Pound Sterling Price News and Forecast: GBP/USD slips as Trump’s tariffs roil FX markets, CPI data looms

GBP/USD slips as Trump’s tariffs roil FX markets, CPI data looms

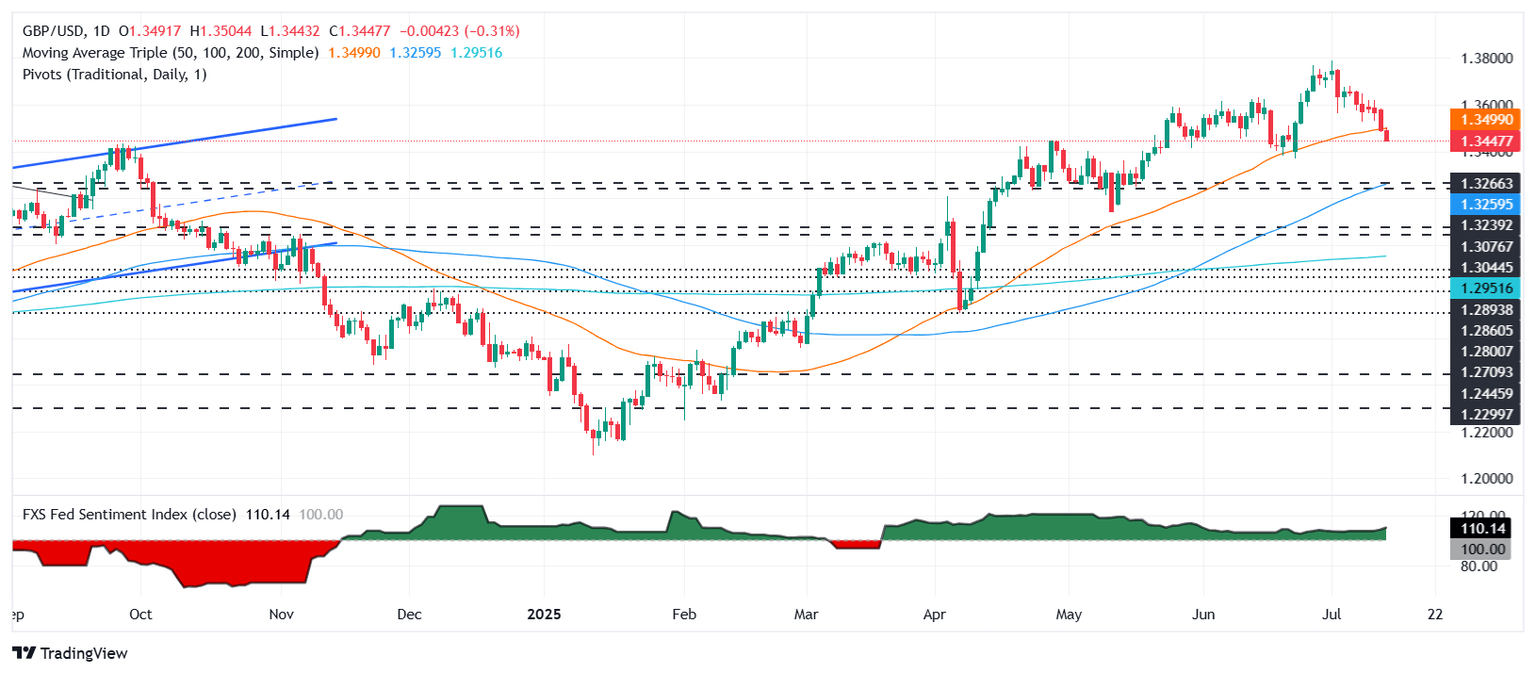

The Pound Sterling (GBP) retreats by 0.18% during the North American session as the US Dollar (USD) recovers following US President Donald Trump's wave of tariffs that included the European Union (EU) and Mexico. Although initially triggering a risk-off reaction, sentiment shifted positively in equities but not in the FX space. GBP/USD trades at 1.3453 at the time of writing. Read More...

Pound Sterling trades lower against US Dollar, US-UK CPI data comes into focus

The Pound Sterling (GBP) slides to near 1.3450 against the US Dollar (USD) during the European trading session on Monday, the lowest level in three weeks. The GBP/USD pair declines as demand for risk-perceived assets has diminished, following a jittery market mood amid trade tensions between the United States (US) and the European Union (EU). Read More...

GBP/USD holds steady around 1.3500; seems vulnerable near multi-week low

The GBP/USD pair enters a bearish consolidation phase during the Asian session and oscillates in a narrow band around the 1.3500 psychological mark, just a few pips above a three-week low touched on Friday. Moreover, the fundamental backdrop suggests that the path of least resistance for spot prices remains to the downside. Read More...

Author

FXStreet Team

FXStreet