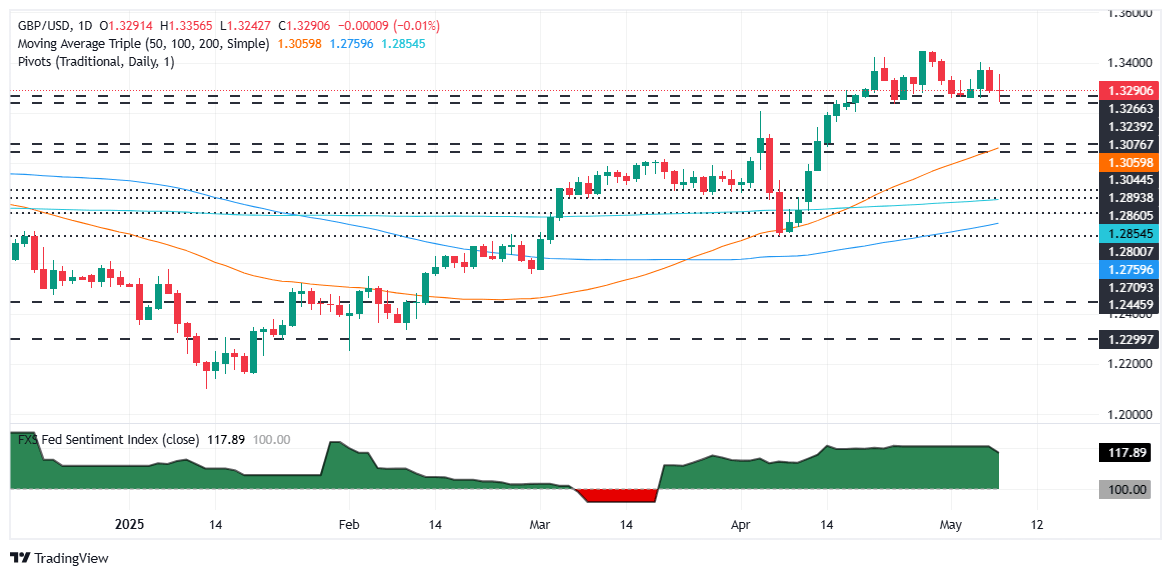

Pound Sterling Price News and Forecast: GBP/USD reversed early gains to fall another 0.34%

GBP/USD eases post-BoE rate cut as Greenback flows rise

GBP/USD kicked off Thursday with an early spat of gains, fueled by the Bank of England (BoE) delivering the market a widely-anticipated quarter point rate cut. However, bullish momentum behind the Pound Sterling evaporated quickly as markets pivoted toward trade headlines from the United States (US). Investors are hoping for quick progress on the US making trade deals that will allow it to climb down from its own self-imposed tariff stance.

Market sentiment pinned firmly on the high side and bolstered the US Dollar (USD) after the Trump administration announced an impending trade deal between the US and the United Kingdom (UK) that will see the UK avoid steep “reciprocal” tariffs on an ongoing basis, which are due to come back into effect on July 9 after President Trump temporarily walked back imposing his own ‘Liberation Day’ tariffs. A sweeping 10% tariff is still set to be imposed on all imports into the US from the UK, which could crimp market sentiment in the near future. Read more...

GBP/USD climbs past 1.33 on BoE hawkish cut, US-UK reaching trade deal

The Pound Sterling (GBP) advanced during the North American session after the Bank of England (BoE) reduced borrowing costs on a 7-2 vote split, with two members voting to hold rates unchanged. Positive United States (US) jobs data failed to propel the US Dollar (USD), while a trade deal between the US and the UK is a tailwind for GBP/USD, which trades at 1.3300, up 0.15%.

GBP/USD rises after BoE’s three-way vote signals caution and Trump-Starmer pact adds bullish tailwind. The BoE reduced rates to 4.25% on Thursday, as expected, in what was perceived as a hawkish cut due to the three-way vote split: two members voting for a 50-basis-point cut, five for a 25-basis-point cut, and two more to keep rates at 4.50%. This propelled Cable higher although an announcement of a trade deal between the US and the UK supported GBP/USD in remaining above the 1.33 handle. Read more...

Author

FXStreet Team

FXStreet