Pound Sterling Price News and Forecast: GBP/USD steadies as markets await key US data

Pound steadies as markets await key US data

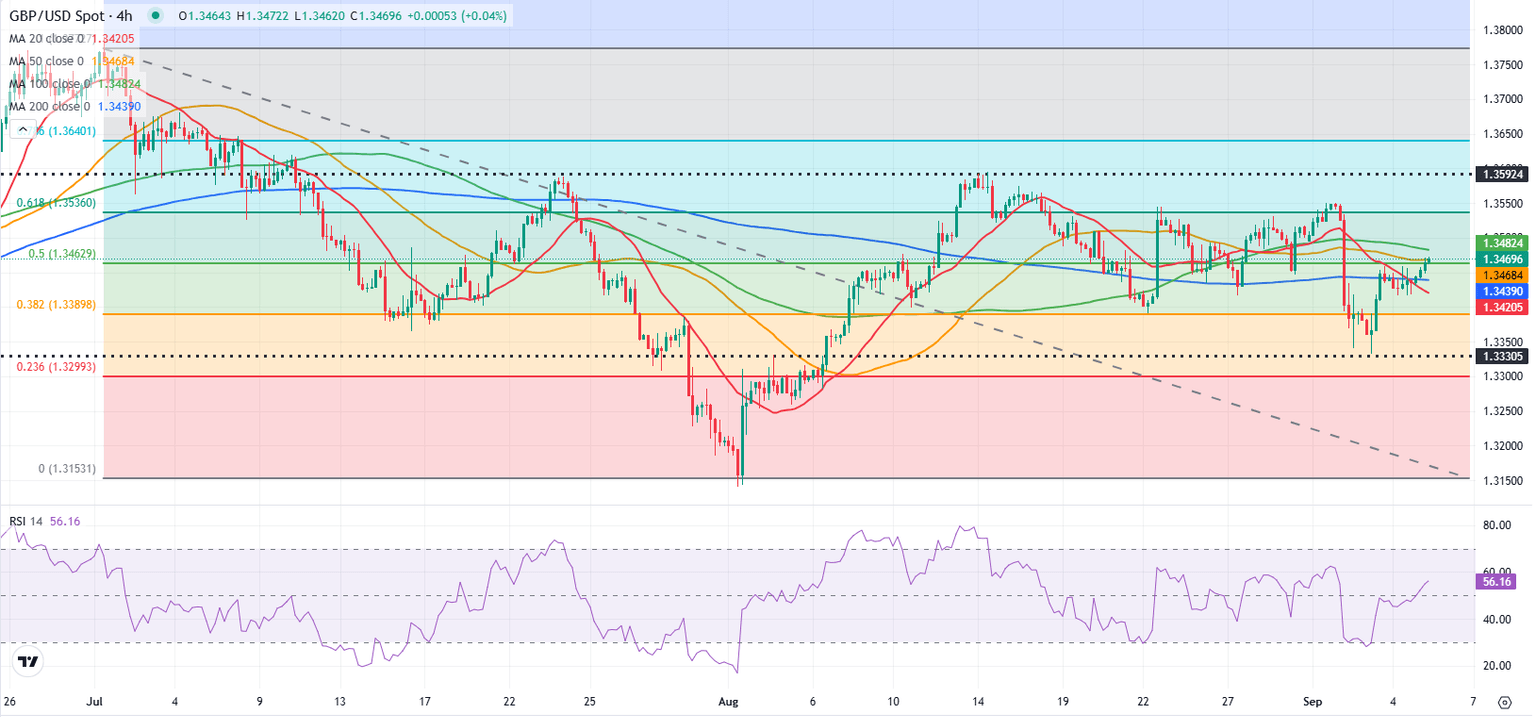

The GBP/USD pair found stability on Friday, trading around 1.3453 as anxiety in the debt markets eased. Investor attention has shifted firmly to the upcoming US Nonfarm Payrolls report, with softer US labour data reinforcing expectations of a Federal Reserve rate cut by year-end.

The latest ADP employment report showed the US economy added just 54,000 jobs in August, well below the forecast of 65,000 and July’s figure of 104,000. The dollar faced additional headwinds from a decline in job openings, which fell to their lowest level since September 2024, and a rise in unemployment claims to a two-month high. Read more...

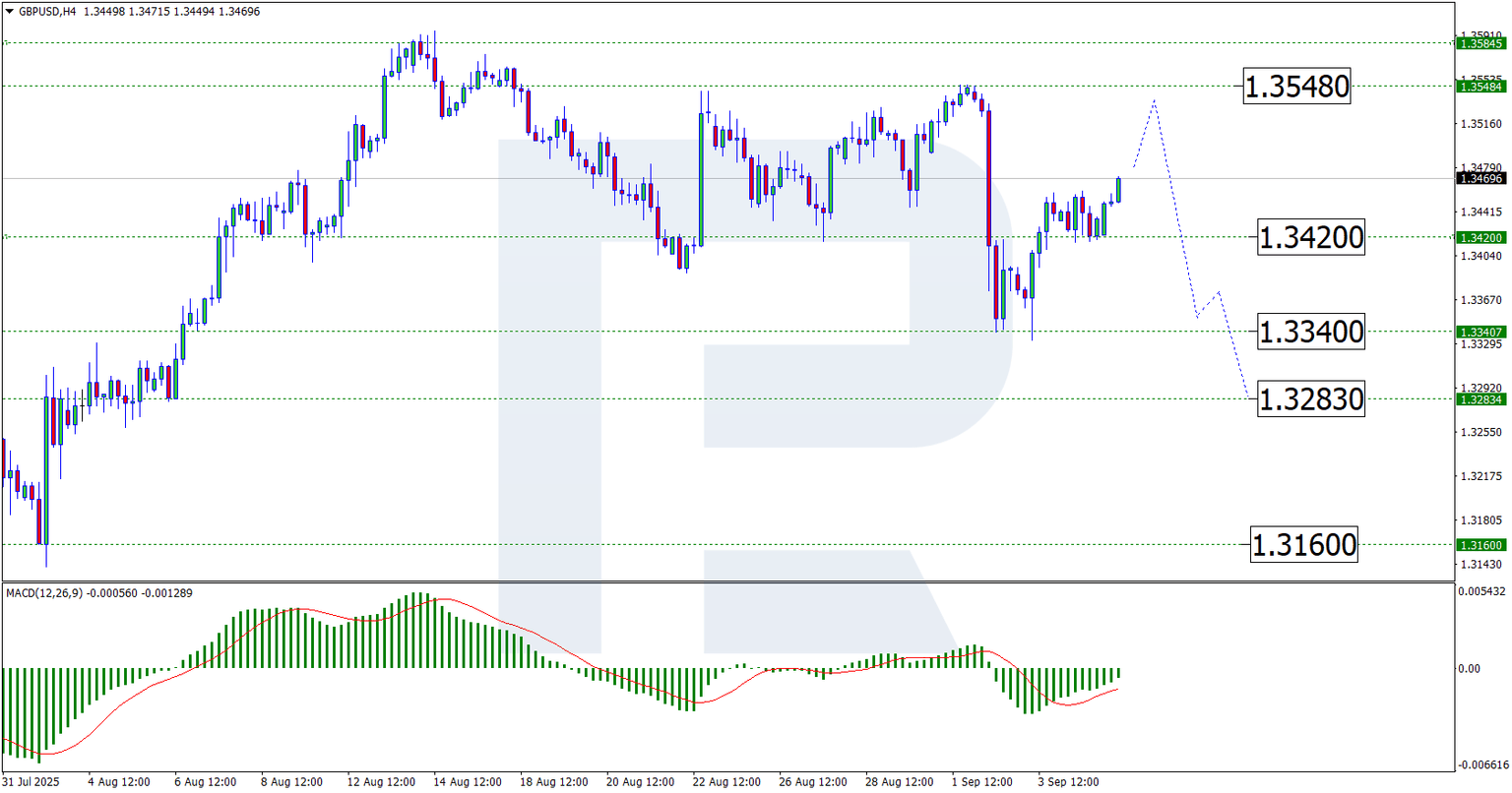

GBP/USD Forecast: Pound Sterling closes in on key resistance ahead of US jobs data

After failing to make a decisive move in either direction on Thursday, GBP/USD gathers bullish momentum and trades above 1.3450 in the European session on Friday. The pair faces a strong resistance at 1.3480 as investors await the August labor market data from the United States (US).

The US Dollar (USD) struggled to gather strength against its rivals as investors refrained from taking large positions following the mixed macroeconomic data releases. The Institute for Supply Management's (ISM) Services Purchasing Managers' Index (PMI) rose to 52 in August from 50.1 in July, surpassing the market expectation of 51. On the other hand, the Automatic Data Processing's (ADP) monthly report showed that private sector payrolls rose by 54,000 in August. This print missed analysts' estimate of 65,000. Read more...

Author

FXStreet Team

FXStreet