Pound Sterling Price News and Forecast: GBP/USD starts the new week softer amid rising geopolitical tensions

GBP/USD Weekly Outlook: Pound Sterling braces for Fed/ BoE policy outcomes

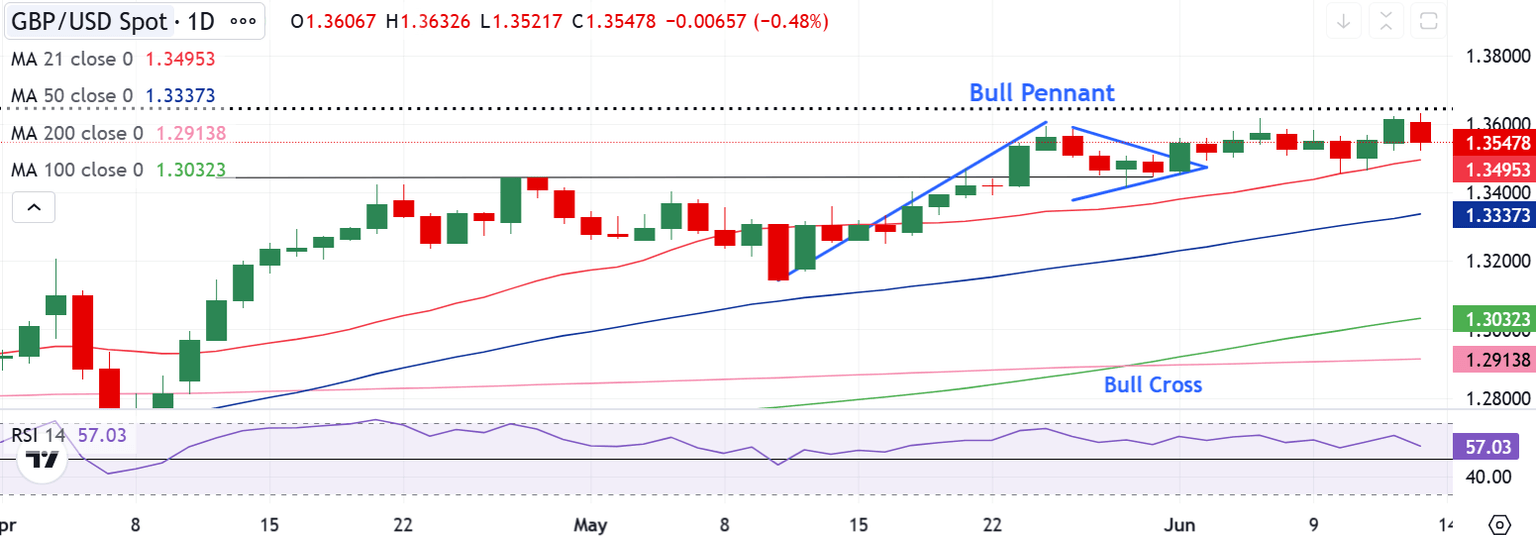

The Pound Sterling (GBP) stood tall for the third consecutive week against the US Dollar (USD) as the GBP/USD pair refreshed 39-month highs above 1.3600. Following a phase of upside consolidation in the first half of the week, GBP/USD regained traction in the latter part and hit the highest level since February 2022, near 1.3635. The choppy price action seen earlier on was mainly attributed to the rangebound movement seen in the US Dollar as markets assessed the progress in the US-China trade talks.

Following a two-day talk in London, the United States (US) and China decided to ease export controls, including the ones on rare earths, and agreed on a framework to keep the tariff truce effective. The Greenback gained briefly but returned to the red in a familiar range amid a lack of specifics on the trade framework. Read more...

GBP/USD consolidates around mid-1.3500s ahead of this week’s key data/central bank event risks

The GBP/USD pair remains on the defensive below a three-year top touched on Friday, though it lacks bearish conviction and oscillates in a narrow band around mid-1.3500s during the Asian session. Traders seem reluctant and opt to wait for this week's key data/central bank event risks before positioning for the next leg of a directional move for spot prices.

The latest UK consumer inflation figures will be released on Wednesday ahead of the Bank of England (BoE) policy meeting on Thursday, which will play a key role in influencing the British Pound (GBP). Furthermore, the US Federal Reserve (Fed) is scheduled to announce its policy decision on Wednesday, which will drive the US Dollar (USD) and provide some meaningful impetus to the GBP/USD pair. Read more...

Author

FXStreet Team

FXStreet