Pound Sterling Price News and Forecast: GBP/USD slumps as Trump’s tariff talk overpowers US PCE data

GBP/USD slumps as Trump’s tariff talk overpowers US PCE data

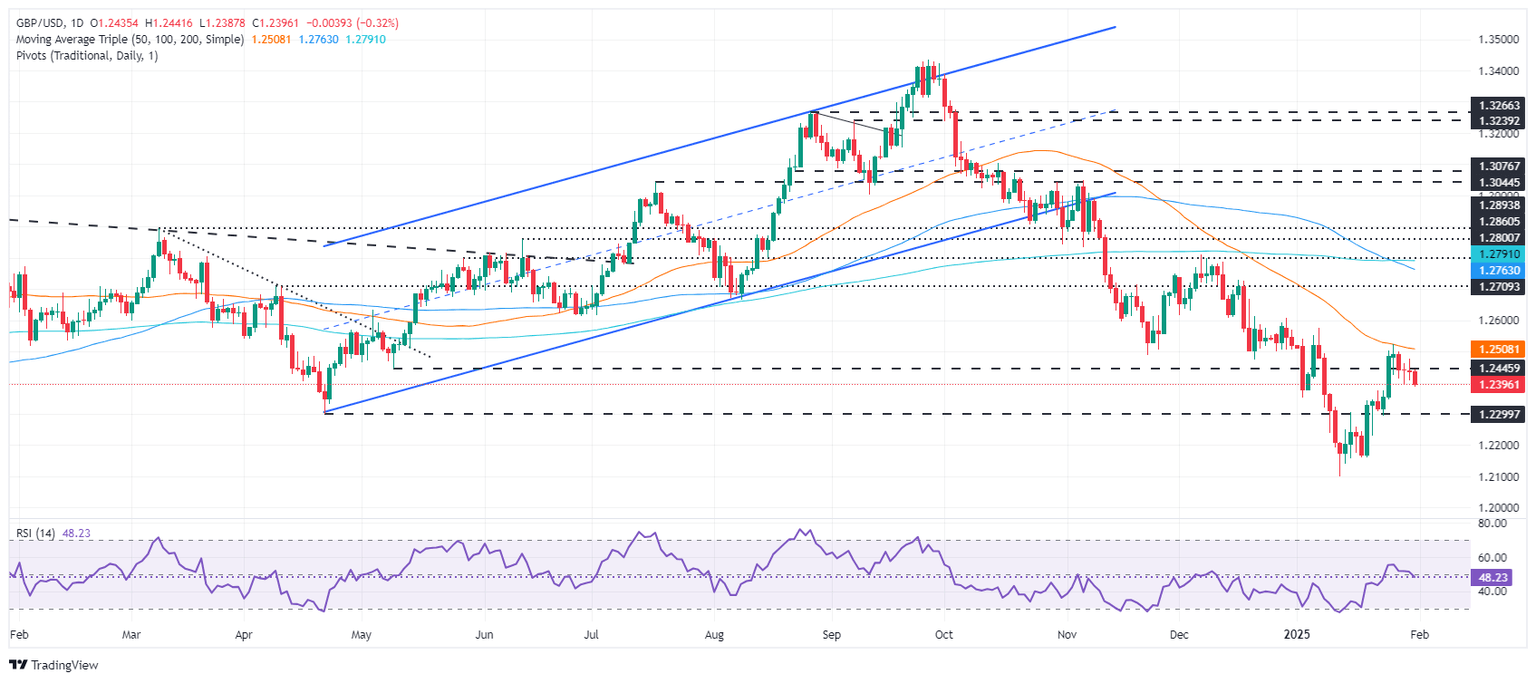

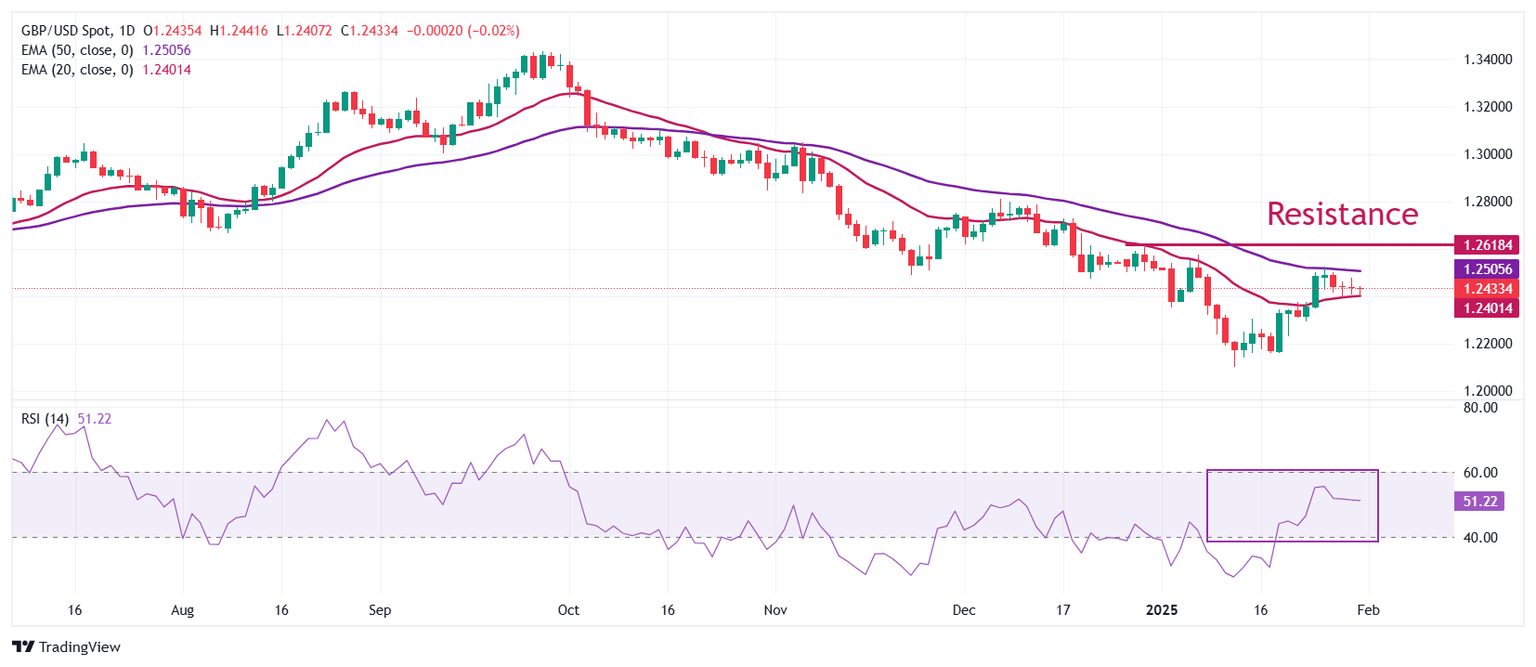

The Pound Sterling extended its losses for the second consecutive day as US President Donald Trump tariffs rhetoric sent ripples across the financial markets. Therefore, the Greenback remains bid, as economic data takes the backseat. The GBP/USD trades at 1.2398, down 0.16%. Read More...

Pound Sterling edges lower against USD as Trump's agenda threatens global economic growth

The Pound Sterling (GBP) ticks lower against the US Dollar (USD) in Friday’s North American session but holds the key support of 1.2400. The GBP/USD pair remains subdued as the US Dollar’s safe-haven demand has strengthened after United States (US) President Donald Trump reiterated his intentions to impose 25% tariffs on Canada and Mexico from Saturday and 100% on BRICS if they try to replace the US Dollar with a new currency in international trade. Read More...

GBP/USD falls to near 1.2400 due to risk-off sentiment following Trump tariff threats

GBP/USD continues its losing streak for the fourth successive session, trading around 1.2420 during the Asian hours on Friday. This downside is attributed to the improved US Dollar (USD) amid increased risk aversion following renewed tariff threats from US President Donald Trump. Read More...

Author

FXStreet Team

FXStreet