Pound Sterling Price News and Forecast: GBP/USD rises as US Dollar weakens on Moody’s decision

GBP/USD Weekly Outlook: Pound Sterling aims to resume uptrend in UK inflation week

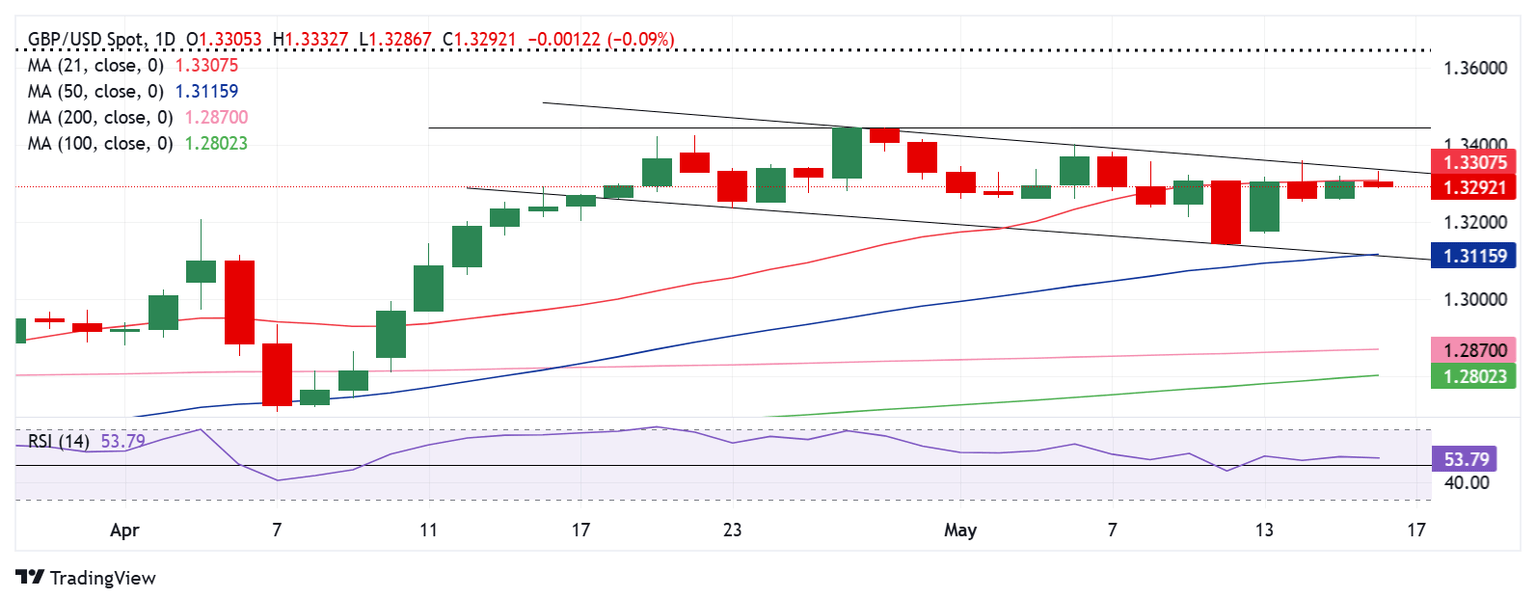

The Pound Sterling (GBP) regained its footing against the US Dollar (USD) after the GBP/USD pair exhibited strong two-way price movements within a 150-pip range during the week. Following a painful start to the week, the GBP/USD managed to find its footing as the US Dollar lost its recovery momentum in the latter part, with optimism surrounding the US-China trade truce fading.

On Monday, the pair came under intense selling pressure, hitting a one-month low at 1.3140 after the US Dollar rallied hard following the news of the highly anticipated US-China trade truce. Following the weekend’s trade talks in Geneva, both sides agreed that the US would reduce levies on Chinese imports from 145% to 30% during a 90-day negotiation period, and China would lower duties from 125% to 10%. Read more...

GBP/USD holds gains around 1.3300 as US Dollar weakens following Moody’s downgrade

The GBP/USD pair recovered from prior session losses, trading near the 1.3300 level during Asian session on Monday. The rebound is largely driven by renewed pressure on the US Dollar (USD) after Moody’s Investors Service downgraded the US credit rating by one notch, from Aaa to Aa1. The agency cited escalating debt levels and a growing burden from interest payments as primary concerns.

This move aligns with previous downgrades by Fitch Ratings in 2023 and Standard & Poor’s in 2011. Moody’s now forecasts US federal debt to rise to approximately 134% of GDP by 2035, up from 98% in 2023. The federal deficit is projected to widen to nearly 9% of GDP, fueled by mounting debt-servicing costs, increased entitlement spending, and declining tax revenues. Read more...

Author

FXStreet Team

FXStreet