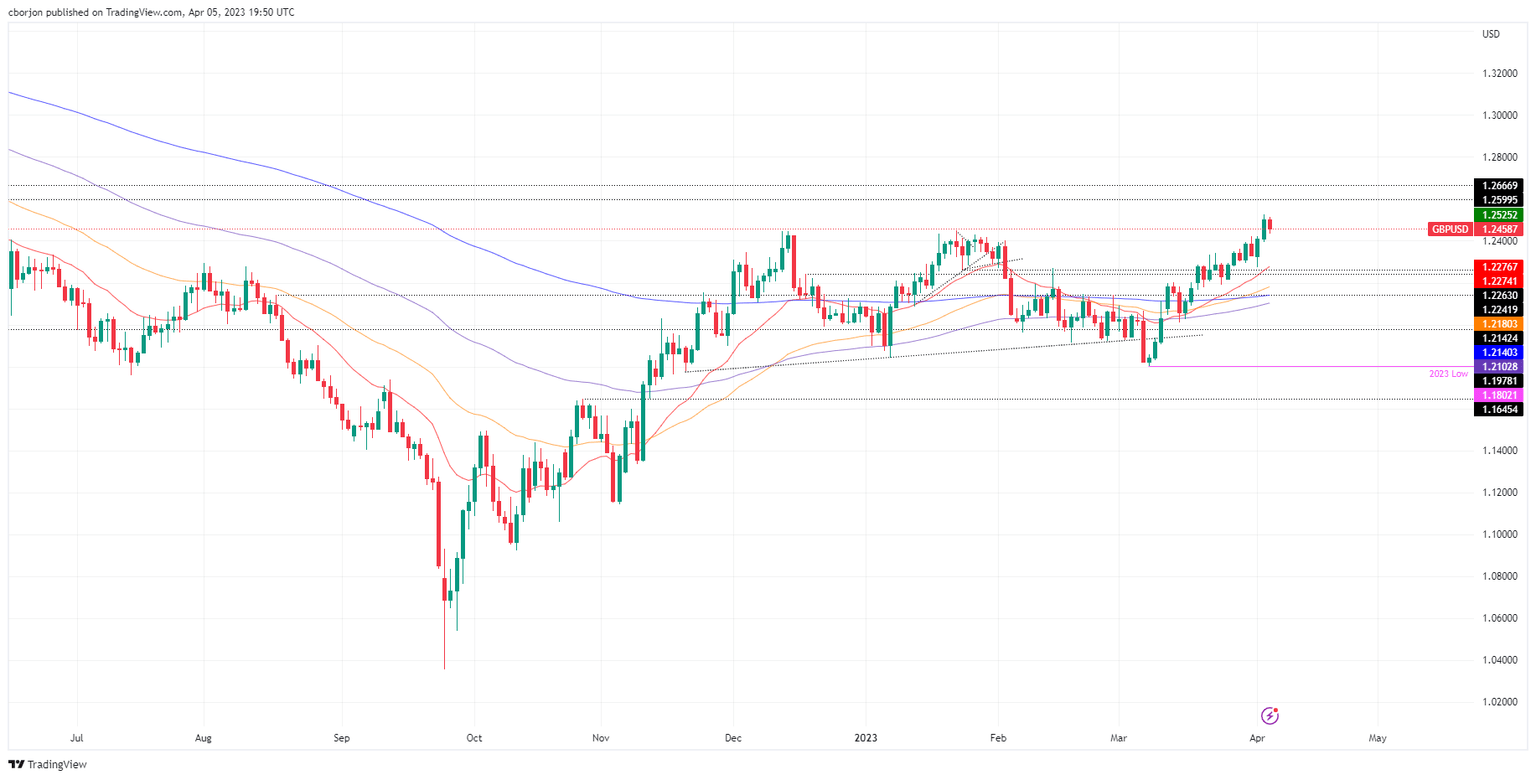

GBP/USD struggles at 1.2500, retraces amidst US recession fears, Fed pause

GBP/USD faces strong resistance at around 1.2500 and retraces due to

risk aversion as investors assess a possible recession in the United States (US). The latest

US economic data paints a gloomy scenario, which is already foreseen by the US Federal Reserve (Fed) as the last piece of the puzzle, the larbor market, showed signs of slowing down. The GBPUSD trades at 1.2459, down by 0.33%.

Read More...

GBP/USD consolidates its recent gains to multi-month top, stuck in a range around 1.2500

The

GBP/USD pair is seen oscillating in a narrow trading band through the early part of the European session on Wednesday and consolidates its recent gains to its highest level since June 2022 touched the previous day. The pair is currently placed around the 1.2500 psychological mark and seems poised to prolong the upward trajectory witnessed over the past month or so.

Read More...

GBP/USD treads water at multi-day top near 1.2500 ahead of US PMI, employment statistics

GBP/USD bulls jostle with the bears at the 10-month high surrounding 1.2500 as they await the key US/UK data during early Wednesday. Not only cautious mood ahead of the important statistics but corrective bounces in the US Dollar and yields also allow the Cable pair buyers to take a breather of late.

Read More...