Pound Sterling Price News and Forecast: GBP/USD rises as the US Dollar weakens amid persistent concerns

GBP/USD rises to near 1.3050 as US Dollar remains tepid ahead of PPI data

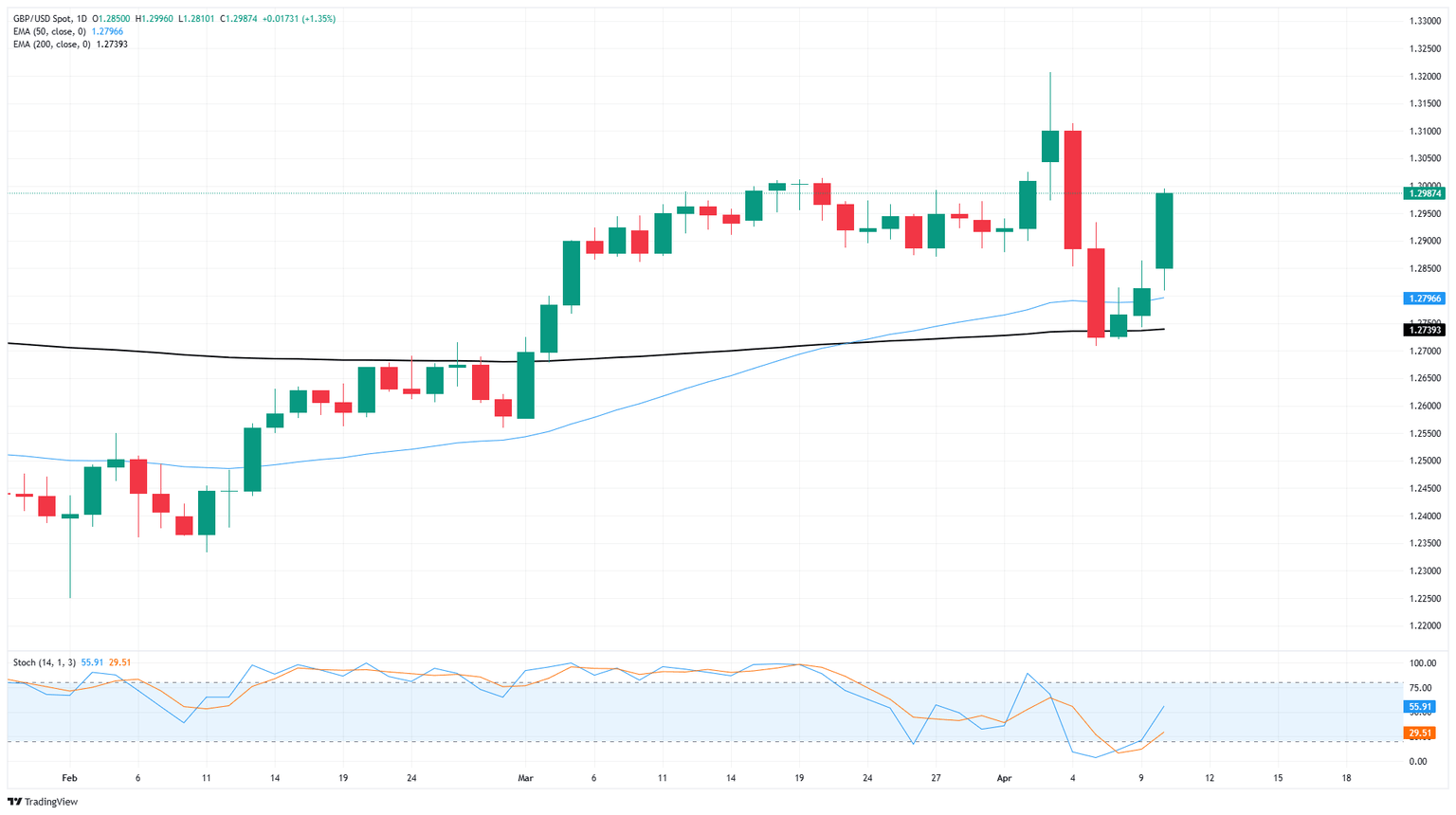

GBP/USD is on track for its fourth consecutive daily gain, trading near 1.3030 during Friday’s Asian session. The pair continues to strengthen as the US Dollar loses ground amid lingering concerns over both the global and US economies.

The US Dollar Index (DXY), which tracks the greenback against a basket of six major currencies, has slipped to around 100.20 at the time of writing. The DXY's decline follows a surprise drop in US consumer prices for March, shifting investor focus to upcoming key data releases — the March Producer Price Index (PPI) and preliminary Michigan Consumer Sentiment, both due later today. Read more...

GBP/USD lurches higher as risk aversion abates

GBP/USD took another bullish step higher on Thursday, bolstered by a broad-base weakening in Greenback demand after US Consumer Price Index (CPI) inflation cooled even faster than expected. Coupled with a general easing in risk-off flows following the Trump administration’s constant carousel of on-again, off-again tariffs, Greenback strength across the board has been receding, giving Cable an opportunity to rebound from recent losses.

US Consumer Price Index (CPI) inflation came in well below expectations in March. Core CPI eased to 2.8% YoY, reaching a four-year low after stubbornly holding above 3.0% for nearly eight months. Headline CPI inflation also eased to 2.4% YoY, and investment markets will be devastated if tariffs undo years’ worth of work by the Federal Reserve (Fed) to bring inflation to heel. Read more...

Author

FXStreet Team

FXStreet