Pound Sterling Price News and Forecast: GBP/USD stays dangerously close to key support level

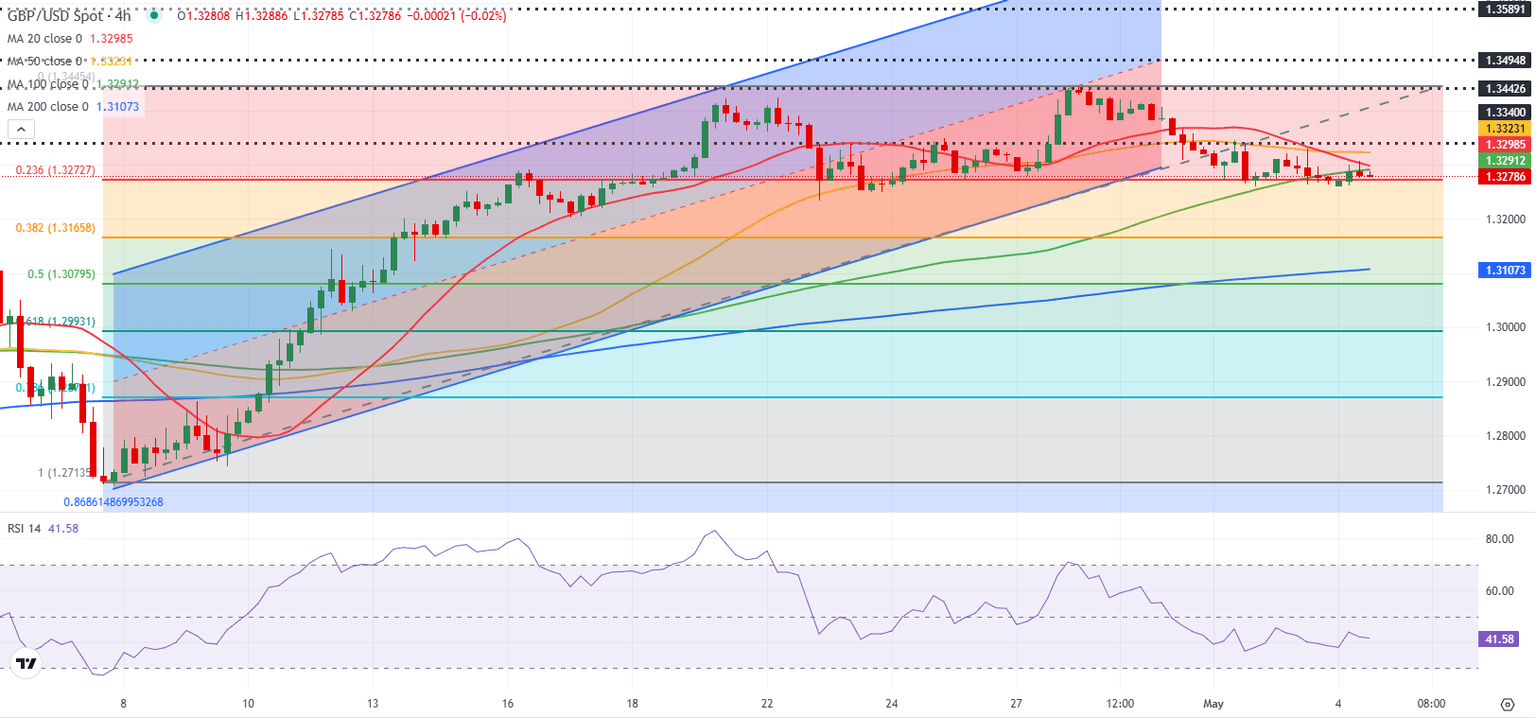

GBP/USD Forecast: Pound Sterling stays dangerously close to key support level

GBP/USD lost 0.3% last week and snapped a three-week winning streak. The pair enters a consolidation phase on Monday and trades below 1.3300.

GBP/USD closed virtually unchanged on Friday as the US Dollar (USD) struggled to gather strength following the April labor market data from the US. The Bureau of Labor Statistics (BLS) reported that Nonfarm Payrolls (NFP) increased by 177,000 in April. Read more...

GBP/USD Weekly Outlook: Pound Sterling awaits Fed-BoE policy decisions for fresh impetus

King Dollar regained its throne, booking the third weekly gain, due to receding tariff war fears and optimism emerging from potential trade deals between the United States (US) and its major Asian trading partners.

US President Donald Trump and some of his colleagues stuck to their rhetoric that trade negotiations continued with China even though Beijing dismissed such talks. Trump said during the week that he has "potential" trade deals with India, South Korea and Japan and that there is a very good chance of reaching an agreement with China. Read more...

Author

FXStreet Team

FXStreet