Pound Sterling Price News and Forecast: GBP/USD attracts follow-through buying on Monday amid a bearish USD

GBP/USD Weekly Forecast: A near-term move to 1.3000 should not be ruled out

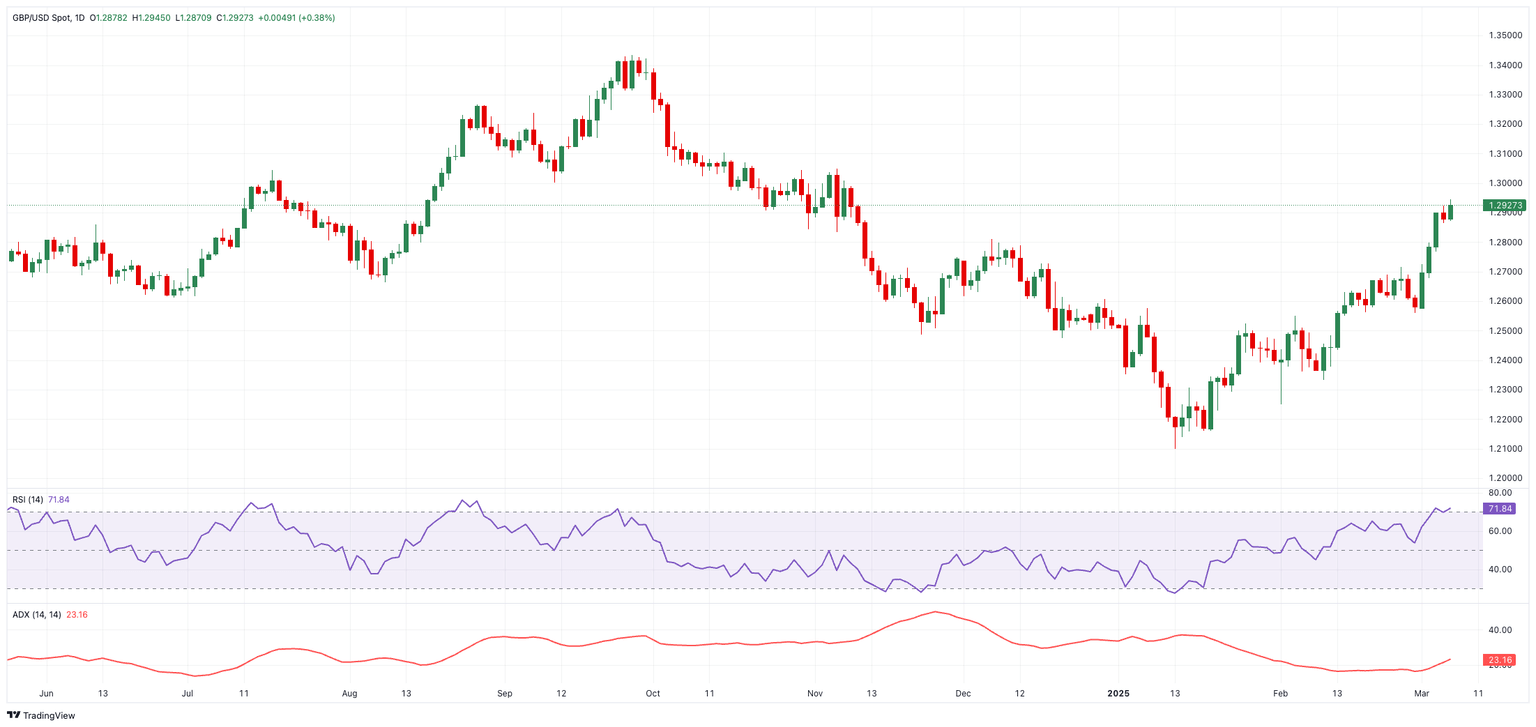

The British pound (GBP) maintained its constructive bias well in place this week, motivating GBP/USD to extend its recovery north of 1.2900 the figure, an area last visited in early November.

The strong move higher in Cable came almost exclusively on the back of the firm and persistent selling impulse in the US Dollar (USD), which remained at the mercy of the White House’s alternating mood regarding the implementation of tariffs. Also underpinning the solid tone around the sterling, 10-year gilt yields rose to multi-week lows near the 4.80% level, running out of some steam afterwards. Read more...

GBP/USD stands firm near multi-month peak, just below mid-1.2900s on weaker USD

The GBP/USD pair kicks off the new week on a positive move and trades around the 1.2940-1.2945 region during the Asian session, or a four-month high touched on Friday. Moreover, the bearish sentiment surrounding the US Dollar (USD) supports prospects for an extension of last week's breakout momentum above the very important 200-day Simple Moving Average (SMA).

In fact, the USD Index (DXY), which tracks the Greenback against a basket of currencies, hangs near its lowest level since early November touched in reaction to weaker US monthly employment details on Friday. The headline Nonfarm Payrolls (NFP) print showed that the US economy added 151K jobs in February, less than consensus estimates. Adding to this, the previous month's reading was revised down to 125K and the Unemployment Rate unexpectedly edged higher to 4.1% from 4.0% in January. Read more...

Author

FXStreet Team

FXStreet