Pound Sterling Price News and Forecast: GBP/USD rises against USD on slower US GDP growth

Pound Sterling rises against USD on slower US GDP growth

The Pound Sterling (GBP) rises to near 1.2460 against the US Dollar (USD) in North American trading hours on Thursday. The GBP/USD gains as the US Dollar drops after the advanced Gross Domestic Product (GDP) report for the fourth quarter of 2024 showed a slower-than-expected growth rate. The US economy expanded 2.3% year-over-year (YoY), slower than estimates of 2.6% and 3.1% growth seen in the third quarter of 2024. Read More...

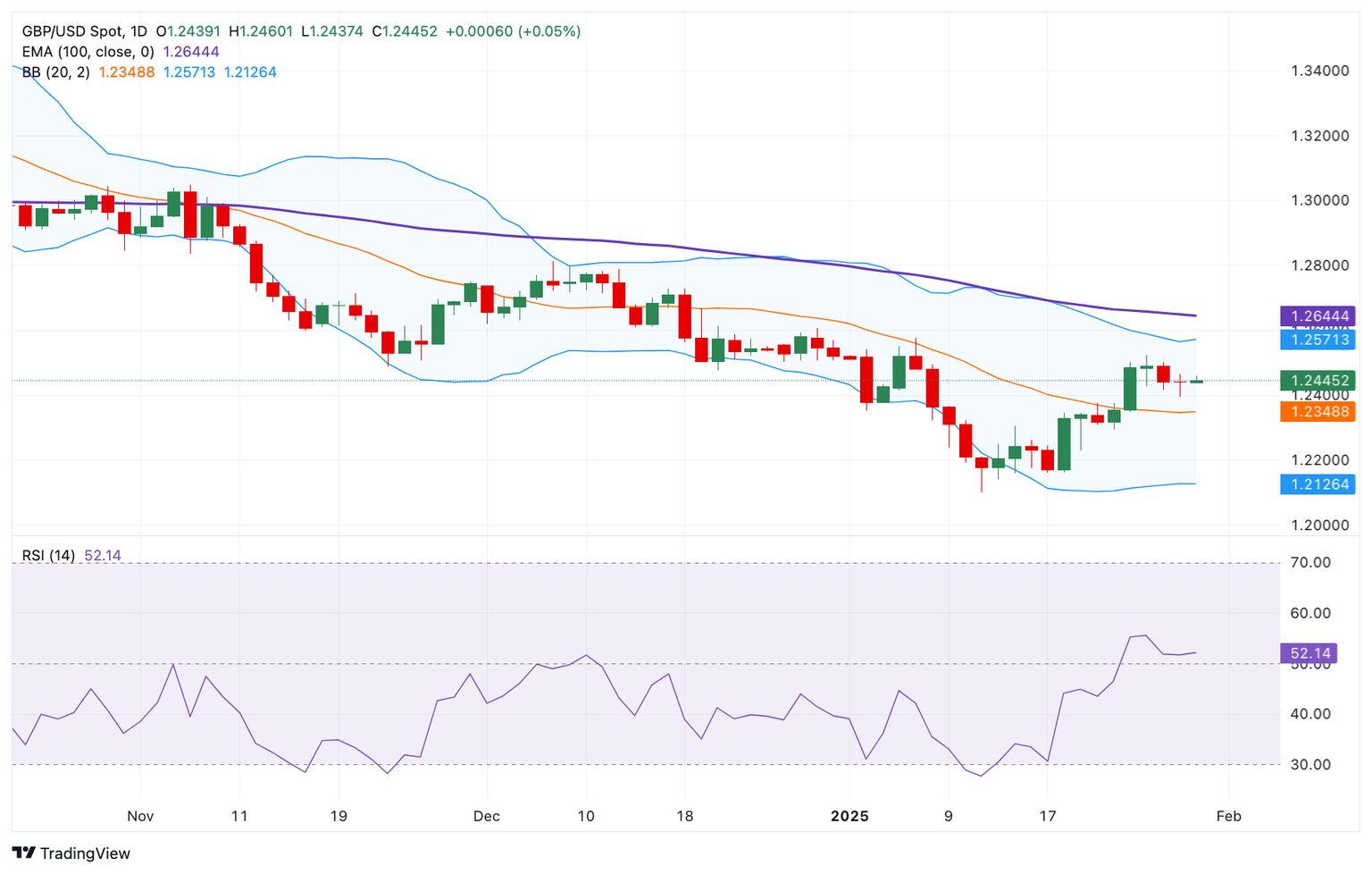

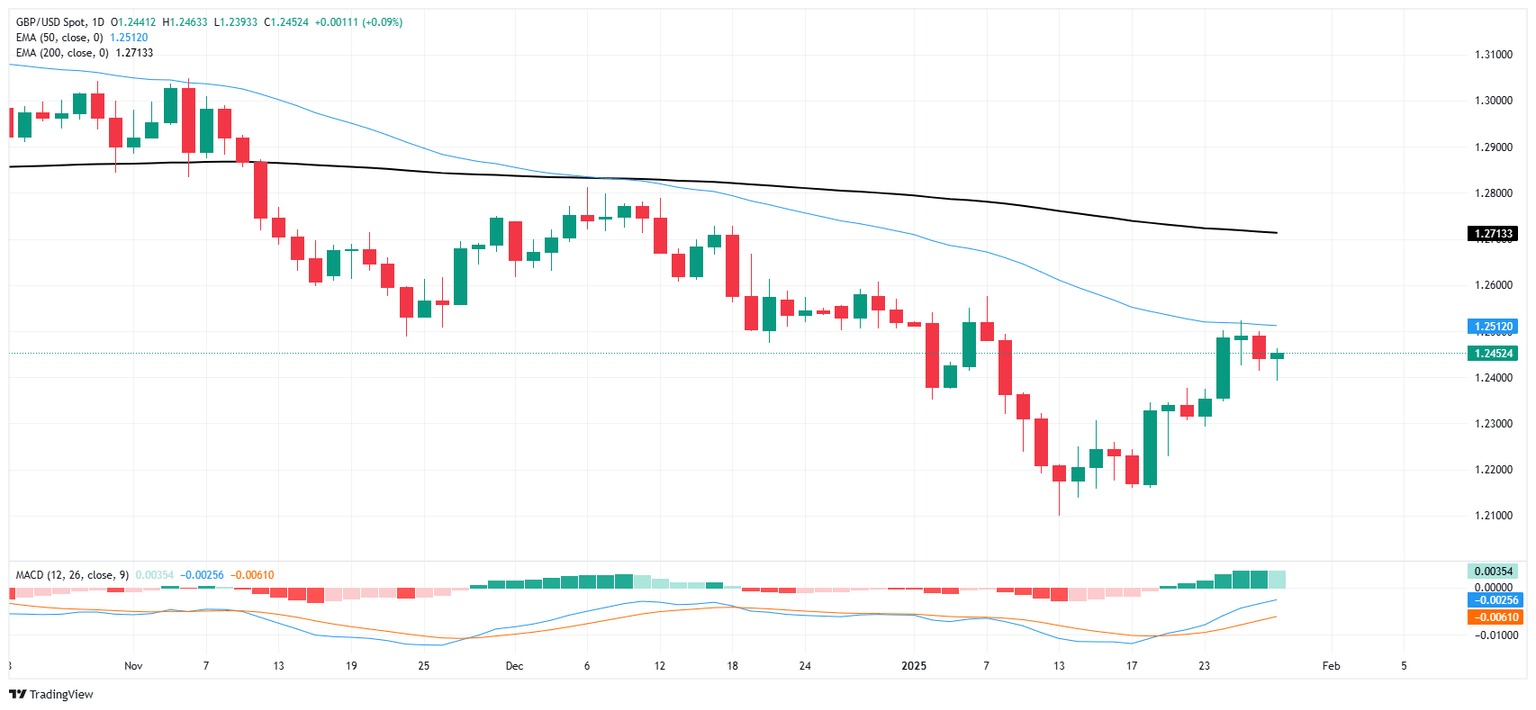

GBP/USD Price Forecast: Bearish outlook remains in play below 1.2450

GBP/USD tests the water near 1.24 as key US data looms

GBP/USD spun in a tight circle on Wednesday, briefly dipping into the 1.2400 handle after the Federal Reserve (Fed) kept interest rates on hold. Rate futures markets broadly forecast the lack of movement on interest rates, with the Fed citing no particular reason to rush into further rate cuts. The back half of the trading week will be key US data releases to see if the Fed made the right call. Read More...

Author

FXStreet Team

FXStreet